The persistent shortage of housing inventory, stemming from a combination of long- and short-term factors, continues to challenge prospective homebuyers in the U.S.

Since 2022, high mortgage rates have deterred many would-be sellers from listing their properties, fearing the loss of existing low rates. Higher borrowing costs have also caused new residential construction activity to slow, resulting in fewer new units entering the housing market. At the same time, institutional investors—largely unaffected by mortgage rate fluctuations due to their cash-based transactions—have increasingly acquired a larger share of homes sold.

Trends in U.S. Housing Inventory

Low housing inventory continues to challenge prospective homebuyers in 2024

Source: Construction Coverage analysis of Redfin data | Image Credit: Construction Coverage

The result is that over the past decade, the number of homes for sale at any given point in time decreased from more than two million in 2012 to a low of approximately 630,000 at the start of 2022, according to data from Redfin. Over the same time period, months’ supply—a measure of how long it would take existing inventory to sell if no new homes came on the market—plummeted from a high of 7.5 months to a historic low of 1.1 months.

While the inventory deficit has eased slightly since early 2022, the situation is far from ideal for buyers. Throughout the first quarter of 2024, the national inventory hovered around 970,000 homes for sale, marking a 4.0% year-over-year increase. Despite this uptick, existing inventory would sustain the current sales pace for just 2.9 months, a marginal increase from 2.8 months recorded last year.

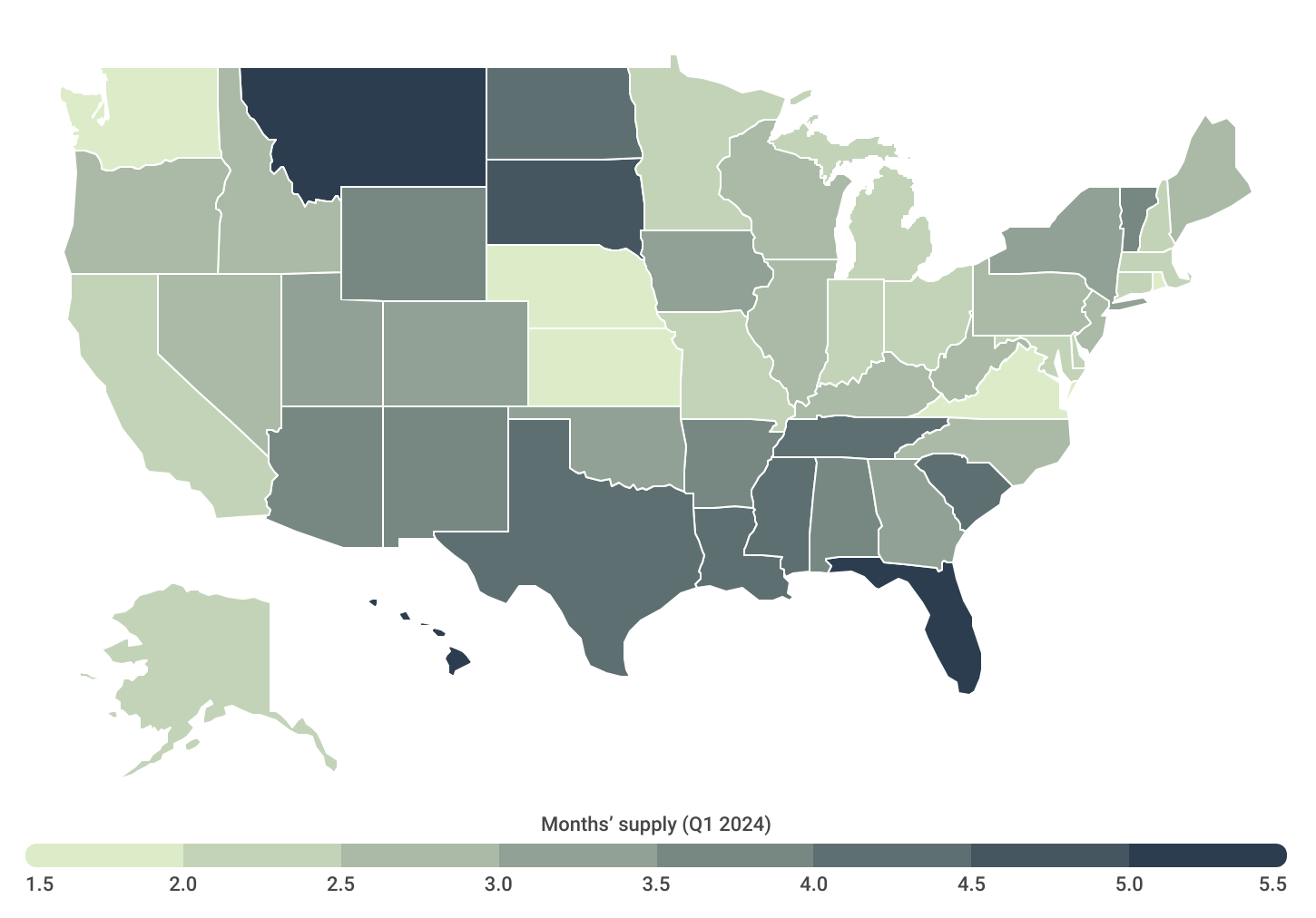

Residential Housing Inventory by State

Florida, Hawaii, & Montana have the greatest housing supply relative to demand

Source: Construction Coverage analysis of Redfin data | Image Credit: Construction Coverage

Regionally, the lack of housing affects certain areas more severely than others due to both short- and medium-term market conditions, as well as long-standing trends in construction activity. An analysis conducted by the National Association of Home Builders showed that throughout the 2010s, approximately 77% of single-family housing starts occurred in the South and West, compared to just 23% in the Midwest and Northeast.

These regional disparities manifest in the housing market’s current landscape. As of the first quarter of 2024, states with the lowest levels of supply are concentrated in and around the Midwest (such as Kansas with 1.5 months of supply) and the Northeast (including Rhode Island with 1.8 months of supply). However, Washington state also stands out for having some of the lowest levels of available housing nationally, with just 1.9 months of supply.

In contrast, several states in the South, led by Florida (with 5.2 months of supply), along with Hawaii (5.2 months) and Montana (5.1 months), present notably more favorable conditions for buyers. In fact, Redfin data indicates that currently, over 55% of homes for sale nationally are located in Southern states, despite these states comprising just 38% of the population.

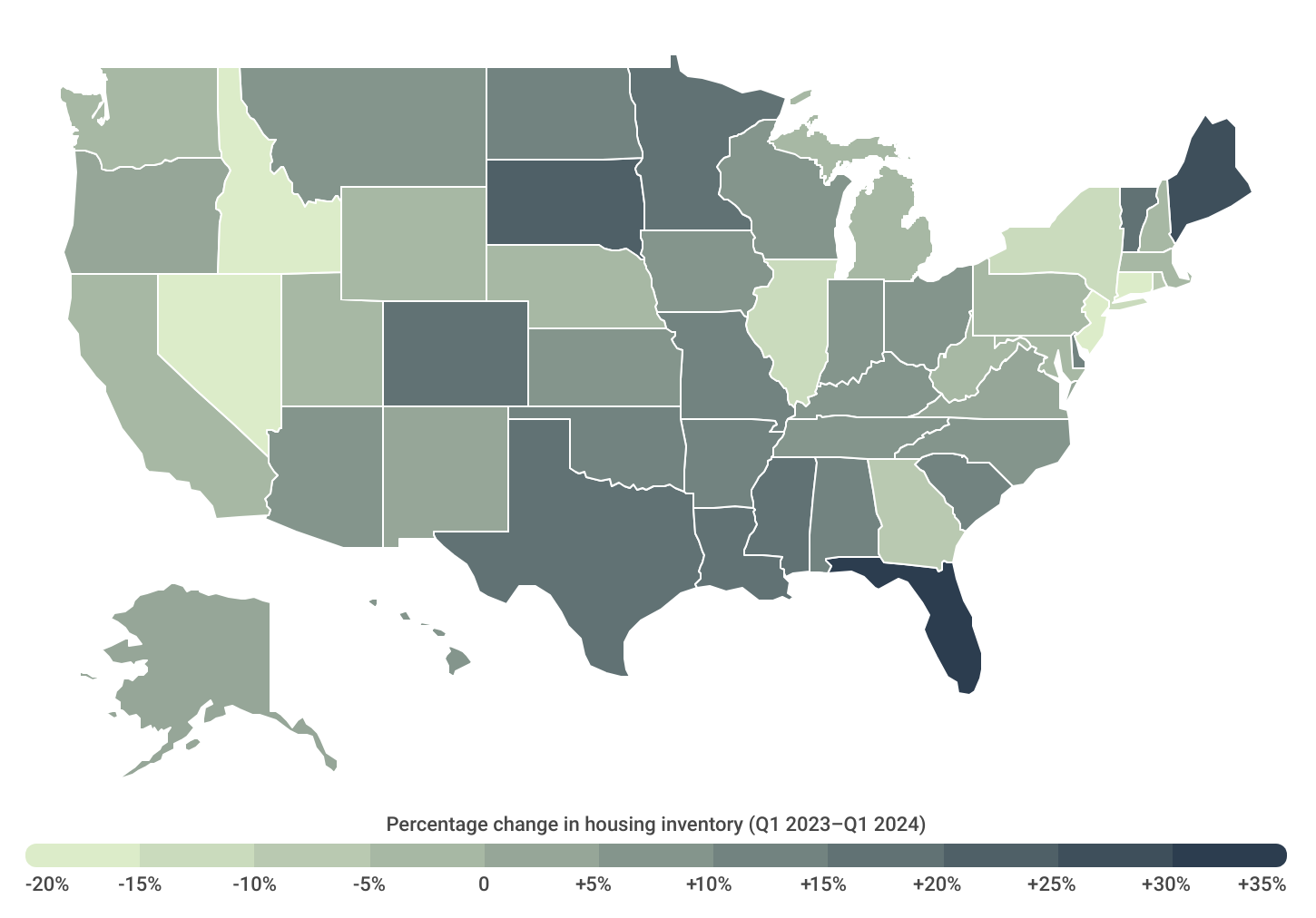

Changes in Housing Inventory by State

Florida & Maine recorded the largest increases in housing inventory over the past year

Source: Construction Coverage analysis of Redfin data | Image Credit: Construction Coverage

Nationally, the number of homes for sale increased by 4.0% between the first quarters of 2023 and 2024. However, this figure varied significantly across states, ranging from a nearly 35% surge in Florida to a 19.2% decline in Nevada. These discrepancies underscore the distinctive nature of local markets and emphasize the need for individualized policy approaches in addressing housing issues.

In Florida for example, demand for homes shot up dramatically during COVID-19 as remote workers from other states sought out affordable, warm-weather locales with more lenient pandemic regulations. Builders capitalized on this surge, constructing substantially more homes than in any other state but Texas. But now, as softer demand from out-of-state residents coincides with a large cohort of Florida homeowners eager to capitalize on the appreciation of their home values, a surplus of homes has flooded the market. A similar situation is currently playing out in Texas.

Among the nation’s largest cities, Denver, El Paso, and Dallas recorded the largest year-over-year increases in housing inventory. At the opposite end of the spectrum, Las Vegas, Raleigh, and Chicago recorded the biggest declines.

This analysis was conducted by Construction Coverage, a website that compares construction software and insurance, using data from Redfin. Here is a summary of the data for Kentucky:

- Percentage change in housing inventory (Q1 2023–Q1 2024): +9.4%

- Total change in housing inventory (Q1 2023–Q1 2024): +737

- Months’ supply (Q1 2024): 2.8

- Months’ supply (Q1 2023): 2.5

- Median sale price (Q1 2024): $249,360

- Median sale price (Q1 2023): $231,789

For reference, here are the statistics for the entire United States:

- Percentage change in housing inventory (Q1 2023–Q1 2024): +4.0%

- Total change in housing inventory (Q1 2023–Q1 2024): +37,214

- Months’ supply (Q1 2024): 2.9

- Months’ supply (Q1 2023): 2.8

- Median sale price (Q1 2024): $412,360

- Median sale price (Q1 2023): $391,892

For more information, a detailed methodology, and complete results, see U.S. Cities With the Biggest Increase in Housing Inventory on Construction Coverage.