Home to a booming economy and a dynamic business scene, Texas has become a magnet for homebuyers across the nation. While traditionally known for affordability, the Texas housing market is experiencing a period of transition. The market is demonstrating resilience and gradual improvement in 2024.

Home prices have stabilized, new listings are increasing, and the market is adjusting to higher mortgage rates and economic factors influencing homebuyer behavior. The overall outlook remains positive, supported by Texas’ strong labor market and economic conditions. Here are the latest trends in the Texas housing market.

How is the Texas Housing Market Doing in 2024?

Texas Home Sales

The Texas housing market has shown a significant rebound in April 2024, following a decline in March. Seasonally adjusted housing sales have increased, driven by a rise in new listings for the fourth consecutive month. This recovery has resulted in 29,212 homes sold on a seasonally adjusted basis, marking a 5.9 percent increase month over month (MOM).

- San Antonio saw the highest recovery among the major cities, with an 8 percent increase in home sales, bouncing back from a 9.2 percent decline.

- Dallas experienced a 4 percent increase in home sales.

- Other major cities also saw slight increases in sales.

This upward trend in home sales indicates a strong demand for housing across Texas, supported by a robust labor market and economic strength.

Texas Home Prices

Despite the fluctuations in sales, home prices in Texas have remained stable. The median home price in the state has held steady at approximately $340,000 for two consecutive months.

- Austin experienced a notable increase of 5.1 percent in home prices, with the median price rising from $421,572 to $443,247.

- Houston saw a 2.1 percent increase in home prices.

- Dallas had a modest 0.7 percent increase.

- San Antonio was the only major city to experience a decline in home prices, falling by 0.9 percent.

The Texas Repeat Sales Home Price Index (Jan 2005=100) also showed positive growth, increasing by 0.9 percent MOM and 2.6 percent year over year (YOY).

Texas Housing Supply

The supply of housing in Texas has been on the rise, contributing to the stabilization of the market.

- The number of active listings increased from 106,428 to 111,707, a 4.9 percent increase.

- New listings have been increasing steadily from December to April, with a total of 47,000 new listings in April 2024.

Among the Big Four cities:

- Dallas saw a decline in new listings over the past two months, currently at 11,523 new listings.

- Austin experienced a significant increase of 25 percent in new listings between January and April.

- Houston added 2,788 listings (a 10.7 percent increase), almost five times that of the previous month.

- San Antonio saw a modest increase of 2 percent.

The average days on market has remained unchanged at 57 days. However, there were variations among the major cities:

- Austin decreased by almost four days.

- Dallas increased by less than one day.

- San Antonio experienced an increase of just over three days, now having the highest days on market at 72 days.

- Houston had the lowest days on market at 46 days.

Texas Housing Market Trends

Several key trends are shaping the Texas housing market in 2024:

1. Rising Interest Rates:

- Treasury and mortgage rates have been increasing since the start of the year, although they remain below their peak 2023 levels.

- The average ten-year U.S. Treasury Bond yield rose by almost 33 basis points to 4.54 percent.

- The Federal Home Loan Mortgage Corporation’s 30-year fixed-rate rose by 17 basis points to 6.99 percent.

2. Single-Family Starts Declining:

- The number of single-family construction permits increased by 0.9 percent MOM, reaching 13,805 issuances.

- Construction starts, however, decreased by 15.1 percent MOM to 13,731 units, partly due to the strong performance in February signaling an early start to the construction season.

3. Economic Strength and Housing Demand:

- Texas’ robust labor market and economic strength continue to support housing demand.

- Residential mortgage activity is improving as more pre-approved customers search for homes, despite higher mortgage interest rates.

- Financial vulnerability, such as rising credit card delinquencies, is concentrated on the lower end of the income distribution, somewhat shielding the home-purchase market but impacting housing affordability.

4. Housing Affordability:

- While the housing market is stabilizing, the persistent higher mortgage rates and economic factors have broader implications for housing affordability.

- Households at the lower end of the income distribution are less likely to be prospective homebuyers, affecting the overall market dynamics.

Texas Housing Market Predictions

The following data provides insights into the forecast for the Texas housing market. The average Texas home value is $306,756, up 1.0% over the past year and going to pending in around 23 days (Zillow).

Median sale price refers to the middle value of all home sales prices that occurred within a specific time frame, typically a month. In Texas, the median sale price as of April 2024, was $331,508. This means that half of the homes sold during that period were priced above $331,508, and the other half were priced below.

Median list price represents the middle value of all the homes listed for sale during a particular time period, usually a month. The median list price was $365,177. This indicates that half of the properties listed for sale were priced above $365,177, and the other half were priced below.

Percent of sales over list price and percent of sales under list price are indicators of market competitiveness and pricing dynamics.

- Percent of sales over list price: This figure, standing at 18.8%, signifies the proportion of homes that sold for more than their listed price during that period. A high percentage can indicate a seller’s market, where demand exceeds supply, leading to competitive bidding and higher sale prices.

- Percent of sales under list price: At 59.3%, this metric indicates the percentage of homes that sold for less than their listed price. A higher percentage in this category may suggest a buyer’s market, characterized by more inventory than demand, potentially leading to price reductions and negotiations favoring buyers.

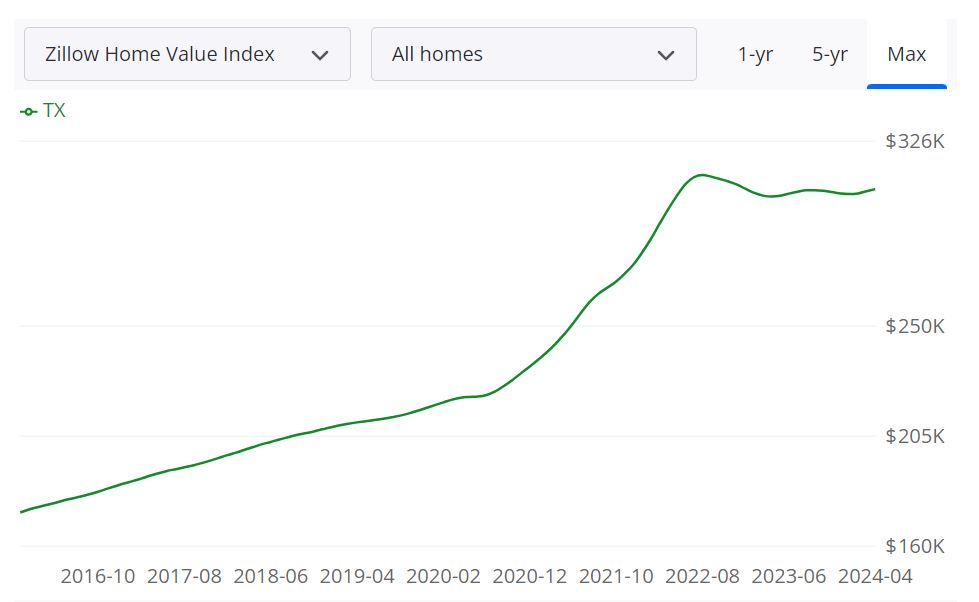

This graph by Zillow illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

The Texas housing market, a perennial powerhouse, is in for a period of adjustment in 2024. While the frenetic pace of the past few years may ease, experts predict a market characterized by a more balanced approach. Let’s delve into the key trends shaping the Texas housing landscape this year.

Inventory on the Rise, Prices Finding Equilibrium

One of the biggest shifts will likely be in housing inventory. For years, buyers have faced a seller’s market with tight supply. However, with rising mortgage rates, some homeowners who were hesitant to sell due to low rates may now be more willing to list their properties. This influx of inventory, coupled with a potentially softening demand due to higher borrowing costs, could lead to a more balanced market where buyers have more options.

While some predict price drops, a complete crash is unlikely. Instead, experts anticipate a moderation in price growth. Texas’ strong job market and steady population increase will continue to fuel demand, preventing a significant decline. The most likely scenario is a shift to a more sustainable price appreciation rate, somewhere in the 2-4% range over the next few years.

Mortgage Rates: A Pivotal Factor

The trajectory of mortgage rates will be a major factor influencing the market. The Federal Reserve is expected to raise rates in 2024, though some forecasts suggest these hikes may slow down in the latter half of the year. A potential decrease in rates could incentivize more buyers and sellers to re-enter the market, further contributing to a more balanced environment.

Texas’ Allure: Enduring Appeal

Texas’ inherent strengths – a robust economy, low cost of living, and job opportunities – will continue to attract residents. This steady influx of new residents will bolster demand, particularly in major metros like Austin, Dallas-Fort Worth, Houston, and San Antonio.

Market Variations: Sizing Up the Lone Star State

It’s important to remember that Texas is a vast state with diverse housing markets. While some areas, particularly those with a high concentration of tech industries, may see a slight cooling, others could experience continued strong growth. Always consult local market data and reports for a more precise picture of a specific city or region.

A Market for Savvy Homebuyers and Sellers

With a more balanced market on the horizon, 2024 presents an opportunity for both buyers and sellers to be strategic. Buyers will have a wider range of options and potentially more negotiating power. Sellers, on the other hand, should ensure their properties are priced competitively to attract buyers in a market with a growing inventory.

The Final Word: A Market in Transition

The Texas housing market in 2024 is poised for a period of transition. While the breakneck pace of the recent past may slow, the underlying fundamentals remain strong. Affordability will be a key concern, and those with a long-term view will likely find the most success. As always, staying informed about local market trends and seeking professional guidance from real estate agents will be crucial for navigating this housing market.

Top Markets in Texas at Risk of Home Price Decline

While the overall Texas housing market remains stable, certain regions are projected to experience significant home price declines over the next year. These areas are facing unique economic challenges that are likely to impact their housing markets more severely.

- Pecos, TX – Expected to see a substantial decline with home prices dropping by 1.3 percent by August 2024 and a steep 9.6 percent by May 2025.

- Big Spring, TX – Forecasted to decrease by 2.6 percent by August 2024 and 9.1 percent by May 2025.

- Lamesa, TX – Anticipated to see home prices fall by 1.2 percent by August 2024 and 8.7 percent by May 2025.

- Raymondville, TX – Projected to experience a 1.6 percent decline by August 2024 and an 8.2 percent decrease by May 2025.

- Alice, TX – Expected to see a slight decline of 0.2 percent by August 2024 and a significant 8.1 percent drop by May 2025.

- Beeville, TX – Home prices are projected to fall by 1.4 percent by August 2024 and 7.8 percent by May 2025.

- Sweetwater, TX – Anticipated to see a 0.6 percent decline by August 2024 and a 7.4 percent decrease by May 2025.

- Rio Grande City, TX – Expected to experience a 2 percent decline by August 2024 and 6.9 percent by May 2025.

- Zapata, TX – Forecasted to see home prices rise by 0.3 percent by August 2024 but then decline by 6.6 percent by May 2025.

- Beaumont, TX – Projected to experience a 1.2 percent decline by August 2024 and 6.4 percent by May 2025.

- Midland, TX – Expected to see a 1.1 percent decline by August 2024 and 6.3 percent by May 2025.

- Snyder, TX – Anticipated to see a 0.8 percent decline by August 2024 and 6.1 percent by May 2025.

- Dumas, TX – Home prices are projected to fall by 1.5 percent by August 2024 and 6 percent by May 2025.

- Borger, TX – Expected to see a 0.7 percent decline by August 2024 and 5.5 percent by May 2025.

- Levelland, TX – Projected to experience a 1.2 percent decline by August 2024 and 5.3 percent by May 2025.

These regions, primarily located in smaller metropolitan areas, are expected to face the largest home price declines in Texas over the coming year. The economic challenges in these areas may be more pronounced, affecting the demand for housing and contributing to the downward pressure on home prices.

In summary, while the Texas housing market as a whole is demonstrating resilience and stability, certain regions are poised for significant home price declines. These trends highlight the variability within the state’s housing market and underscore the importance of considering local economic conditions when assessing real estate opportunities. As Texas navigates these challenges, the overall outlook remains positive, bolstered by the state’s strong labor market and economic conditions.

Top 10 Places to Buy a House in Texas

These are some of the best areas to buy a home in Texas based on home valuations, property taxes, homeownership rates, housing prices, and real estate trends (Niche.com). The ranking is based on statistics from the United States Census Bureau, the FBI, and other sources. Cottonwood Creek South is the best place in Texas to buy a house.

1. Cottonwood Creek South, Richardson, TX: This Richardson neighborhood offers a suburban lifestyle close to the buzz of the Dallas-Fort Worth metroplex’s tech industry.

2. Arapaho, Richardson, TX: Similar to Cottonwood Creek South, Arapaho is another neighborhood in Richardson offering a quieter suburban experience with access to the city’s amenities.

3. Lakeside City, TX: Just south of Richardson, Lakeside City is a family-friendly town known for its good schools.

4. Fulshear, TX: This Fort Bend County town provides a mix of rural and suburban living with easy access to Houston. Fulshear is ideal if you want a quieter area while staying close to the city.

5. Canyon Creek South, Richardson, TX: Yet another Richardson neighborhood on the list, Canyon Creek South offers a suburban setting near the opportunities of the Dallas-Fort Worth metroplex.

6. Heights Park, Richardson, TX: Rounding out the Richardson trio, Heights Park provides a suburban atmosphere with access to the amenities of a big city.

7. Shady Hollow, TX: As a suburb of Austin, Shady Hollow blends small-town charm with the excitement of the state capital. It’s a popular choice for families and young professionals.

8. Red Lick, TX: Located in Bowie County, Red Lick is a more rural area with a small-town feel. This is a good option for those seeking an affordable place to live with plenty of space.

9. Woodway, TX: Situated near Waco, Woodway is a growing suburb known for its peaceful atmosphere and scenic Hill Country views.

10. Timberbrook, Plano, TX: This Plano neighborhood offers a suburban lifestyle with easy access to the amenities of both Plano and Dallas. Plano is another major city in the Dallas-Fort Worth area, known for its strong economy and good schools.

Top 10 Texas Cities with High Appreciation

Texas boasts a diverse landscape, and these 10 cities reflect that variety. These are the top ten cities in Texas that have had the highest real estate appreciation since 2000 (Neighborhoodscout).

- Westworth Village: This could be a smaller town or an affluent suburb that has seen significant growth in property values since 2000.

- Gustine: Perhaps a rural town or a smaller city, Gustine’s popularity surge has likely driven up housing prices.

- Balmorhea: Its unique location near a natural spring or recreational area might be the reason behind Balmorhea’s increased real estate interest.

- Garden City: This could be a growing city or one that’s been revitalized, attracting new residents and boosting property values.

- Mico: Potentially a smaller community or a hidden gem, Mico might have experienced a surge in interest due to affordability or a specific lifestyle factor.

- Runge: This rural town could be experiencing growth due to its proximity to a larger city or changing economic factors.

- Granger: Similar to Runge, Granger might be a growing rural community benefiting from its location or new development.

- Encinal: Potentially a historic town or one with natural beauty, Encinal’s real estate market might have boomed due to its unique appeal.

- Falls City: This could be a smaller city undergoing revitalization or attracting new residents for specific reasons, leading to rising property values.

- Wingate: Potentially a rural town or a lakeside community, Wingate might have seen a rise in real estate interest due to its location or changing lifestyle preferences.

RELATED POSTS: