Community organizations and city officials gathered at Philadelphia City Council to inform residents and entrepreneurs about the tax changes that will take effect in 2025 and the resources available to help small businesses meet their city tax obligations.

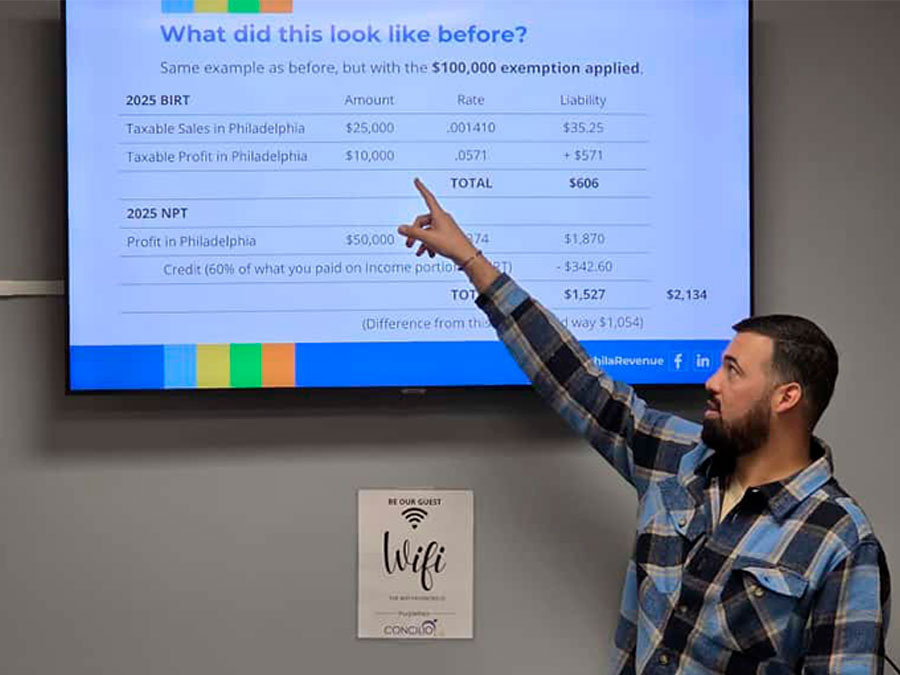

During the event, held on Monday, November 16, representatives from the Philadelphia Department of Commerce and the Department of Revenue explained that, beginning in fiscal year 2025, all individuals engaged in commercial activity in the city will be required to file and pay the Business Income and Receipts Tax (BIRT). This requirement will apply without exceptions, including self-employed workers, micro-entrepreneurs, home-based businesses, and anyone who generates income through commercial activities.

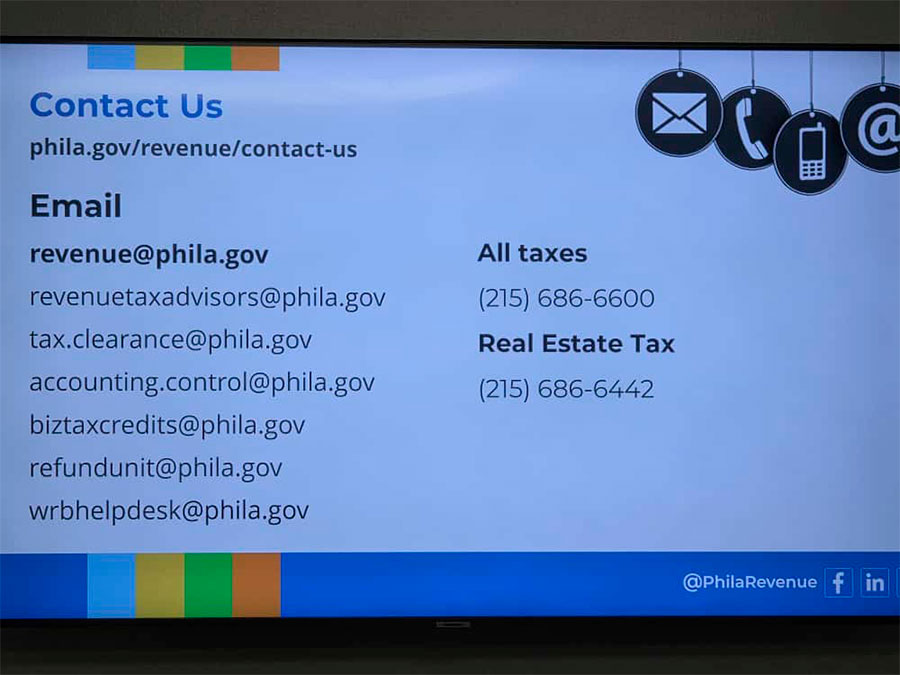

“We want to make sure that all entrepreneurs regardless of the size of their business or the language they speak clearly understand their tax obligations for 2025,” stated a representative from the Department of Revenue during the presentation.

“Transparency and education are essential for our business community to continue growing.”

Officials also outlined the new changes to the Philly Business Taxes, designed to simplify the filing process, clarify who must file, and improve tax compliance among small and medium-sized businesses.

“These adjustments aim to eliminate confusion and make things easier for small businesses,” said a spokesperson from the Department of Commerce.

“We know many entrepreneurs feel overwhelmed by the complexity of the system, which is why we are here: to guide them and offer support.”

The community organization Ceiba emphasized the importance of ensuring that the Latino community receives this information in their language and with culturally competent assistance.

“Our mission is to make sure no one is left behind due to lack of information or language barriers,” said a Ceiba representative.

Ceiba provides free federal and state tax preparation services to low-income families. “We invite the community to visit Ceibaphiladelphia.org to learn about their responsibilities and access free resources in Spanish.”

The city also highlighted the availability of the Free Business Tax Preparation Program, a free service for businesses earning less than $250,000, helping with local, state, and federal tax preparation in multiple languages, both in person and virtually.

Additionally, the Philadelphia Small Business Catalyst Fund continues to offer grants and technical support to help small businesses grow. The fund represents a $5 million investment designed to boost small businesses in Philadelphia, with grants of up to $50,000 per business, along with strategic guidance.

With these announcements and resources, city officials aim to strengthen Philadelphia’s economic development, promote tax compliance, and ensure that small businesses, especially those in historically underserved communities receive the support they need to thrive.

For additional information https://www.phila.gov/programs/the-catalyst-fund/