Denver Health came close to breaking even in 2023 after a few one-time grants came through.

But in 2022, the hospital ran a nearly $32 million deficit.

Colorado’s only safety net hospital has been ringing the alarm about severe funding shortages for years. The number of uninsured patients continues to rise, Medicaid and Medicare reimbursements fail to cover expenses and the cost of health care is increasing.

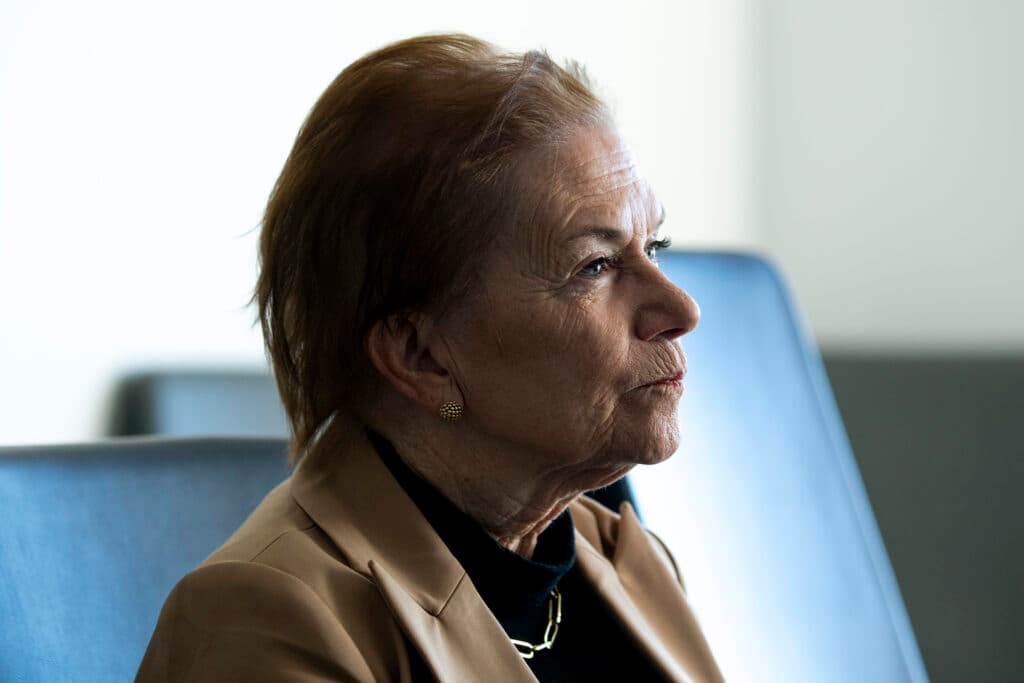

“I will tell you that right now, there isn’t a path out of where we are right now except for service cuts,” Denver Health CEO Donna Lynne told City Council on Wednesday.

Denver Health gets its funding from a number of sources, including a small portion of private insurers, Medicare and Medicaid payments from the government, and money from the city and state.

But the City of Denver’s contribution has stayed relatively flat in recent years, as the cost of care, particularly for patients without insurance, has skyrocketed.

Now, City Council and Denver Health leadership are proposing raising Denver’s sales tax to help fund the hospital system. The added .34 percent sales tax — or an additional 3.4 cents on a $10 purchase — would be expected to raise around $64 million for Denver Health.

Denver Health has already instituted a number of cost-cutting measures. Lynne warned that service cuts could come next.

The hospital network already has a hiring freeze and has eliminated things like travel for conferences.

Denver Health also changed employee benefits part-way through the year, Lynne said, a move she called “quite unprecedented.”

If the sales tax does not pass and the hospital fails to secure more funding, Lynne said Denver Health might have to consider service cuts or even close some clinics and institute layoffs.

Denver Health already struggles with staffing. The hospital has nearly 80 psychiatric and substance abuse beds, but can often only open around 50 of them at a time.

“74 percent of our patients come from racially and ethnically diverse populations,” Lynne told City Council on Wednesday. “By ignoring the urgent need for funding at Denver Health, I believe we are contributing to an inequitable and unjust health care system.”

If passed, the sales tax could help stave off more dramatic cuts at the hospital.

Denver Health leadership worked with dozens of community leaders to develop the proposal for the sales tax. Voter polling on a sales tax did well, compared to a property tax, which Lynne said received less support. Property taxes have risen sharply in Denver in recent years.

If the sales tax passes, Denver Health would have autonomy over how exactly to use more than $60 million in new funding. The bill would require the hospital to submit expenditure reports and expected spending to the city, in addition to financial audits by an independent body.

Based on community input, the ballot measure would have the hospital prioritizing spending on emergency and trauma care, primary medical care, mental health care, drug and alcohol recovery and pediatric care.

In recent years, the Colorado legislature has approved a few million in extra funding for the hospital.

Denver Health plans to pursue more state and federal funding along with additional philanthropy, but Lynne said that money is simply not enough.

In 2019, Denver Health spent $42.1 million on uncompensated care, which is treatment for patients without any insurance. In 2023, that figure rose to $102.6 million. Lynne called the rise in uninsured patients a “tsunami” happening not just in Colorado, but nationwide.

“We often just tighten our belts internally [and] make unwise decisions for the health of the Denver community,” she said.

Lynne said that a 2021 study of a group of nationwide safety net hospitals found that the average public hospital gets about 11 percent of its budget from local public funding. Denver Health gets 2.39 percent of its budget from local governments.

With Denver’s recent budget cuts, Council President Jamie Torres said she does not expect Denver’s annual contribution to the hospital from the city budget to change.

That’s why she is sponsoring the initiative for the sales tax, along with Councilmember Serena Gonzales-Gutierrez.

“That brings us to I think what is a long overdue conversation about potentially public funding for Denver Health,” Torres said.

Doctors, emergency responders and City Councilmembers voiced support for the potential sales tax.

Sonja O’Leary is a pediatric doctor with Denver Health who runs school-based health programs. She talked about how the funding crisis has affected her work, which includes things like student vaccinations and screening for depression.

“Our program remains chronically underfunded, which has prohibited its growth at times,” she said. “We currently have a nearly $2 million gap, and even when it’s filled with grants, it still limits our ability to grow in critical areas such as mental health.”

Mack Thompson, a captain with Denver Health paramedics, put his thoughts succinctly: “I can’t imagine what would happen to the city without Denver Health,” he said.

Councilmember Stacie Gilmore praised the initiative but questioned if it will raise enough money. Representing Denver’s far northeast, she said she wants to see better health care away from the city’s core.

“I have limited time in this seat, and I would like to see in the next 10, 15 years, that we have a greater safety net for those who are most in need,” she said. “This is our moment in time, this is an opportunity.”

But Councilmember Kevin Flynn raised concerns about ever-growing number of sales taxes.

Flynn recognized the need to boost Denver Health funding. But he also pointed out that Denver voters have approved a slew of sales taxes on themselves in recent years, funding everything from preschool programs to mental health services and healthy food for kids.

Since 2018, voters have passed what adds up to a more than 30 percent increase in sales taxes.

“I do feel like someone needs to be the canary in the coal mine, and I guess that’s going to be me,” he said.

Since Denver Health is Colorado’s only safety net hospital, Flynn raised the possibility of a regional tax that could include nearby towns that send uninsured patients to Denver Health.

According to Lynne, Denver Health sees the highest proportion of patients compared to other hospitals in the region.

Flynn also mentioned that sales tax revenue has been down this past year.

“My concern is that if we provide $70 million a year and growing into the future, solely from Denver sales taxpayers, that it might preclude a more regional solution to the problem of indigent care,” he said.

Lynne said she would support a statewide focus on solving Denver Health’s budget problems. She said hospital leadership has reached out to neighboring municipalities about similar bills to the one under consideration in Denver, but did not receive much of a response.

If City Council votes to put the measure on the ballot, Denver voters will vote on the sales tax increase on Nov. 5. The sales tax would go into effect on Jan. 1, 2025.