A vocal Christian nationalist minority has been working for two decades to overturn a vital federal law that safeguards our democracy and elections. After countless failures, they may finally succeed by colluding with Donald Trump’s government.

A federal court is hearing arguments on Tuesday about whether to approve a settlement between Trump’s IRS and two churches represented by Michael Farris, who sued the IRS, arguing that religious freedom means churches should be able to use their tax exemptions to benefit partisan political campaigns.

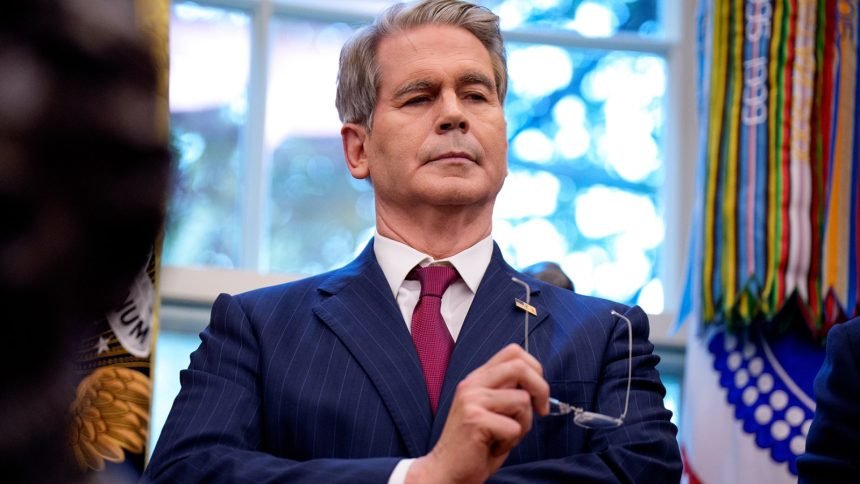

Farris is a fervent Christian nationalist. He’s the former head of the Alliance Defending Freedom and founder of the Home School Legal Defense Association and also Patrick Henry College — all notable for their advancement of Christian nationalism. The settlement Farris is proposing with Acting IRS Commissioner Steve Bessent would declare that the Johnson Amendment is unconstitutional and prohibit the government from enforcing the rule. This would effectively neuter a crucial safeguard and turn American churches into unregulated, unaccountable Super PACs. It could make Citizens United, the 2010 Supreme Court decision that gave wealthy donors and corporations enormous political influence, look tame by comparison.

For all the venom directed at the Johnson Amendment, it’s pretty simple: Charitable giving should fund charitable work, not political campaigns.

Nonprofits, including churches, are eligible for tax exemptions. Tax exemption is a privilege, not a right. And the government can attach strings to that privilege. One string is the Johnson Amendment. It prevents 501(c)(3) charities from endorsing or opposing political candidates. That’s it.

Farris and a small, vocal faction of Christian nationalist organizations are trying to eviscerate this common-sense rule by arguing free speech and religious freedom. But what they really want is money and power.

Twenty-five years ago, the United States Court of Appeals for the D.C. Circuit, sometimes called “the second highest court in the land,” entertained a similar challenge to the one Farris seeks to settle here (also brought by Christian nationalist groups). The court explained that the Johnson Amendment is constitutional and does not violate churches’ free speech rights or free exercise rights. In other words, it directly contradicts the proposed settlement Farris is seeking between the Trump administration and the churches.

The rule isn’t even that broad. It doesn’t stop churches from talking about issues, including marriage, abortion, and civil rights. It was passed in 1954 but didn’t stop Martin Luther King Jr. from preaching civil rights. Nor did it stop conservative white churches in the South from opposing King. Plus, the rule only stops nonprofits and their representatives from politicking in their official capacity. Preachers are free to tell friends and family how to vote, just not from the pulpit or on official church letterhead. And remember, if a nonprofit or church really wants to endorse a political candidate, it can. It just has to pay taxes like everyone else. But Farris and the Christian nationalists want to have their cake and eat it too.

The bigger problem is that, unlike other 501(c)(3)s, churches do not have to report any financial information to the IRS. Every other charity in this country has to file a Form 990 or financial disclosures. They track every penny that comes in and goes out.

But not churches. They are financial black holes. Without the Johnson Amendment, any mega-donor could write a check to a church for any amount, earmark the donation for politicking, and take a tax write-off.

The church would become a driving force in American political campaigns, something akin to, but more influential then, Super PACs — unregulated, unaccountable, opaque Super PACs. That’s the goal.

Existing PACs might even reorganize as churches to compete.

Under a normal administration, churches being able to spend on campaigns would lead to government regulation. Churches would be forced to comply with Super PAC rules and file financial disclosures. But does anyone seriously believe that the Trump regime — the most corrupt in recent memory, if not American history — would do anything other than profit from this grift?

Gutting this rule will be far worse for our democracy than the Citizens United decision, and will hand this fringe faction a terrifying amount of political power. And it is a fringe, because the Johnson Amendment is very popular. According to Lifeway Research, an evangelical polling group whose slogan is “Biblical Solutions for Life,” nearly 80 percent of Americans oppose pastors endorsing a candidate in church and 75 percent oppose churches publicly endorsing candidates. More than 4,000 faith leaders from diverse backgrounds asked Congress to protect this rule. As did nearly 6,000 nonprofits.

Everyone wants to keep the Johnson Amendment as it is — except the power-hungry Christian nationalists.

They failed in 2017, when, relying on Trump’s transactional nature, they persuaded the president to sign an executive order his lawyers admitted in court did “nothing.” (Disclosure: I was counsel in the lawsuit that forced that admission.)

Christian nationalists can’t turn public sentiment against the rule. They can’t undo the law via executive order. They couldn’t persuade higher courts to strike down the law. So instead, they’re colluding with Trump’s administration to settle a lawsuit that regurgitates arguments the second-highest court in the land rejected long ago. The IRS and these Christian nationalists are hoping the court will rubber-stamp a settlement that effectively voids a federal law duly passed by Congress.

But the separation of powers still lives. Thirteen members of Congress, led by Reps. Jared Huffman (D-Calif.) and Jamie Raskin (D-Md.), have asked the IRS to withdraw the proposed settlement, which is “a transparent end-run around Congress.” They were not swayed by the idea that any settlement would only apply to two churches involved in the case because it “blows the door wide open for both secular nonprofits and all other religious organizations to petition the courts for their own free pass to engage in tax-exempt electoral speech.” They did not mince words: “Congress has repeatedly chosen to maintain the Johnson Amendment in statute, and we reject the notion that the IRS can unilaterally reinterpret 70 years of this settled law.”

If the IRS does not withdraw the proposed settlement, the court could approve it at the Tuesday hearing. Lawyers for the nonprofit group Americans United for Separation of Church and State will be in court defending the Johnson Amendment because the Trump administration will not.*

The court should not let Christian nationalists collude with Trump to blow a gaping hole in American democracy. And if it does, Americans should not stand for it.

Andrew L. Seidel is a constitutional attorney, author of several books on Christian nationalism and religious freedom, and host of the “One Nation, Indivisible” podcast. He is vice president of strategic communications for Americans United for Separation of Church and State. This piece was written in his capacity as an independent attorney, author, and scholar.