As the temperatures warmed and the real estate market dynamics shifted, Houston witnessed a notable change in its housing market during the month of April. After a slow start to the spring homebuying season, there was a resurgence in home sales, coupled with an expansion in inventory levels reminiscent of pre-pandemic times.

This shift has not only provided opportunities for both buyers and sellers but also injected a renewed sense of optimism into the local real estate landscape. Here are the latest trends in the Houston housing market.

Trends in the Houston Housing Market

Good news for Houston real estate investors and buyers! The spring buying season, which initially lagged, appears to be blooming later than usual. Here’s a breakdown of the key data from the Houston Association of Realtors (HAR) for April 2024:

Rising Sales Figures

According to the Houston Association of Realtors’ (HAR) April 2024 Market Update, single-family home sales across the Greater Houston area surged by 9.2 percent. This increase is significant, with the Houston Multiple Listing Service (MLS) reporting a total of 7,926 units sold, compared to 7,256 in the same period last year. What’s more, all housing segments experienced growth in sales, with the luxury segment ($1 million+) witnessing a remarkable 33.8 percent surge, despite representing only a small fraction of the market.

HAR Chair Thomas Mouton, of Century 21 Exclusive Properties, noted that while the spring homebuying season seemed to be unfolding later than usual, the rebound in April home sales is indicative of buyers adapting to the evolving market conditions. This adaptability, combined with the rise in inventory levels, has presented new opportunities for both buyers and sellers alike.

Market Performance Metrics

The average price of a single-family home in Greater Houston saw a 4.6 percent increase, reaching $437,198. This marks the second-highest price recorded, second only to May 2022 when it peaked at $438,350. Additionally, the median price rose by 3.0 percent to $340,000, reflecting a healthy growth trend in property values.

A closer look at the market comparison for April reveals promising trends. Total property sales witnessed an 8.7 percent increase, translating to a total dollar volume surge of 13.8 percent, reaching $4 billion. Single-family pending sales also saw a double-digit rise of 10.3 percent, indicating sustained buyer interest.

One of the most notable shifts has been in housing inventory levels, which expanded to a 3.7-month supply, up from 2.6 months compared to the previous year. This surge in inventory is the highest recorded since October 2019, underscoring a favorable market environment for both buyers and sellers.

Segment Breakdown

Broken down by housing segment, April sales performance highlights the following:

- $1 – $99,999: increased 24.3 percent

- $100,000 – $149,999: increased 20.9 percent

- $150,000 – $249,999: increased 2.2 percent

- $250,000 – $499,999: increased 6.1 percent

- $500,000 – $999,999: increased 14.0 percent

- $1M and above: increased 33.8 percent

Furthermore, existing single-family home sales totaled 5,753 in April, marking a 9.7 percent increase from the same period last year. The average price for existing homes rose 6.8 percent to $442,773, reflecting sustained demand across various price points.

Townhouse/Condominium Market

While the single-family home market experienced robust growth, the townhouse and condominium segment saw a slight decline in sales. Inventory levels, however, reached their highest point in over four years, signaling increased options for buyers in this segment.

Despite a 1.3 percent decrease in sales, the median price for townhomes and condominiums declined by 1.8 percent to $230,000. Similarly, the average price saw a marginal dip of 0.5 percent to $278,048. Nonetheless, this segment continues to offer diverse opportunities for prospective buyers.

What it Means for Investors

The Houston housing market appears to be adjusting to the new realities of higher interest rates. While there may be fewer bidding wars for single-family homes, the increased inventory creates opportunities for investors seeking value. The luxury market’s strong performance is also a noteworthy trend, indicating continued demand for high-end properties.

Remember

- While the market seems to be favoring buyers with more choices, rising interest rates are still a factor to consider when evaluating investment opportunities.

- Carefully assess your financial situation and investment goals before making any decisions.

Houston Real Estate Market Predictions

Houston’s real estate market has garnered a reputation for stability and consistent growth. Fueled by a dynamic economy, a booming job market, and a relatively low cost of living, the Bayou City continues to attract homebuyers and investors alike.

But with the ever-shifting sands of economic trends, what’s on the horizon for Houston’s real estate landscape in 2024? Let’s delve into some key predictions to help you navigate this crucial market, along with insights.

A Steady Stream of New Residents: Houston’s population is expected to maintain its upward trajectory, propelled by a robust job market and the city’s affordability. This influx of new residents will likely translate to a rise in housing demand, potentially putting some upward pressure on prices, though experts anticipate a moderate increase.

Stability Reigns Supreme: Prices Hold Steady: Market forecasts paint a picture of continued stability, with home prices remaining relatively flat compared to the previous year. This is a welcome contrast to the potential national slowdown some experts predict. While price appreciation may be modest, it should keep pace with inflation, ensuring a healthy market for both buyers and sellers.

Inventory Levels Remain Tight: Sellers can rejoice, as housing inventory is expected to stay low throughout 2024. This scenario suggests a seller’s market will likely persist, with buyer demand continuing to outpace available homes. However, with rising interest rates (which we’ll discuss next), affordability may become a factor for some buyers, potentially mitigating the intensity of bidding wars.

Navigating the Mortgage Maze: Mortgage interest rates are a crucial factor for any real estate market. While some forecasts suggest a slight decline from current levels, rates are still expected to hover around 6%. This could potentially impact affordability for some buyers, particularly those on tighter budgets. However, Houston’s strong job market and steady wages should help offset this concern for many.

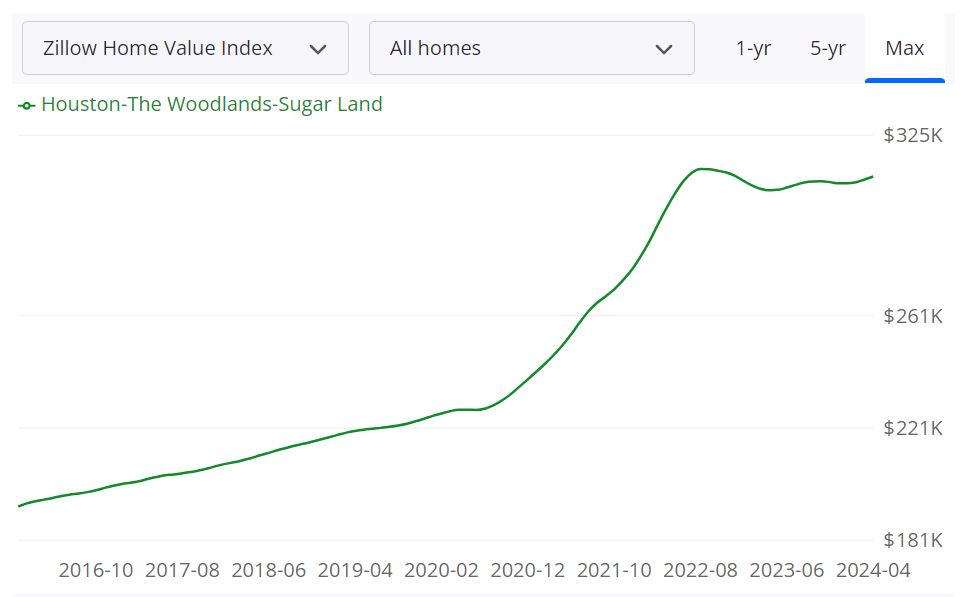

Houston Housing Data Snapshot (as of April 30, 2024):

- Average home value: $310,906 (Zillow)- This metric reflects the median of estimated market values across all homes in the Houston-The Woodlands-Sugar Land area. It provides a general idea of what a typical home might be worth in this region.

- Median sale price: $318,104 – This represents the midpoint of sale prices for homes recently sold in the area. It’s a more accurate indicator of what homes are actually selling for compared to the average home value.

- Median list price: $358,000 – This shows the midpoint of asking prices for homes currently listed for sale. It can be helpful to understand how aggressive listing prices are in the market.

- Expected market change (1-year): -1.5% (indicating a slight decline) – Zillow predicts a slight decrease in home values over the next year. This is important to consider, especially for buyers who may be concerned about future equity growth.

- List price disparity:

- 14.9% of sales went above list price – This suggests a competitive seller’s market, where some buyers are willing to pay more than the asking price to secure a home.

- 65.4% of sales went under list price – This might seem counterintuitive given a seller’s market, but it could be due to several factors. For instance, some sellers may have priced their homes aggressively, leaving room for negotiation. Additionally, the data may include condominiums or townhomes, which tend to sell for lower prices than single-family homes.

This graph illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

Beyond the Numbers: Emerging Trends: The Houston market is constantly evolving. Here are some additional trends to keep an eye on:

- Energy Efficiency Takes Center Stage: As sustainability concerns rise, energy-efficient homes are likely to become even more coveted by buyers. This presents an opportunity for both existing homeowners to consider renovations and for developers to prioritize energy-saving features in new construction.

- Technological Integration: Technology is transforming the real estate experience. Virtual tours, 3D imaging, and online platforms are becoming increasingly popular tools for both buyers and sellers.

The Local Touch: A Key Advantage: While national trends provide valuable insights, the Houston market has its own unique characteristics. Consulting with a local real estate professional who understands the nuances of specific neighborhoods and market dynamics is invaluable for both buyers and sellers in making informed decisions.

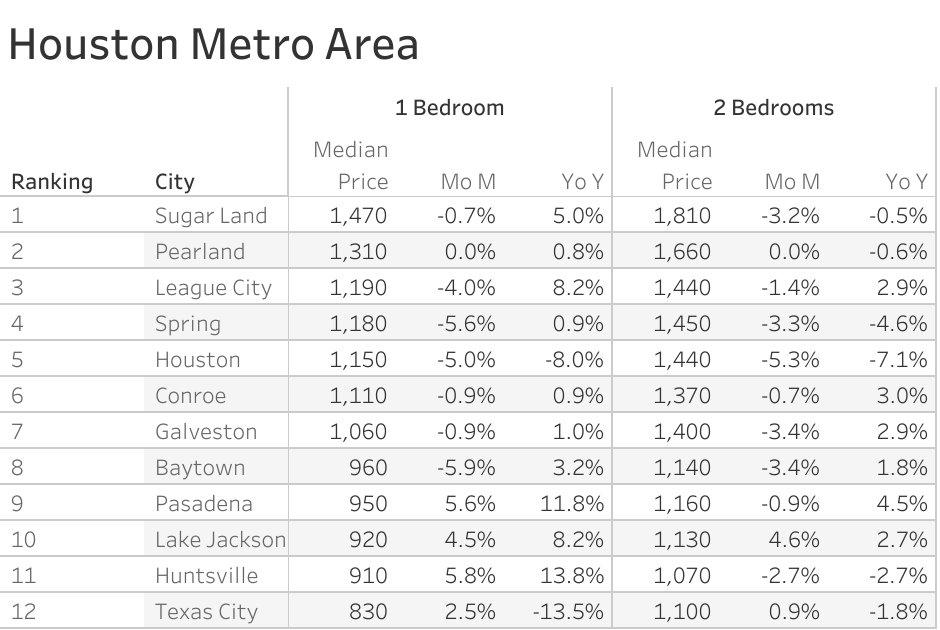

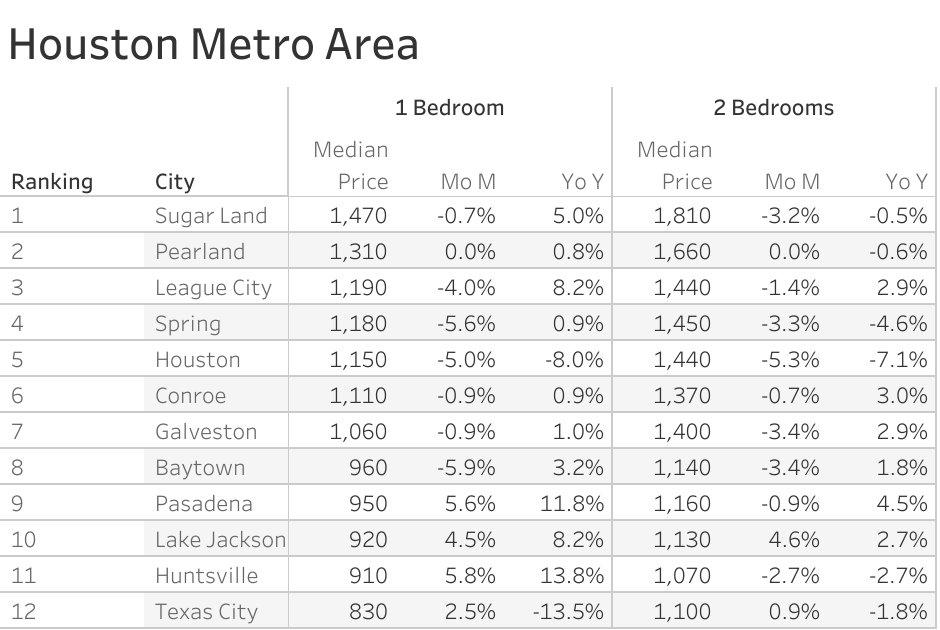

Trends in the Houston Rental Housing Market

The Zumper Houston Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Texas one bedroom median rent was $1,136 last month. Sugar Land was the most expensive cities with one bedroom priced at $1,470. Texas City was the most affordable city with rent at $830.

The Fastest Growing Cities For Rents in Houston Metro Area (Year-Over-Year)

- Huntsville had the fastest growing rent, up 13.8% since this time last year.

- Pasadena saw rent climb 11.8%, making it second.

- Lake Jackson was third with rent increasing 8.2%.

The Fastest Growing Cities For Rents in Houston Metro Area (Month-Over-Month)

- Huntsville experienced the largest monthly rent price growth rate, growing 5.8%.

- Pasadena was second with rent climbing 5.6%.

- Lake Jackson saw rent increase 4.5% last month, making it third.

Should You Invest in the Houston Real Estate Market?

The city of Houston has long been a beacon for real estate investors seeking opportunities for long-term growth. As one of the largest and most dynamic cities in the United States, Houston offers a unique landscape for those looking to make strategic real estate investments. In this essay, we’ll explore the factors that make Houston a promising destination for long-term real estate investment and provide insights into its outlook for sustainable growth.

Economic Resilience

One of the fundamental factors that underpin Houston’s real estate investment potential is its economic resilience. Houston is home to a diverse range of industries, including energy, healthcare, manufacturing, and aerospace. Its role as the energy capital of the world has historically been a significant driver of economic activity.

While energy markets can be cyclical, Houston’s economy has shown remarkable resilience even in the face of energy price fluctuations. This economic diversity serves as a stabilizing force for real estate investors, reducing the risk associated with economic downturns in any single sector.

Population Growth

Houston has consistently experienced population growth over the years. This demographic expansion is driven by several factors, including a robust job market, affordable housing, and a high quality of life. The city’s attractiveness to both domestic and international migrants bodes well for long-term real estate investment. As the population continues to grow, the demand for housing and commercial properties is expected to follow suit, creating a reliable source of rental income and property appreciation for investors.

Infrastructure Development

Houston has made significant investments in infrastructure development. The city’s commitment to improving transportation, public amenities, and urban planning has enhanced its livability and attractiveness. Infrastructure investments not only make the city a better place to live but also contribute to increasing property values. As Houston continues to expand and modernize its infrastructure, investors can expect to see a positive impact on their real estate holdings in the long term.

Real Estate Diversity

Houston’s real estate market offers a diverse range of investment opportunities. Whether you’re interested in residential, commercial, industrial, or mixed-use properties, Houston has options to suit various investment strategies. The city’s size and varied neighborhoods provide investors with choices to tailor their portfolios to their specific goals. This diversity allows for risk mitigation through portfolio diversification, a key strategy for long-term real estate investors.

Houston’s Top 10 Hotspots for Rising Home Values

Houston’s real estate market is a diverse tapestry, offering a range of neighborhoods catering to various lifestyles and budgets. But for those seeking promising investment opportunities, specific areas are projected to see significant home value appreciation. Here’s a closer look at the top 10 contenders (Neighborhoodscout).

- Gulfgate/Riverview/Pine Valley East: This revitalizing pocket on Houston’s east side boasts a mix of affordable housing options, proximity to downtown, and ongoing development projects. These factors are fueling a surge in investor interest and property value appreciation.

- Lawndale/Wayside South: Located southeast of downtown, this area is undergoing a transformation. Historic bungalows are being restored, attracting young professionals and families. This growing demand is likely to push home values upwards.

- Downtown Southeast: As Houston’s urban core continues to expand, the southeastern quadrant near Minute Maid Park is witnessing a development boom. New apartment buildings, office spaces, and revitalized historic structures are drawing residents and businesses alike. This confluence of factors positions the area for significant home value appreciation.

- Gulfton South: This established neighborhood southwest of downtown offers a multicultural vibe and a variety of housing options, from single-family homes to apartments. The area benefits from easy access to major freeways and proximity to the Medical Center. With its affordability and growing popularity, Gulfton South is poised for steady home value growth.

- Second Ward East: Steeped in history, Second Ward East is experiencing a renaissance. Art galleries, restaurants, and trendy shops are transforming the neighborhood into a vibrant destination. As the area attracts a new wave of residents, expect home values to rise alongside its growing appeal.

- Close In: This central district encompasses a diverse range of neighborhoods, each with its own unique character. Its proximity to downtown and eclectic offerings are propelling home value appreciation across the area.

- Second Ward: Once a predominantly industrial area, Second Ward is undergoing a complete overhaul. New developments, art studios, and a burgeoning nightlife scene are attracting residents, leading to anticipated growth in home values.

- Greenway/Upper Kirby Area West: This prestigious enclave on the west side of Houston boasts luxury high-rises, single-family homes, and high-end shopping. Its established affluence and desirability are likely to continue driving home values upwards.

- Second Ward West: Once industrial, this area is transforming with converted lofts, art studios, and a growing young professional scene. Its proximity to downtown and development potential position it for rising home values.

- South Main: South Main’s revitalization is well underway, with historic buildings being restored and repurposed for creative uses. This influx of investment and trendy establishments suggests promising prospects for home value appreciation.

By understanding the unique dynamics of these top neighborhoods, you can make informed decisions about where to invest in Houston’s ever-evolving real estate landscape. Remember, consulting with a local real estate expert can provide valuable insights into specific neighborhoods and their potential for future growth.

Conclusion: Houston’s Promise for Long-Term Real Estate Investment

When considering the outlook for long-term real estate investment, Houston stands out as a city with immense potential. Its economic resilience, population growth, infrastructure development, and real estate diversity create a fertile ground for investors seeking sustainable and reliable returns. The city’s track record of weathering economic challenges and its proactive approach to urban development positions it as an attractive destination for those who value long-term real estate investments. As Houston continues to evolve and expand, it will likely remain a shining star in the constellation of real estate investment opportunities.