Technology, media and telecom executives identify emerging risks and opportunities: WTW survey.

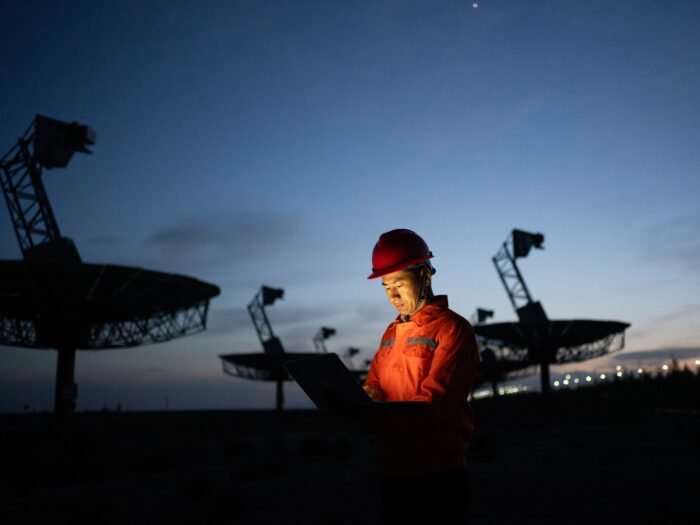

In an era of unprecedented digitalization, businesses in the technology, media and telecommunications (TMT) sectors find themselves at a critical juncture. While innovations like artificial intelligence, 5G networks and streaming content present immense opportunities, TMT businesses also face mounting challenges as they adapt to rapidly evolving customer demands and brace against strengthening regulatory, geopolitical and economic headwinds, according to a WTW survey.

“Like other sectors, TMT businesses face adaptation challenges — finding the right products and business models to meet fast-changing customer expectations

and generate returns on their large investments. All against strengthening regulatory, geopolitical and economic headwinds,” WTW stated.

Two-thirds, or 67%, of TMT industry executives surveyed ranked innovation among their greatest strategic objectives over the next two years, far outpacing other priorities. Interestingly, most companies are focusing on driving innovation organically, with 61% prioritizing organic growth well ahead of growth through acquisition, WTW noted. This suggests TMT leaders recognize the critical importance of developing new technologies and solutions in-house to stay ahead of the competition.

“From the outside, TMT appears to be the arch disruptor, pushing out new technologies, platforms and networks the rest of the world must adapt to. But the speed and scale of change is no less testing for those within the industry,” the report stated.

A key trend transforming the TMT industry is the blurring of lines between the technology, media and telecommunications sectors. Cutting-edge innovations like artificial intelligence, machine learning and 5G wireless networks are emerging as drivers of disruption across all three segments. The survey found that 51% of technology companies and 49% of media and telecoms businesses named AI and machine learning among their greatest opportunities in the near-term. Meanwhile, the impending rollout of 5G ranked as a top prospect for both the technology and telecoms sectors. As these technologies become more intertwined, TMT companies will need to collaborate more closely and rethink traditional industry boundaries, WTW stated.

While technological advancement is enabling TMT companies to innovate faster than ever, geopolitical tensions and regulatory hurdles are constraining their global ambitions. Trade disputes emerged as the top geopolitical risk factor in the survey, cited by 74% of respondents. Escalating trade battles are leading to more restrictions and tariffs that make it harder for TMT firms to access key markets and acquire foreign innovation targets. At the same time, the industry is grappling with a growing web of regulations, which 55% of executives named as the biggest obstacle to achieving their strategic objectives. From tighter data privacy rules to stricter antitrust enforcement, the regulatory scrutiny is forcing TMT companies to be more cautious as they navigate an increasingly complex global landscape, WTW reported.

Sector-Specific Opportunities and Risks

Technology: For technology companies, the greatest opportunities on the horizon center around cutting-edge innovations, the survey found. Over half (51%) of technology executives see major potential in AI and machine learning, while 43% are enthusiastic about the overall accelerated pace of innovation and R&D in the sector. The rapid adoption of remote work is also opening doors, with 43% bullish about opportunities in remote work technologies.

However, tech firms face mounting risks alongside these opportunities. Cyber security and data privacy topped the list of concerns, cited by 46%. The complex web of regulation around technology is also causing headaches, with 42% pointing to regulatory and anti-trust challenges among their top risks. An equal 42% worry about potential business interruption in the fast-moving sector.

Media: The proliferation of digital channels is shaking up the media landscape. Over half of media companies (52%) see online advertising as their greatest opportunity in the coming years. AI and machine learning came in a close second at 49%, with its potential to revolutionize everything from content creation to personalized marketing. Original content production (46%) rounds out the top three opportunities.

On the risk side, media companies are most concerned about cyber security and data privacy (51%), likely heightened by the sector’s increasing reliance on customer data and digital platforms. Brand and reputational risk followed at 43%, underscoring the high stakes in the crowded media environment. Content piracy and copyright infringement remains an enduring challenge, with 42% ranking it among their top risks.

Telecoms: For telecoms, the 5G rollout is a major focal point, with 56% eyeing opportunities in 5G expansion. But even more (62%) see the greatest potential in providing cybersecurity services, suggesting telecoms are well-positioned to support the increasing digital security needs of businesses and consumers. Fiber optic broadband expansion came in third at 52%.

In terms of risks, telecoms are aligned with their media and tech peers in placing cyber and data privacy risk at the top of the list (51%). Notably, security concerns specifically around the new 5G networks emerged as the second biggest risk factor at 48%. Telecoms are also highly attuned to brand and reputational risk (38%) in the hypercompetitive industry prone to customer churn.

View the full survey here. &