After good performance throughout 2024, the technology sector collapsed in the first quarter of 2025. While we recently thought the sector was fairly valued overall, we now see it as attractive. Results for software companies have generally been solid, but shares ran hard in the previous quarter and are now reverting to levels consistent with the start of that performance.

Overall, tech was the second-weakest sector in the first quarter, which dragged its performance down from being one of the best performing sectors over the last 12 months to being middle of the pack. We see no consistent performance differentiation among market capitalization tranches. Our confidence in secular tailwinds, such as cloud computing, artificial intelligence, and the long-term expansion of semiconductor demand, remains unchanged. As tech stocks have sold off, we see heightened investment opportunities. The Morningstar US Technology Index is up 11.4% on a trailing-12-month basis, compared to the US equity market being up 11.5%. In the quarter, the US equity market was down 1.74%, while tech was down 7%.

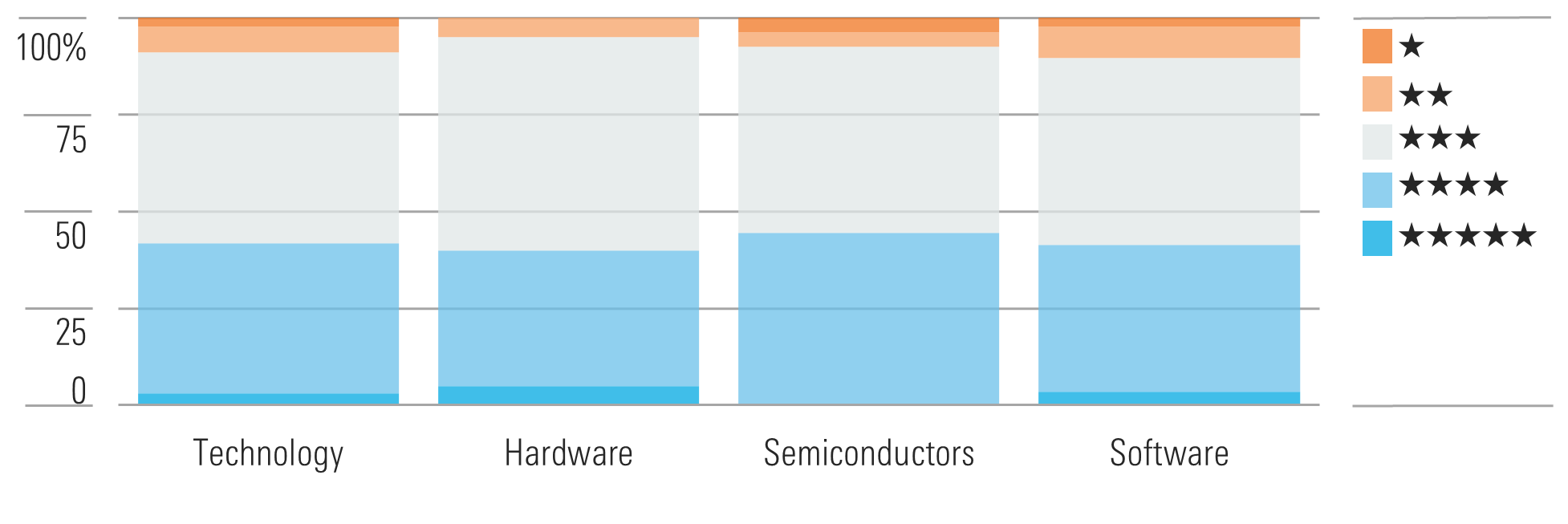

The median US technology stock is undervalued, with a reasonable margin of safety. We see hardware as the most undervalued, with semis and software also skewing attractive.

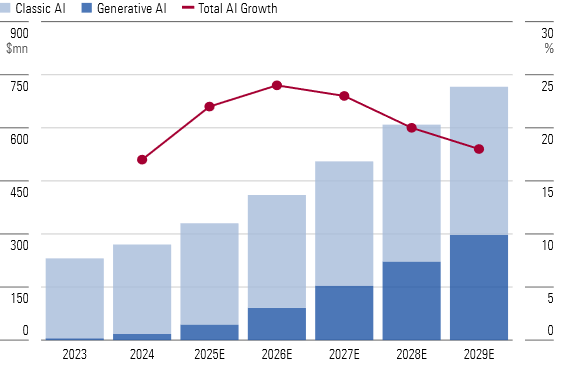

Generative AI remains the biggest theme within the tech sector. Software companies are developing and incorporating next generation AI capabilities within their solutions, while cloud providers are introducing new services and ramping capacity, and some semiconductor firms, notably Nvidia, are experiencing surging demand for AI and data center chip applications. That said, shares of AI-related companies have also sold off early in 2025.

We think generative AI will support revenue growth over the next five years, even if it has not led to much growth in the past year or two as buyers mostly evaluated the technology. Growth has certainly been explosive for the public cloud vendors. We see the biggest generative AI use cases over the next several years within the customer service and software development areas. Both markets are already large, and efficiencies gained from generative AI make for a compelling value proposition.

Top Technology Sector Picks

NXP Semiconductors

NXP Semiconductors NXPI is one of our top picks in the analog and mixed-signal chip space. We’re especially fond of the company’s outsized exposure to the automotive end market, where it obtains nearly 50% of revenue. NXP is well-diversified in automotive, with a nice product portfolio of processors, microcontrollers, and analog parts. We think the firm will gain its fair share in electrification and safety automotive products too, such as radar and battery management systems. Overall, NXP’s auto business is tied to the secular tailwinds around rising chip content per vehicle, and we think the market is too focused on a near-term slowdown in demand. We expect NXP will return to revenue growth in 2025.

Adobe

Adobe ADBE has come to dominate in content creation software with its iconic Photoshop and Illustrator solutions, both of which are contained in the broader Creative Cloud, which is the clear leader for software for creative professionals. Adobe Express is widening the funnel for new customers, which we think bodes well for growth over the next several years. We also see Firefly generative AI models as an important growth driver. Overall, we see plenty of momentum within product innovation, client interest, and revenue creation, and we are encouraged by solid quarterly results

Microsoft

Microsoft MSFT dominates several of its served markets, such as with Office in productivity software and Windows for PC operating systems, and it has established itself as one of the clear leaders in public cloud. We think the proliferation of hybrid cloud environments will continue to strengthen its position with Azure. Further, the firm’s investment in OpenAI has catapulted Microsoft to a leadership position in generative AI, which has driven an acceleration of Azure growth in recent quarters.