Michael and I were out in Las Vegas last week to put on a live Animal Spirits at the annual FPA conference.

It was a fun trip.

We ate some good food, had some fancy cocktails, played some blackjack and talked some artificial intelligence with a few hundred financial advisors.

On stage we did a deep dive into what’s going on with the biggest companies in the world and their push for AI supremacy. You can listen to the audio from the podcast here:

If you weren’t one of the lucky people in the MGM conference center that day I thought it would be useful to provide some of the slides we covered in our presentation.

First up we talked about the shift from investing in intangible to tangible assets by the big tech firms using Meta’s new Hyperion data center as an example:

These companies believe AI is worth the investment but this is a risk and a change to their business models.

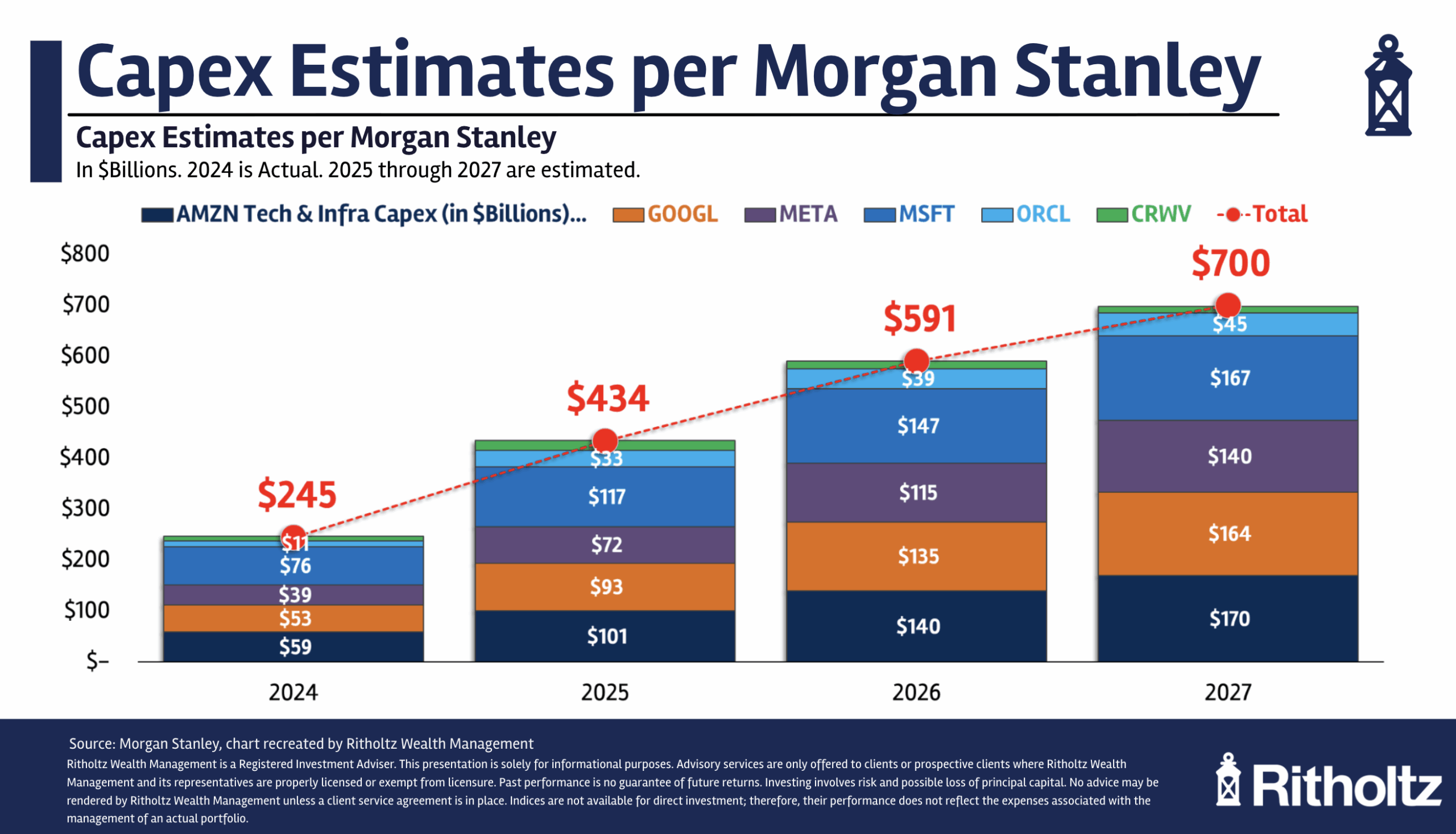

Spending from the hyperscalers continues to go up, up and away:

How long will stock market investors allow this? The companies spending money are getting the benefit of the doubt that this will all pay off. I do wonder when the market will want to see a big ROI on this spend.

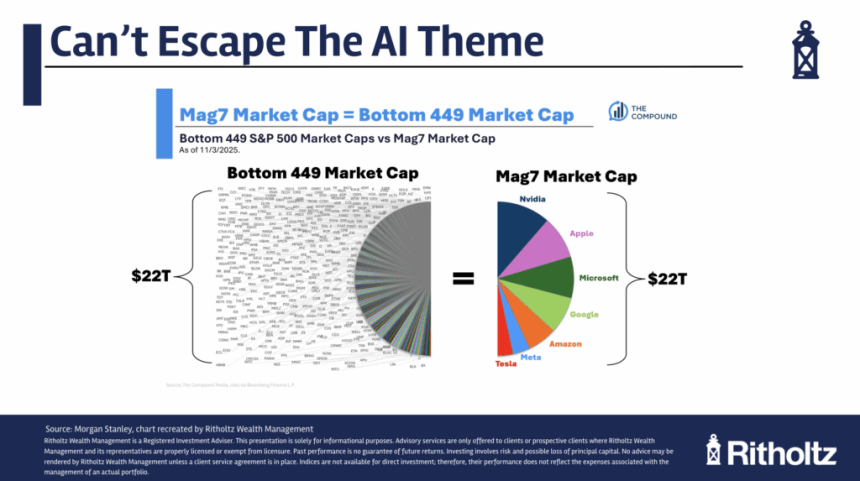

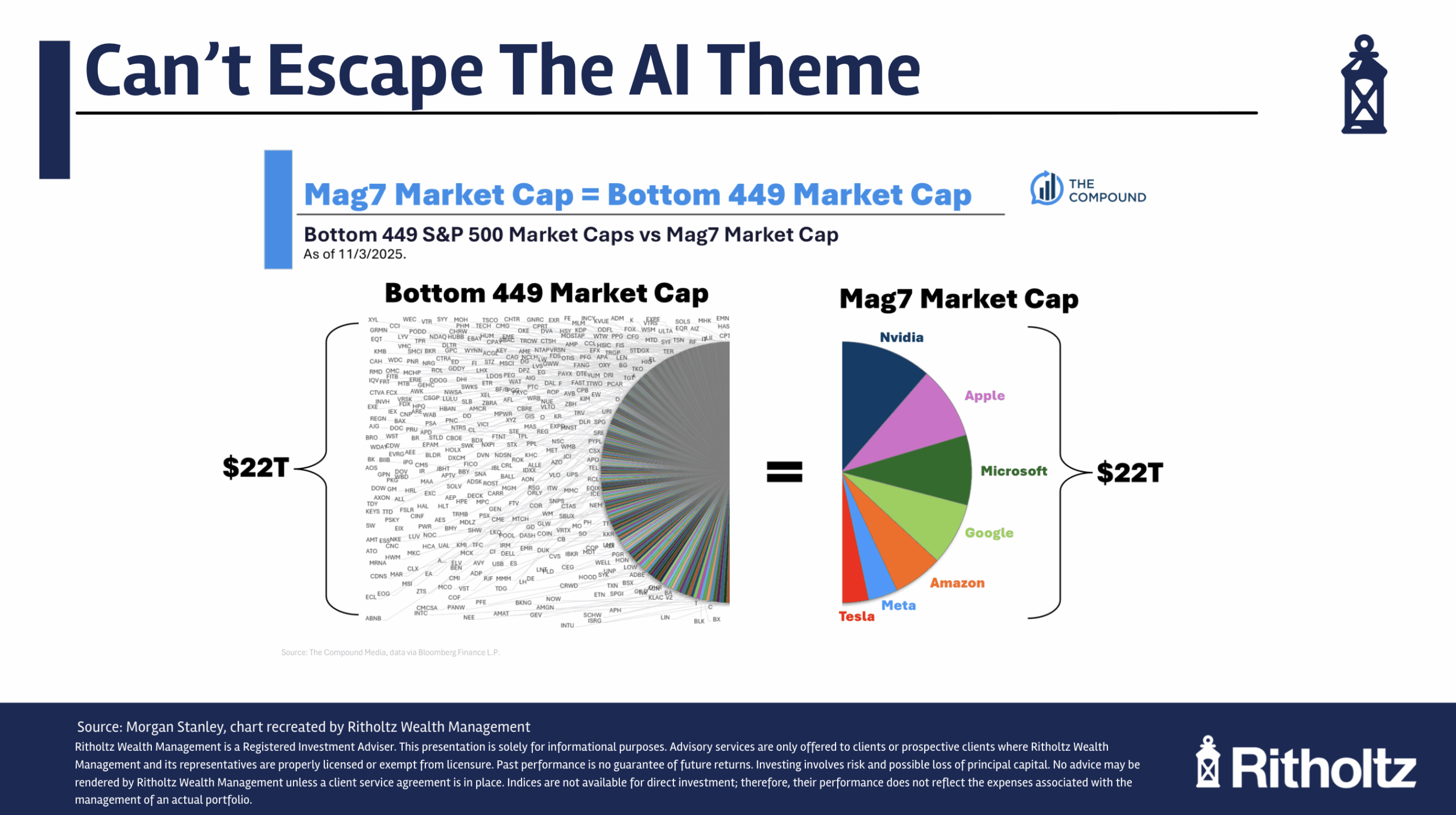

The sheer size of these companies is astounding:

The Mag 7 stocks are now as big as the bottom 449 stocks in the S&P 500 combined.

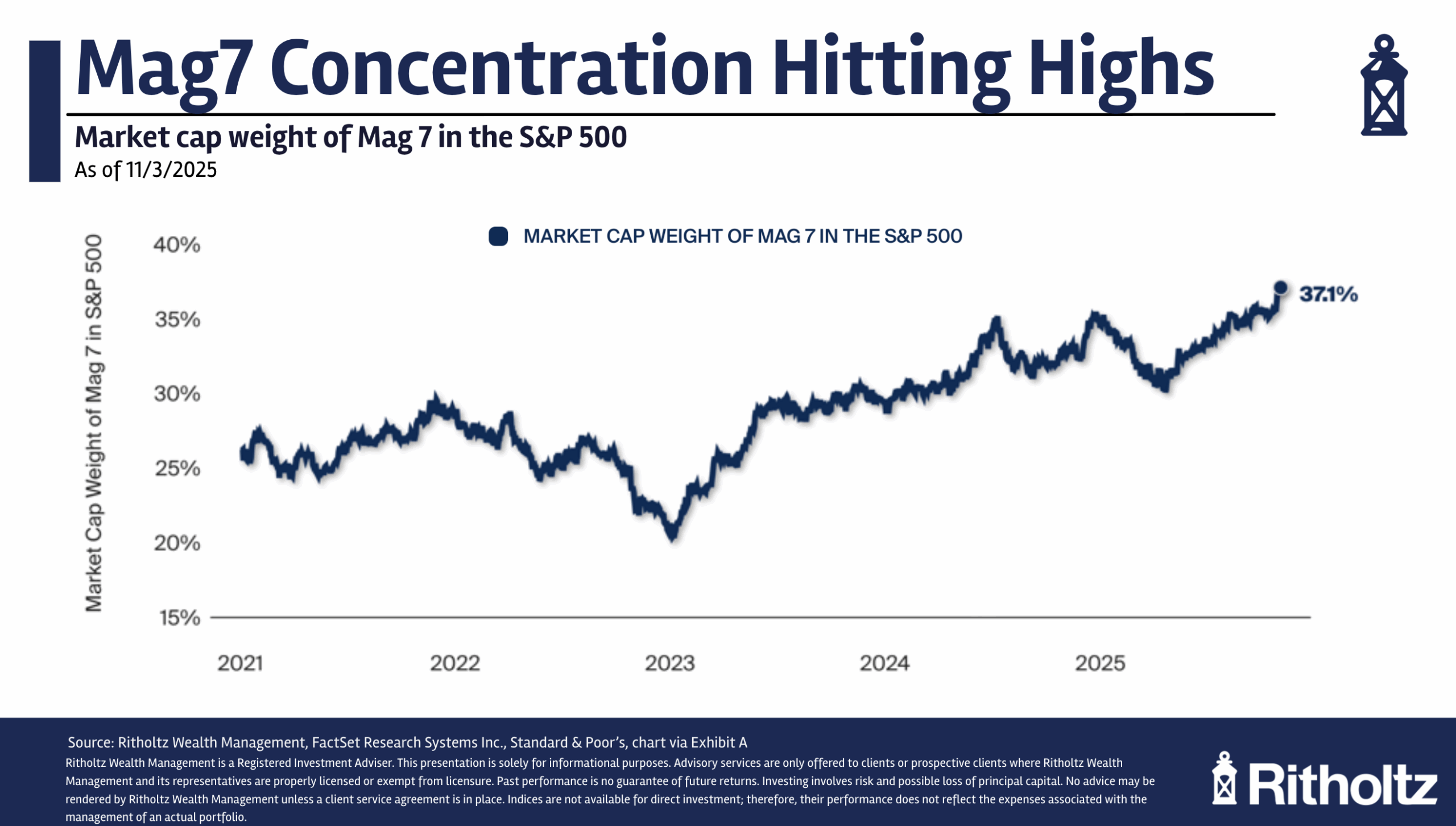

It seems we’ve entered the new normal of stock market concentration:

At least for now.

One of the reasons for this is that fundamentals are matching the stock price gains:

Nvidia is now the biggest company in the U.S. stock market but the fundamental growth has exceeded the price growth since the release of ChatGPT.

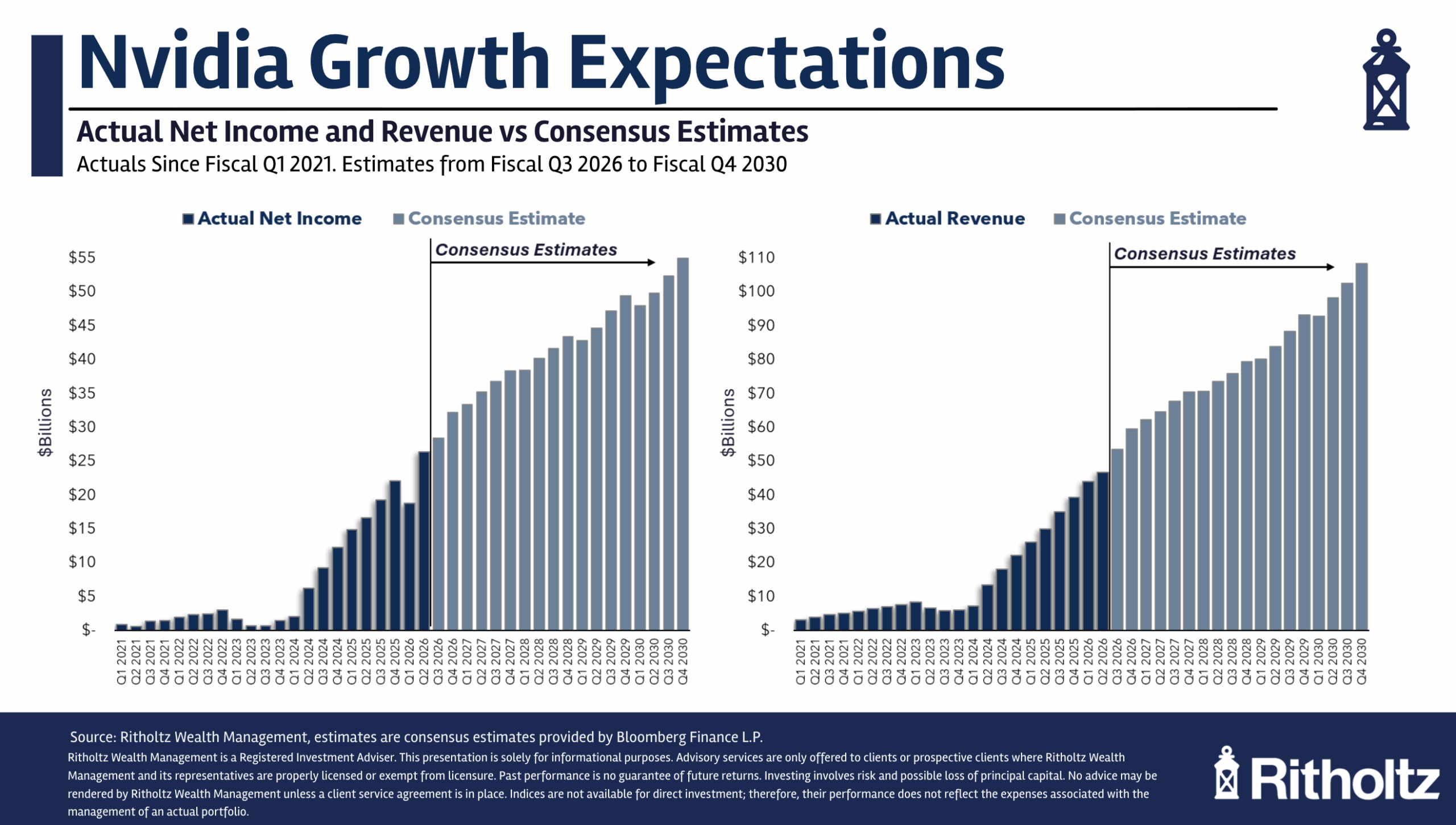

Analysts expect the growth to continue:

Is it possible for a $5 trillion company to grow at these insane levels for this long? We shall see.

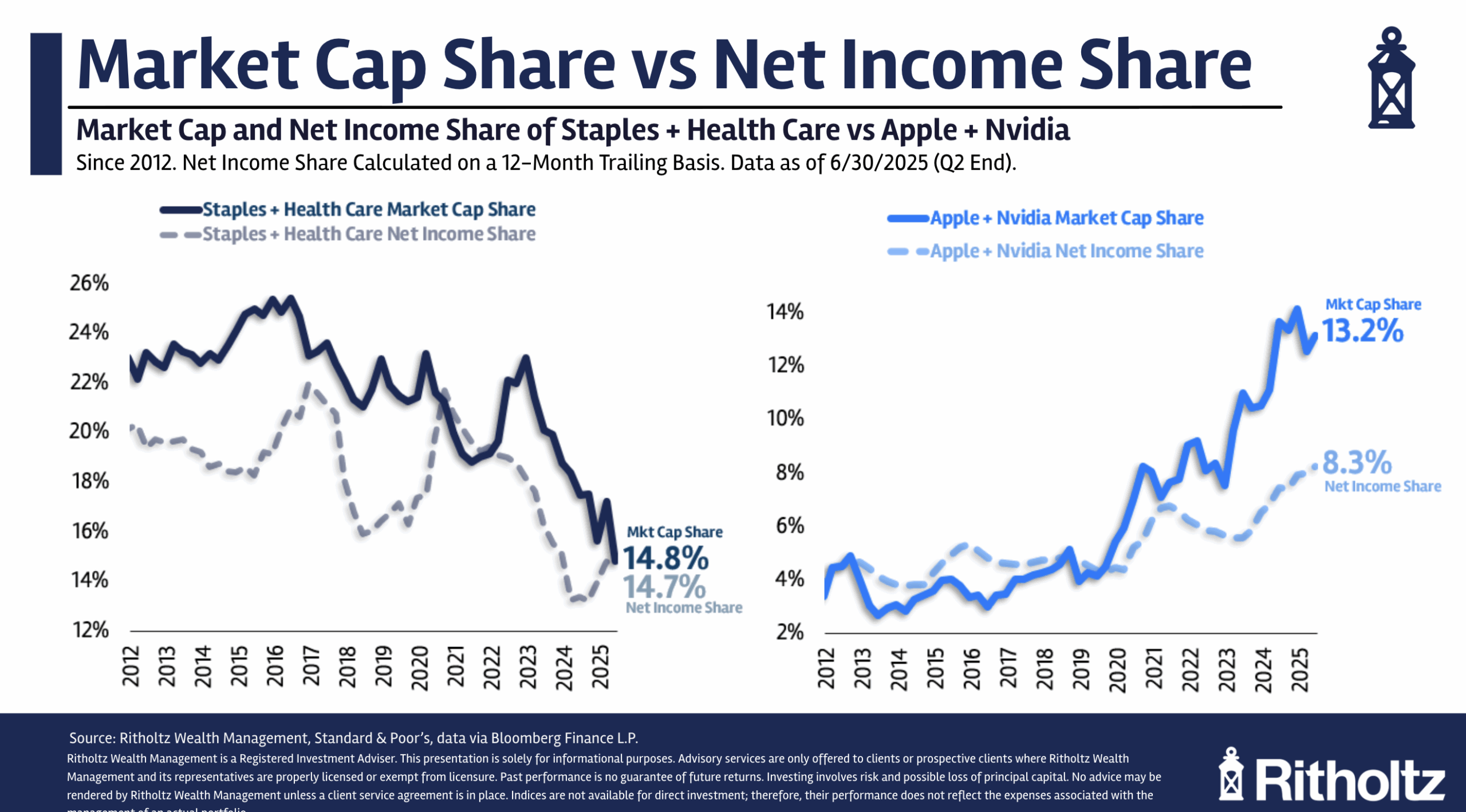

Here’s a real face-blower for you:

Apple and Nvidia alone are now worth nearly as much as the health care and consumer staples sectors combined.

Here’s another one for you — the market cap of the Mag 7 stocks is now the same size as the energy, materials, consumer staples, health care, financials, utilities and real estate sectors combined.

There have been instances of stock market concentration in the past. But we’ve never had corporations this efficient before.

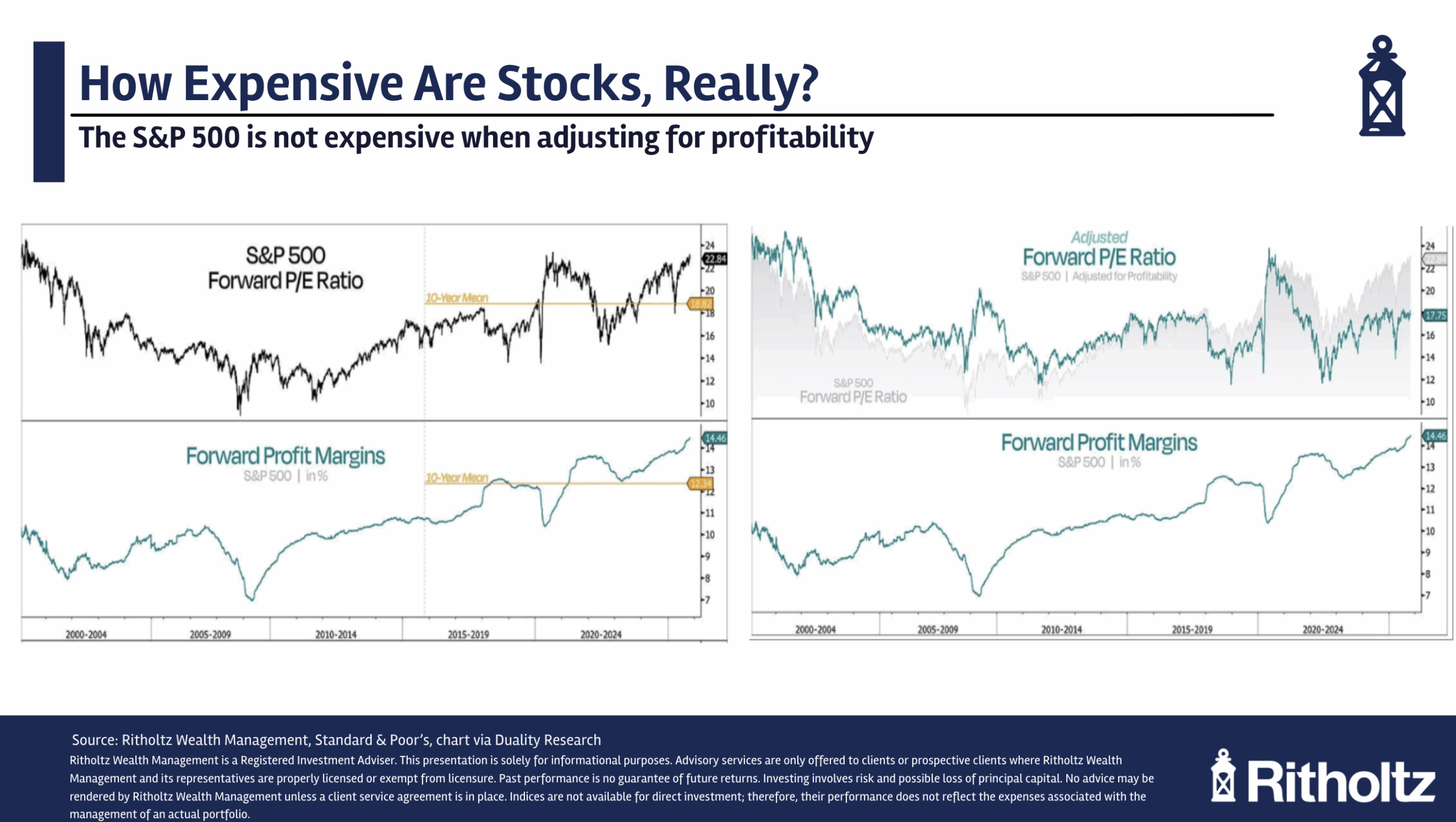

If you take this efficiency into account by adjusting valuations for the changes in margins, the market doesn’t appear as expensive as you might think:

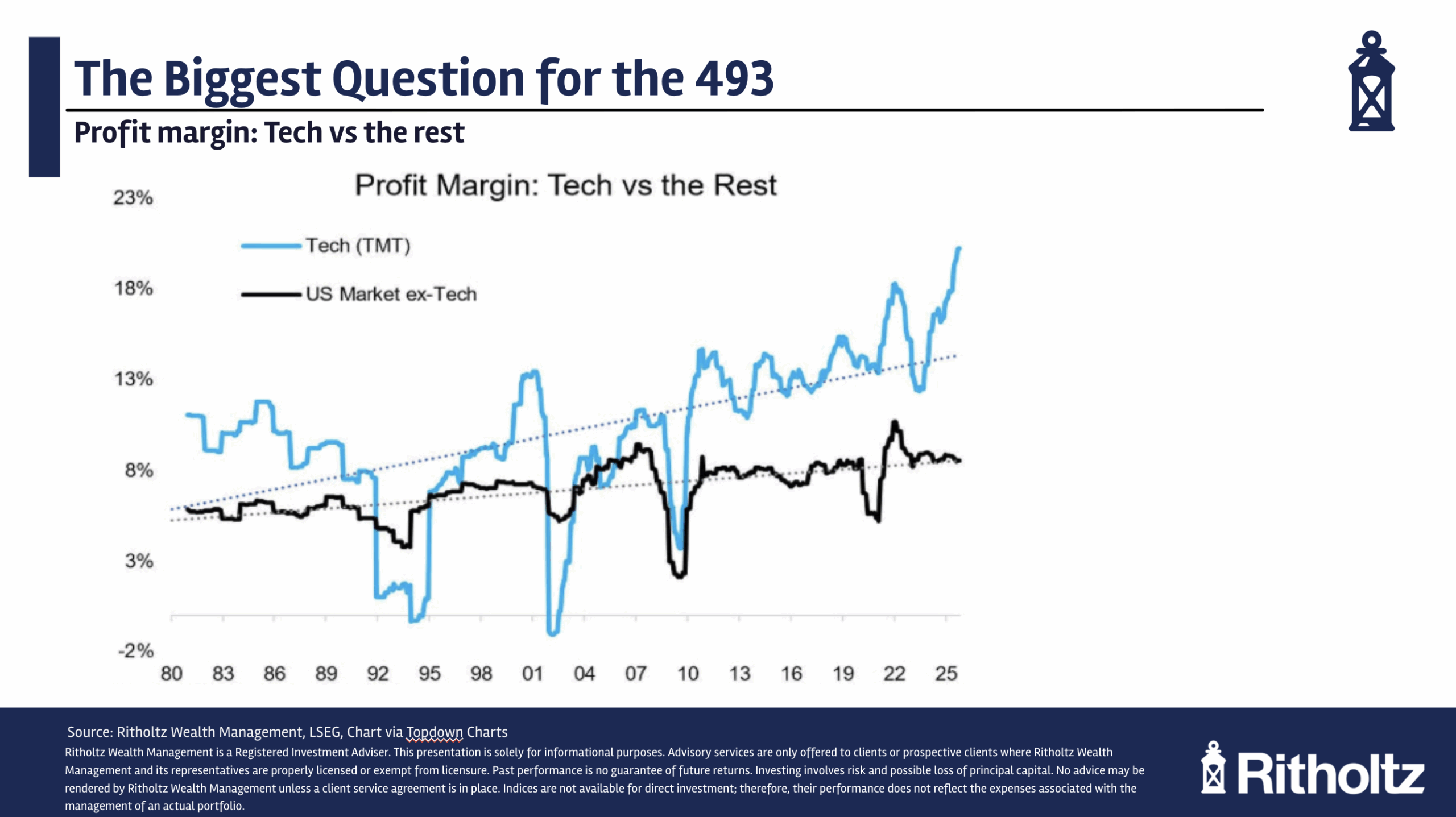

One of the biggest questions of the AI boom is how much the other companies that aren’t making these investments will benefit.

Outside of tech, the margins are much smaller:

Will AI improve productivity enough for some of these other companies to increase their margins? That would be something.

And finally — the question everyone wants to know — will this end badly for these huge companies?

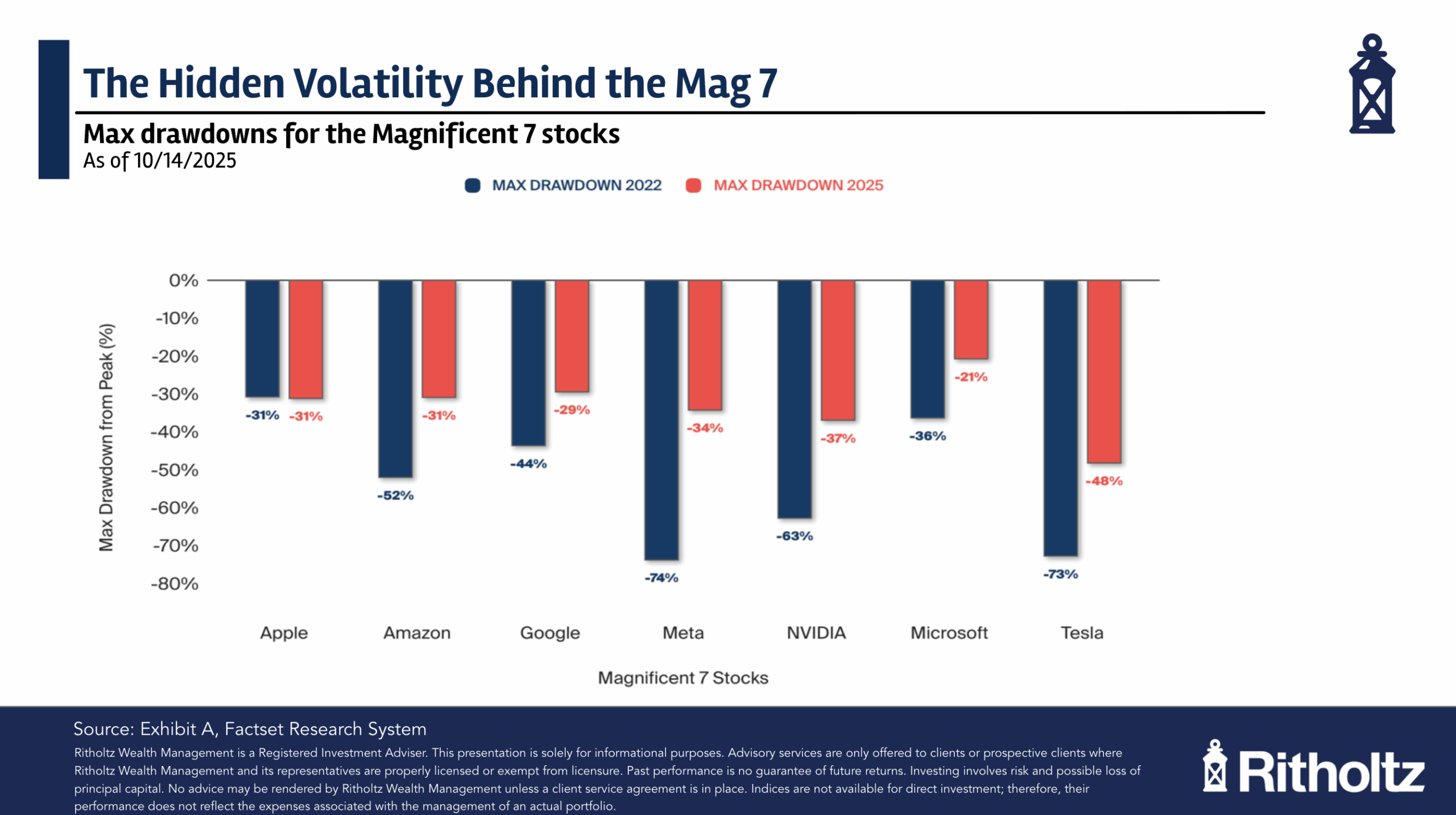

The Mag 7 is no stranger to crashes this decade:

When the expectations get out of whack will we see some or all of these stocks crash?

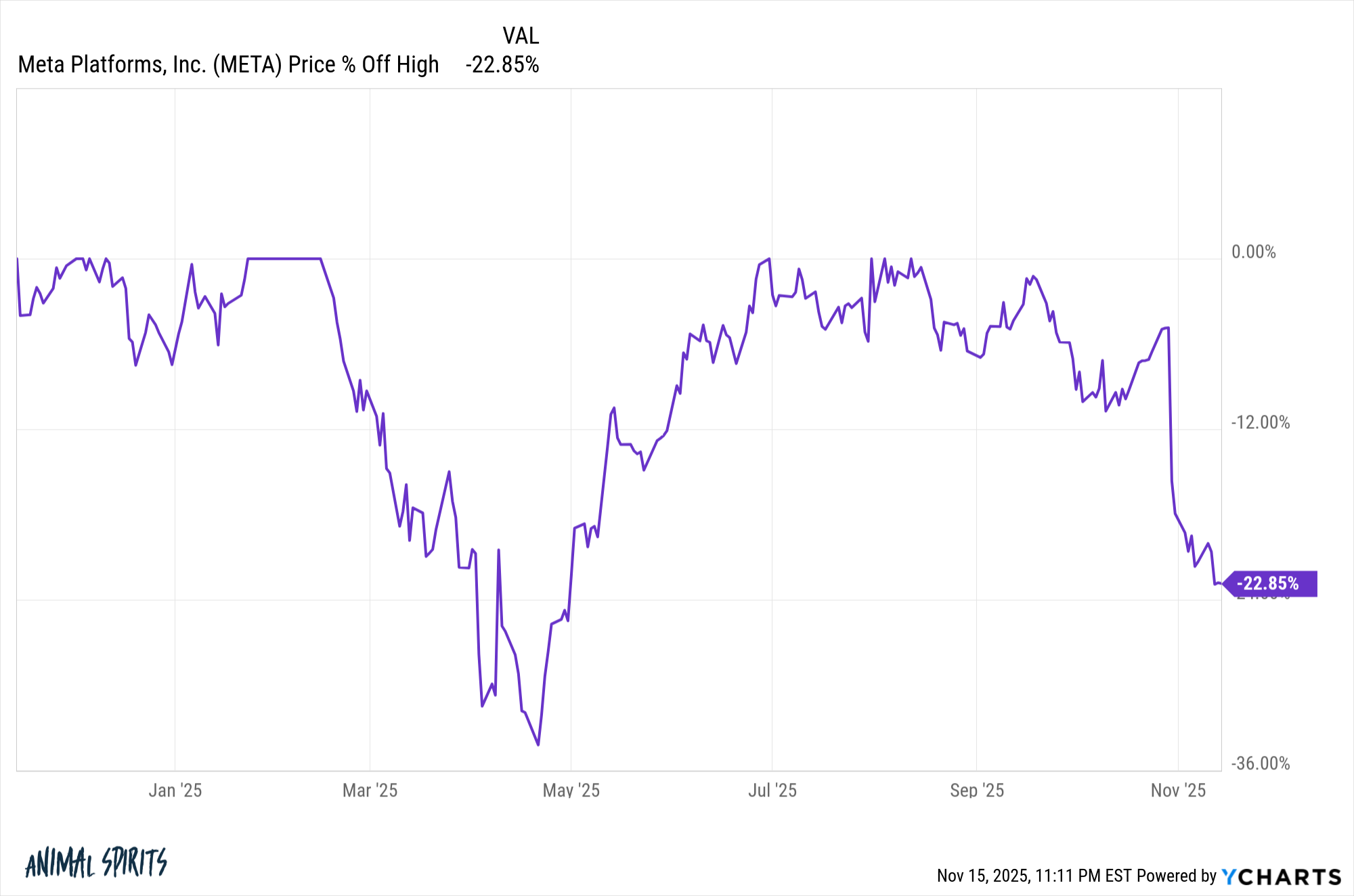

And what does a crash look like? A 20% decline is nothing. Meta is down more than 20% from the highs right now:

Are we looking at a 40% crash? 50% or more?

Would an AI bubble popping offer a wonderful buying opportunity because these companies are still better at what they do than everyone else?

Or what if these companies see a payoff sooner than we think and the gigantic crash never comes?

I have three words to sum up my conclusion on the matter:

I. Don’t. Know.

If anyone tells you they know how this will play out they have a horrible case of hubris or just want their investment stance to be proven right.

I remain open to a wide range of outcomes on the matter.

Further reading:

The Biggest Risk & The Biggest Opportunity