Real Estate

While that’s good news for owners and sellers, the Zillow report offered hope to buyers. In metro Boston, 14.1% of listings had a price cut in April. A year earlier, it was 11.1%.

Home values in the United States grew 4.3% year over year in April, but in Massachusetts, ever the outlier, the increase was more than double that, according to Zillow.

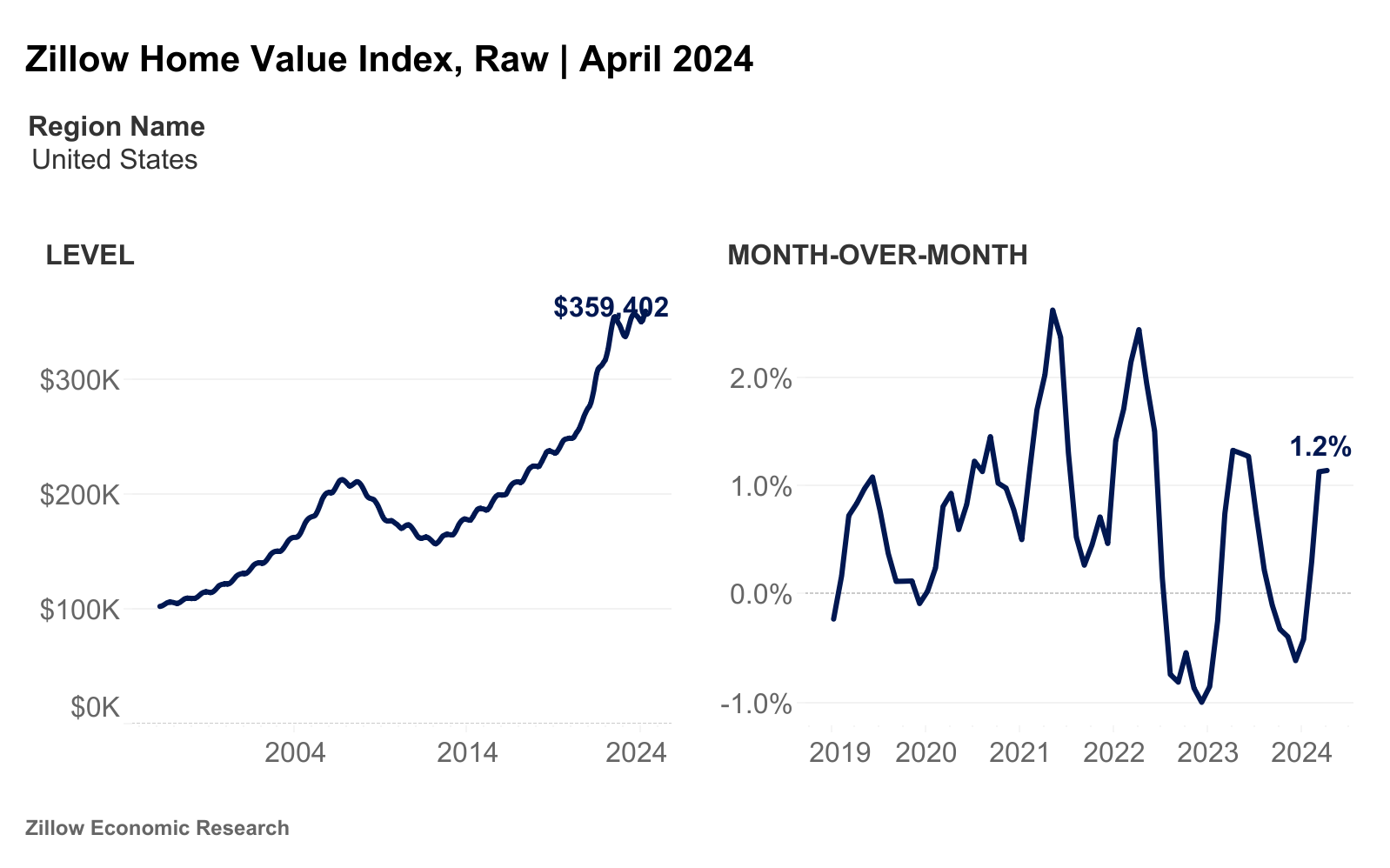

Today, Zillow Home Values Index indicated that the average Massachusetts home value, based on data collected through May 31, is $629,177. The national average is $360,681.

“We’re continuing to see fast price growth and really strong competition that is accelerating as we would expect in the spring and early summer,” Nicole Bachaud, a senior economist at Zillow, said of the US housing market.

The Northeast stands out as one of the best areas for sellers, while states like Texas and Florida are great for buyers, according to Zillow’s market heat index.

A lack of inventory and high mortgage rates have some buyers sitting on the sidelines, however. Mortgage rates surpassed 7% for the first time this year in April.

“Mortgage rates have stayed stubbornly high over the last year,” Bachaud said.

Higher home values and mortgage rates raise home buyer costs, pushing some shoppers out of the market. Zillow’s Housing Market Report, published on May 15, said home values in the country grew by 1.2% month over month alone in April.

But there are signs of hope for buyers.

“Price cuts can be a sign of weakening demand that foretells softer price growth ahead, or they can be a natural feeling-out process as sellers and their agents come up with their pricing strategy,” the Zillow report states.

Properties with price cuts in the United States shot up to 22.4% of listings in April, a big jump from last year (17.2%). In Boston, 14.1% of listings had a price cut. In April 2023, it was 11.1%, Zillow data show. (To Zillow, Boston means metro Boston, which spans west to Newton and north to Southern New Hampshire, according to the online marketplace.)

In Florida and Texas, which has seen a marked increase in in-migration in the past few years, the price cuts were more pronounced. For example, in North Port, Fla., the April price cuts increased from 30.2% in 2023 to 36.1% this year. In San Antonio, the number shot up from 24.3% in 2023 to 30% in 2024.

Bachaud said the price cuts are a result of fluctuations in mortgage rates and affordability, along with seasonal trends in which people try to move quickly. “We still are seeing strongly priced homes moving at a faster pace than pre-pandemic norms.”

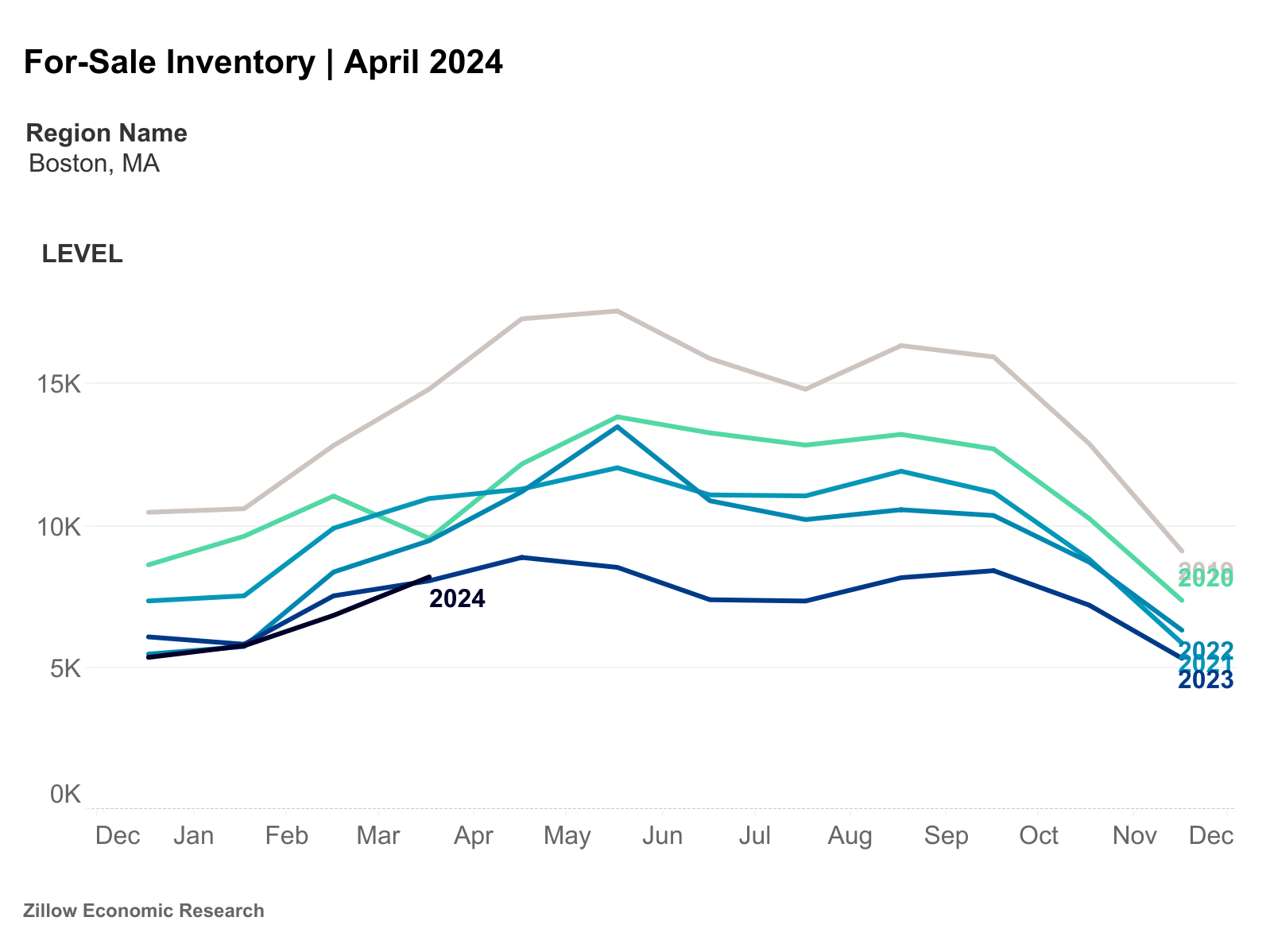

Metro Boston is not seeing such fluctuations in price cuts because of a lack of inventory and a dearth of space for construction and expansion, Bachaud said. “We have a lot of people looking to buy homes, and [there are] just not a lot of homes available to purchase.”

“Boston’s a little bit of an outlier in terms of growth slowdown, in terms of pricing, and also in terms of price cuts and demand,” said Dan Richards, president of Flyhomes Mortgage, a real estate firm and online marketplace.

In April, Greater Boston saw a 12.3% increase in single-family home sales, “marking the third time in the first four months of 2024 that home sales have risen on a year-over-year basis,” according to a report the Greater Boston Association of Realtors released on May 21. The number of homes on the market reflected a nearly 30% increase.

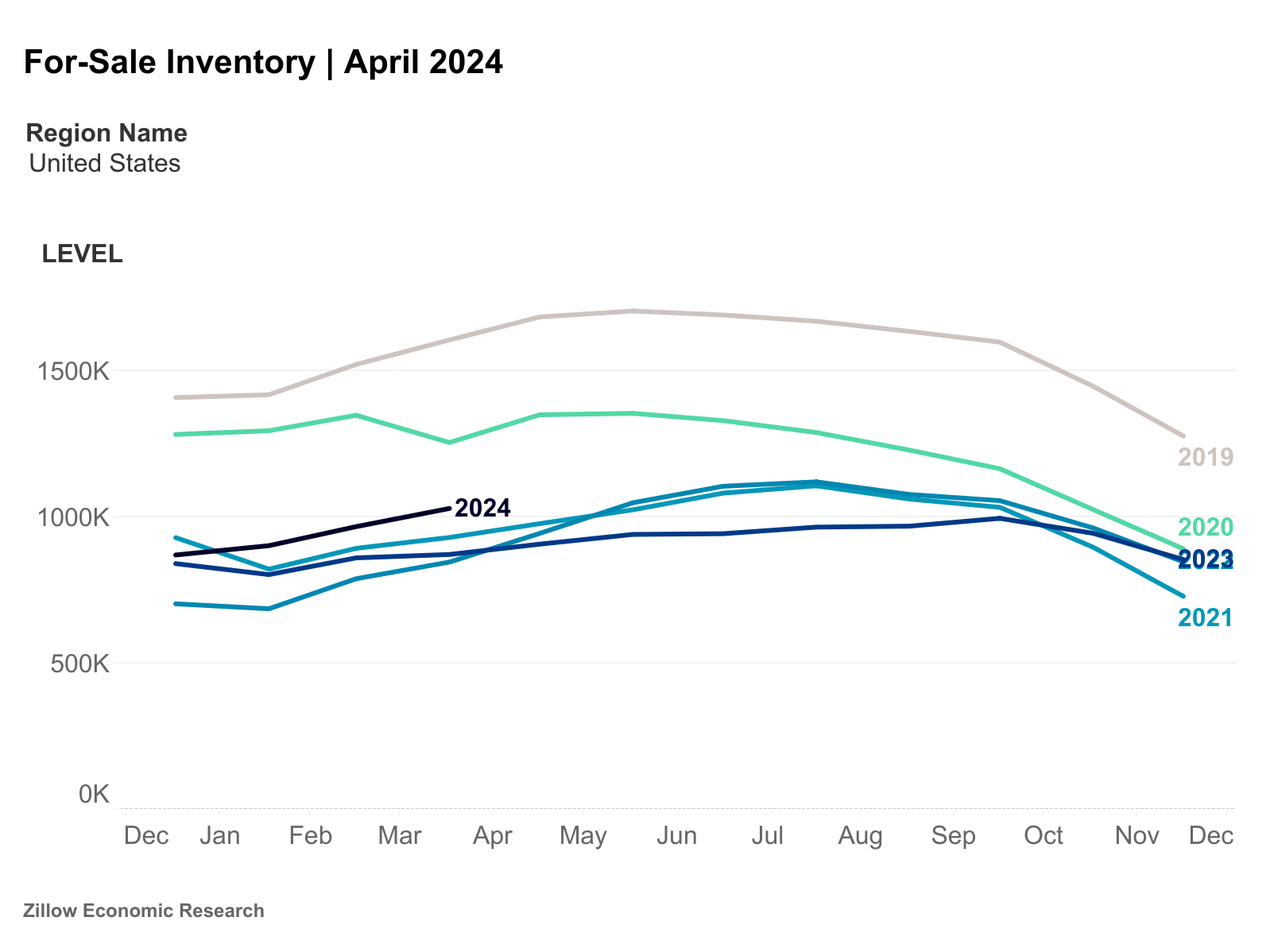

As for the rest of the country, new sellers are entering the market. The number of listings rose 6.4% month over month and 18% year over year, the highest increase since 2019, according to the Zillow housing market report.

Even though the statistics show a positive trend, new listings are still 24.7% and inventory levels are 35.7% below pre-pandemic levels. In Boston, the inventory showed a gradual but steady increase from 6,854 in March to 8,210 in April.

Rents in metro Boston have also increased and are up 3.6% from last year, the Zillow report states.

But Boston does not lead the list of metro areas with the highest increase. Providence does: 7.7%. “In Boston, we’re seeing that rents actually decreased from January to April, but then they’re back up in May and continuing up in June,” Richards said.

According to Bachaud, mortgage rates are going to be the biggest factor affecting a person’s ability to afford a house today versus tomorrow.

“As we see signals that inflation is continuing to stabilize and the labor market is continuing to stabilize, we will see likely rates coming down lightly in the next couple of months.”

Address Newsletter

Our weekly digest on buying, selling, and design, with expert advice and insider neighborhood knowledge.