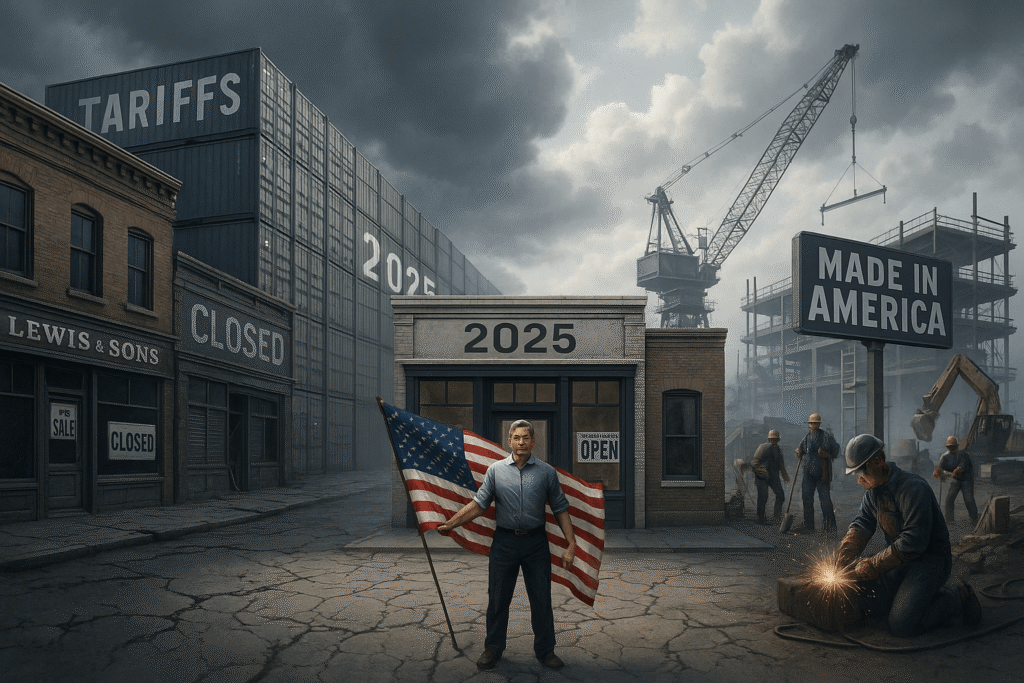

An Economic Turning Point for Small Businesses in 2025

The final quarter of 2025 places American small businesses at a critical crossroads. With President Donald Trump back in office, his administration has launched a series of aggressive economic policies aimed at reshoring manufacturing, increasing domestic employment, and reasserting “America First” priorities. At the center of this shift are renewed tariffs on foreign goods, deregulation for U.S. industries, and proposed tax incentives for domestic production.

Small businesses are once again feeling the ripple effects. Whether they thrive or struggle in Q4 2025 depends heavily on their ability to adapt to a changing trade environment, labor conditions, and consumer behavior—all reshaped by the Trump administration’s economic playbook.

Economic Overview: Resilience Amid Volatility

Despite fears of a slowdown early in the year, mid-2025 reports show a stabilizing economy led by consumer spending and reshoring efforts. However, inflation remains persistent due to higher import costs, and credit conditions are tightening.

Key Mid-2025 Economic Indicators:

Indicator | Status (July 2025) | Source |

GDP Growth | Projected 2.1% annualized in Q4 | Bureau of Economic Analysis |

Consumer Confidence Index | 98.7 | Conference Board |

Producer Price Index (PPI) | +1.8% since Q2 | U.S. Bureau of Labor Statistics |

Small Business Optimism Index | 89.6 | NFIB |

Unemployment Rate | 4.0% | U.S. Department of Labor |

The small business outlook remains cautiously optimistic in regions benefitting from new reshoring initiatives and federal incentives. But uncertainty over tariffs, interest rates, and global trade continues to weigh on businesses in import-heavy sectors like retail and electronics.

Trump’s Economic Agenda: What’s New in Q4?

President Trump’s second term has focused on economic nationalism and strategic decoupling from China and other high-import economies. Key elements of his 2025 agenda include:

1. Expanded Tariffs on Imports

Trump’s administration expanded tariffs mid-year, with targeted increases on Chinese, Mexican, and South Korean imports:

- Electronics: Up to 30% tariff on semiconductors, smartphones, and accessories

- Automotive Parts: 22% tariff on imported components

- Retail Goods: 25–40% increase on clothing, toys, and home goods

- Steel & Aluminum: Restored duties of 10%–15% on many grades and types

Impact: Businesses reliant on foreign materials report supply chain strain and cost surges. Retailers and ecommerce shops are hit hardest, while U.S. manufacturers are ramping up production capacity.

2. “America First 2.0” Reshoring Incentives

Although no bill has passed named the “Big Beautiful Bill,” Trump has repeatedly teased large tax breaks for companies that bring operations back to the U.S., particularly in tech, automotive, and construction manufacturing.

Key proposals:

- 25% tax credit for equipment purchased from U.S. manufacturers

- Payroll tax breaks for hiring U.S. workers in formerly offshored jobs

- Priority SBA loans for businesses manufacturing in key economic zones

These proposals are already influencing business behavior—even before full legislative implementation.

3. Rollback of Business Regulations

Trump’s 2025 executive orders have reversed several Biden-era labor and environmental policies:

- Loosened rules for independent contractors

- Paused climate-related disclosures for small public companies

- Streamlined federal permitting for industrial construction

This deregulation has lowered compliance costs for construction, trucking, and logistics companies, enhancing profitability.

Industry Spotlight: Winners and Losers in Q4 2025

The small business outlook varies widely by industry depending on their exposure to foreign supply chains and access to domestic growth incentives.

Sector | Q4 Outlook | Tariff Risk | Policy Benefit |

Manufacturing | Strong Growth | Low (reshoring boost) | High |

Retail & Ecommerce | Challenging | High | Low |

Construction | Solid Expansion | Low | Medium |

Tech Hardware | Moderate Risk | High | Low |

Digital Services | Growth | Low | Medium |

Auto Repair | Stable | Medium | Medium |

Food Services | Stable Growth | Low | Low |

Tariffs and Inflation: Pressure Mounts

Tariff-induced inflation is a key concern as businesses see their input costs climb. According to the U.S. Bureau of Labor Statistics and ISM (Institute for Supply Management):

- Import costs are up 4.8% YoY

- Consumer price inflation forecast at 3.4% through Q4

- Wholesale prices rose 5.2% in electronics and 4.1% in consumer goods

- Wage growth in service jobs is lagging at 1.5%, adding retention challenges

Businesses in urban areas and states like California, New York, and Illinois report the most pressure due to higher labor and energy costs.

Holiday Season: Make-or-Break for Retailers

For retail small businesses, Q4 remains the most critical period of the year. But tariff hikes, shipping delays, and higher product prices are complicating holiday strategies.

2025 Holiday Sales Forecast (Adobe Analytics & Salesforce):

- Ecommerce sales: +7.3% YoY

- Mobile shopping: 58% of online traffic

- BNPL (Buy Now, Pay Later): Usage up 18%

- In-store traffic: Expected 4% lower than 2024

Small retailers offering omnichannel solutions—like curbside pickup, local delivery, and live shopping—are seeing higher conversion rates.

Strategic Responses: How Smart Businesses Are Adapting

The small business outlook depends on agility, resource access, and digital transformation. Business owners embracing these trends are reporting stronger performance even amid economic headwinds.

1. Diversifying Supply Chains

Tariffs have forced many small businesses to rethink sourcing:

- Shift from China to Vietnam, India, and Central America

- Bulk purchasing and warehouse expansions to hedge against price spikes

- Joint purchasing groups among local SMBs to reduce costs

2. Leveraging SBA and State-Level Incentives

In response to the new economic direction, several programs remain open for funding and support:

- SBA 7(a) and 504 Loans with interest subsidies for U.S.-based production

- State reshoring grants in Texas, Ohio, and Indiana

- Made in America Tax Credit (proposed): 25% write-off for U.S.-made goods

- SBA Office of International Trade assistance for reexporting

3. Embracing Automation and Digital Transformation

The productivity gap between digitized and analog small businesses continues to widen. Trends accelerating in Q4 2025 include:

- Cloud-based POS and ERP systems

- Generative AI for marketing and customer service

- Inventory automation with RFID/IoT

- Selling through TikTok Shop, Instagram Checkout, and Amazon Buy with Prime

Labor Market: Competitive But Uneven

Labor challenges continue to define the small business outlook. Although unemployment remains low, wage growth has been inconsistent and many service jobs remain hard to fill.

Solutions small businesses are exploring:

- Training partnerships with local colleges

- Flexible scheduling and remote options for digital roles

- Hiring incentives using state and federal tax credits (like WOTC)

- H-2B visa hiring for seasonal retail, hospitality, and agricultural labor

Regional Trends: Where Small Businesses Are Thriving

Location matters in Q4 2025. Small business momentum is strong in states that benefit from manufacturing and logistics booms.

Top States for Small Business Growth (Q4 Projections):

State | Strengths |

Texas | Reshoring, broadband, logistics |

Florida | Construction, tourism rebound |

Arizona | Manufacturing, warehousing |

Tennessee | Auto parts, textiles |

Indiana | Equipment and steel |

States heavily reliant on imports (like California and New Jersey) are seeing more friction due to port congestion and higher costs.

What Comes Next? Q1 2026 Outlook

Looking ahead, Trump’s administration is signaling more moves in favor of U.S. producers:

- A possible 0% capital gains tax for small business owners selling U.S.-made goods

- Expansion of tariff lists to include European auto parts and pharmaceuticals

- A new “Made in America Council” aimed at enforcing reshoring commitments from larger corporations

While none of these are confirmed laws yet, businesses should plan with caution and flexibility, understanding that policies may shift with the 2026 midterms.

Final Thoughts: Navigating Q4 with Strategy

The small business outlook in Q4 2025 is a story of divergence—those who adapt fast are positioned to win; those tied to outdated models may falter.

To thrive in this changing landscape, small businesses must:

- Stay informed on tariff changes and policy announcements

- Invest in automation and digital infrastructure

- Take advantage of federal and state-level support

- Adapt pricing, sourcing, and marketing with agility

As President Trump pushes forward with his America First 2.0 agenda, small businesses willing to retool, reskill, and rethink their operations will lead the charge into 2026.