Subscribe to our newsletter dedicated to New York’s Cannabis industry with a focus on the Mid-Hudson region. Sign-Up now to receive the newsletters. By signing up, you agree to receive information and advertising related to cannabis, cannabis dispensaries, cultivators, processors, and similar regulated entities.

New York Licensed Adult Use Dispensaries

(As of May 31, 2024)

***Denotes Delivery Only

New! Proximity Protected Location Map (From data.ny.gov)

CCB Approves Home Grow Cannabis Cultivation

June 14, 2024 – The Control Board approved a resolution to adopt regulations for the personal home cultivation of cannabis, enabling adults aged 21 and older in New York State to cultivate cannabis at home.

Home Cultivation Allowance:

- Adults can grow up to six plants individually.

- Maximum of 12 plants per household.

- Registered medical cannabis patients can have a designated caregiver grow on their behalf, provided no one can exceed the maximum of 12 plants per household.

Learn more about the home cultivation of cannabis in the Office’s fact sheet, available here.

Expansion of Cultivation Rights:

- Personal cultivation of adult-use cannabis permitted within private residences.

- Licensed entities like dispensaries and microbusinesses can sell seeds and immature cannabis plants to consumers.

According to its press release: This significant development empowers New Yorkers who wish to participate in the adult-use cannabis market by providing them with the autonomy to cultivate their own cannabis plants. Home cultivation offers a cost-effective and accessible option for personal use, ensuring that individuals have control over the quality and strain of cannabis they consume. It also promotes a deeper understanding and appreciation of the cultivation process, fostering a more informed and engaged community of cannabis consumers in New York State.

Amendments underwent a sixty-day public comment period. The CCB voted to adopt the regulations and make them effective at the June 11, 2024 Board meeting.

Cannabis Control Board Approves 105 Adult-Use Licenses, Bringing Total Adult-Use Licenses to 654 Issued in 2024 Thus Far

June 14, 2024 – The New York State Cannabis Control Board (CCB) took substantial steps to advance the state’s cannabis regulatory framework during this month’s board meeting, addressing several key topics: license approvals, market updates, home grow regulations, and enforcement updates. The CCB authorized the issuance of 105 varied adult-use cannabis licenses spanning the supply chain, encompassing microbusinesses, cultivators, processors, distributors, and retail dispensaries. This move paves the way for entrepreneurs and businesses to enter the budding adult-use cannabis market, driving economic growth and fostering innovation.

“New York is building a robust and equitable legal market that is driving significant economic growth within our communities,” Governor Hochul said. “The issuance of 105 additional adult-use licenses is just the next step in developing the nation-leading industry New Yorkers expect and deserve.”

The breakdown of the 105 license types approved today includes:

- Adult-Use Cultivator License: 25

- Adult-Use Distributor License: 22

- Adult-Use Microbusiness License: 22

- Adult-Use Processor License: 19

- Adult-Use Retail Dispensary License: 17

- 45 out of the 105 are transitioning AUCC or AUCPs

The CCB also issued denials to 100 applications at the board meeting. These applications either did not meet the eligibility for licensure or had already been issued an adult-use cannabis license from another application.

The Office of Cannabis Management announced that in May alone, sales surged by $4.4 million, reaching a total of $46.2 million, and with the month ending with a new weekly sales record of $12.5 million.

Projections show that 2024 cannabis sales will exceed $200 million by early June, underscoring the sector’s rapid expansion and growing consumer capture.

Another Lawsuit Challenging Cannabis Board’s Social Equity Program

May 19, 2024 – Yet another lawsuit has been filed in State Supreme Court in Albany claims CCB acted arbitrarily, capriciously and illegally. The suit argues that the CAURD program is an “arbitrary and capricious” application of state law and that “and any and all licenses improperly granted pursuant to this program are invalid.”

The suit once again raises challenges to New York’s controversial Conditional Adult-Use Retail Dispensary (CAURD) program, which prioritized “justice-impacted” individuals who could demonstrate harm caused by the war on drugs.

In a lawsuit filed May 9 in state Supreme Court in Albany County against New York’s Cannabis Control Board and Office of Cannabis Management, four plaintiffs – Organic Blooms, Niagara Nugget, Blackmark and Windward Management – point out that CAURD applicants were able to file an initial request for a state license without securing real estate and alerting the local municipality.

The suit charges that those privileges were not extended to anyone who applied for a general license rather than a social equity permit during an October-December application window..

Plaintiffs filed their adult-use applications during the October-December application period and are still waiting to receive a decision from the state on their pending applications.

The lawsuit seeks declaratory relief and asks the court to invalidate the CAURD licenses issued to date, equating with the revocation of roughly 460 CAURD permits, including most of the 127 adult-use stores licensed to date.

Nearly all of the retail stores open in New York are CAURD licensees.

A copy of the lawsuit is available here.

Rescheduling Marijuana To Schedule III, What Does It Mean?

May 5, 2024 – According to the Associated Press, the Drug Enforcement Administration (DEA) has concurred with decisions made by the US Department of Health and Human Services (USHHS), advancing the move of marijuana from Schedule I to Schedule III under the Controlled Substances Act (CSA).

Cannabis was first listed more than 50 years ago as a strictly prohibited drug, on par with heroin and LSD and defined as a substance with no known medical value and a significant abuse potential. Previous efforts to reschedule cannabis during the Obama administration were rejected.

USHHS determined that cannabis “has a currently accepted medical use in treatment in the United States” and has a “potential for abuse less than the drugs or other substances in Schedules I and II.”

The move to Schedule III will have a major impact on state-legal cannabis businesses, and not all of them good.

One positive business impact — marijuana firms can officially take federal tax deductions that they’ve been barred from under an Internal Revenue Service (IRS) code known as 280E.

One not so good. Marijuana would remain regulated by the DEA. That means, absent a legislative exemption, the roughly 15,000 cannabis dispensaries in the U.S. would have to register with the DEA like regular pharmacies and fulfill strict reporting requirements, something that they are loath to do and that the DEA is ill equipped to handle.

On the plus side, the proposed rescheduling would allow more research on cannabis. Research on cannabis as a Schedule I drugs extremely difficult and limited.

The move to Schedule I would not legalize marijuana at the federal level. Schedule III drugs are still controlled substances and subject to rules and regulations, and people who traffic in them without permission could still face federal criminal prosecution.

The rescheduling does not directly address another important issue to cannabis businesses – banking restrictions. There is legislation pending that would address banking as well as effort to de-schedule cannabis, which would remove it from the Controlled Substances Act.

The next step in the rescheduling process is for the White House Office of Management and Budget (OMB), to review the rule. If approved, it would go to public comment before potentially being finalized.

New Litigation Filed Challenging License Issuance Under OCM’s Queue System

May 5, 2024 – A Hudson Valley applicant seeking a marijuana cultivation and processor license is suing regulators in the latest legal challenge to alleged “priority” status in the state.

Tree Hill Innovations, operated by its majority owner, Marguerite Mikol of Saugerties, filed a petition claiming certain applicants were given “extra priority” by submitting up to three applications in a lottery designed to vet requests, according to a story in the Albany Times Union.

The lawsuit against the state’s Cannabis Control Board and Office of Cannabis Management alleges regulators changed licensing application rules last year in an “arbitrary and capricious” manner without informing the public.

According to the suit, Mikol has invested more than $700,000 to establish operations, including the purchase of 67 acres in Ulster County.

“This is my livelihood that has been trampled and I would like to see correct policy implemented as it relates to the legislation and have my application reviewed under the current terms with approved time to correct or challenge any and all deficiencies,” Mikol wrote in court papers.

Mikol takes issue with allowing up to three duplicate applications to be submitted and says the change was made “without disclosing it to the public prior to the (second) application period … and suggests that it was established and implemented in an arbitrary and capricious manner.”

She also alleges that some applicants may have submitted more than three applications in the Office of Cannabis Management’s online queue to try and improve their chances of having one reviewed.

Mikol asks the Court to annul the queue system for license applications as arbitrary, capricious and without a rational basis in law. She says that they are outside the scope of OCM’s regulatory authority and in excess of its jurisdiction.

She also asks the Court to require transparency and reveal to the public the exact policies and procedures utilized in the creation and selections made from the queue. She asks for the existing queue to be vacated and for adherence to the law in any future queue system.

The Court has ordered OCM to “show cause” on June 7th in Albany why it should not grant the relief requested. The case has been assigned to Justice Justin Corcoran.

New York has been besieged by cannabis-related lawsuits regarding a variety of claims challenging: social equity licensing; residency requirements; a ban on third-party advertising for cannabis retailers; exclusion of multi-state operators; reverse discrimination of priorities and fees; and new rules governing hemp-derived cannabinoids.

Some of the litigation has stalled the rollout of the state’s cannabis program which Governor Kathy Hochul described as a “disaster.”

New York 2025 Budget Screws Growers, Replaces Potency Tax, Bolsters Local Law Enforcement, Eliminates State Share of Medical Excise Tax

April 21, 2024 – Maybe it’s just a disconnect. New York State Senator Jeremy Cooney is touting the accomplishments in the just-passed New York State Budget, what he calls Padlocks, Potency & Prescriptions, while ignoring the stab-in-the-back cultivators suffered when a proposed fund in the budget to help distressed cannabis farmers was removed from the state’s $237 billion spending plan during negotiations.

Cannabis farmers were expecting some relief in the budget. The proposed Senate version included provisions for cannabis farmers to access $60 million in loans, $40 million in grants, and $28 million in tax credits. Farmers would have accepted less and looked to the dairy bailouts from years past when the State recognized the importance of sustaining a failing agricultural market. They got nothing.

Cultivators are less than pleased. Joseph Calderone from the Cannabis Farmers Alliance said growers felt abandoned by the governor, that farmers are underwater and may be reconsidering planting this year, with some farmers looking to broker their licenses rather than lose more money.

Cannabis Farmers Alliance acting President Joseph Calderone said many cannabis farmers in the state are facing financial ruin. The CFA recently polled the state’s 289 licensed cannabis cultivators, and 97% of those who responded said they’re operating at a loss.

“The burden rate for our farmers is $300,000 a year,” Calderone said. “It’s really difficult to make business decisions.”

Meanwhile, there is some celebration with added enforcement at the local level, the replacement of the potency tax with a flat wholesale tax of 9%, and the elimination of the State’s share of the medical excise tax, keeping in place only the local tax share.

Municipalities will now be able to set their own local enforcement rules to padlock illicit shops and collect civil fines from the illegal businesses they shut down, creating some incentive for local governments to act.

The newest provision in the FY2025 budget addresses landlords. Landlords who turn a blind eye to the illegal activity and fail to bring forth eviction proceedings against tenants in violation of the cannabis law will be held to strict penalties including: a $50,000 fine for any landlord notified of the violation within New York City; or five times the rent from the time the landlord was notified of the violation outside of New York City.

The FY25 Budget also lowers the standard of proof required to evict a tenant in violation of cannabis law. Landlords will now only have to prove that a business is “customarily or habitually” engaged in selling cannabis without a license, rather than “solely or primarily” doing so.

The changes in the burden of proof are intended to eliminate a defense illegal sellers utilized to avoid closure and eviction – making it easier for landlords to remove unlicensed operators.

Court Tosses Regulations Banning Third-Party Platform Participation

April 7, 2024 – State Supreme Court Justice Kevin Bryant took no prisoners (pulled no punches) in his opinion last week on Leafly Holdings v. New York State OCM. In laymen’s terms, he basically said that OCM more or less “made up” regulations barring third party marketing firms from participating in New Yok’s legal cannabis market.

What third party marketers or platforms (TTPs) do is basically provide a sort of one-stop shop for cannabis information – who is selling legally, where they are located, what they are offering, what prices they are asking, how to order, etc. TTPs do not sell, fill orders, or deliver cannabis. They basically provide a marketing and educational vehicle for consumers. They create a check-and-balance on pricing by retailers by publishing competitive information, and allow retailers to market their products on the TTP’s database and mapping programs.

For reasons that were never articulated, or that were justified only after-the-fact, OCM’s regulations banned TTPs in New York. When regulations were first promulgated, Leafly, along with other TTPs, sought to participate in the drafting of the regulations, and for whatever reasons OCM had, it didn’t accept (probably didn’t even read) their input, or the input of similar entities. When the regulations were passed, Leafly had no option but to go to court this past September as it was effectively closed out of the nascent cannabis market in New York.

If claimed that the regulations were arbitrary, capricious, lacked a rational basis, were anti-competitive, violated the New York state constitution, and the US Constitution, largely because they sought to exclude TTPs based on the content of material that it sought to offer consumers. It said OCM wanted to competitive information away from consumers and keep consumers in the dark (and keep prices high) on product pricing from competing dispensaries.

OCM agreed in a temporary arrangement to allow Leafly to service New York while the litigation was pending, and then fought vociferously to have its regulations upheld and ultimately push Leafly out.

While the litigation was pending, Leafly, a publicly traded company, saw its stock price fall by one-half, presumably based on the possibility that it would be permanently barred from one of the potentially largest cannabis markets in the country.

Justice Bryant saw the regulations for what they were, and in a 13-page opinion struck the Third-Party Marketing Ban, the Pricing Ban, the Third-Party Order Ban, the Third-Party All License Listing Mandate, and the Third-Party Distributor Listing Mandate. He rejected the arguments made by OCM and detailed a complete lack of transparency, support, expertise, and process in the passage of the regulations.

He said that there was a “complete lack of justification for the action in the record” and that the “regulations constituted impermissible restrictions” on Leafly’s right to free speech and that they were also unconstitutionally vague.

Lawsuit Challenges Regulations On Proximity Protection

April 7, 2024 – Perhaps OCM needs to hire some additional lawyers.

Last week, a suit was filed in Albany Supreme Court against New York’s cannabis regulators that claims applicants were irreparably harmed because they had to secure retail locations outside of other retailers protected proximities without knowing where those protected areas were located.

The case filed by the law firm of Prince Lobel Tye for its client Gracious Greens, a service-disabled veteran and minority owned SEE candidate, says that its client secured municipal approvals for two locations in Peekskill and New Paltz only to discover that those locations already fell within proximity protection for other licensees.

An attorney from Prince Lobel told that New York Law Journal: “Finding an invisible competitor, not knowing where they are located, and being told, ‘Too bad, you should’ve known’ is incomprehensible.”

The complaint says the proximity regulation is void for vagueness, fails to provide a person with ordinary intelligence with a reasonable opportunity to know what is prohibited, and is written in a manner that encourages arbitrary or discriminatory enforcement.”

The action also takes issue with regulators usurping local municipal planning and zoning by reserving the final say on location with OCM.

As written, the regulations forbid dispensaries from locating within a 1,000 foot radius of another dispensary in municipalities with populations of 20,000 people or more, and a 2,000 foot radius where populations number less than 20,000 people.

The suit basically asks to do away with proximity protection in the earlier application window because applicants were told to secure locations without knowing if they would be acceptable to OCM’s grant of proximity protection to other retailers.

Last month, OCM put out an interactive map designating current and pending storefronts.

Cannabis Farmers Relief Fund Proposed For New York Budget

March 20, 2024 – If the New York State Senate has its way with this year’s budget, cannabis farmers can expect some relief. The proposed Senate budget include provisions for cannabis farmers to access $60 million in load, $40 million in grants, and $28 million in tax credits.

Last year, Governor Hochul vetoed legislation that would have allowed cannabis farmers and cultivators to offload tested, packaged, and sealed cannabis products and cannabis to a cannabis dispensing facilities licensed by a tribal nation for retail. The legislation would have created a new avenue for sales for cannabis farmers.

The Cannabis Farmers Relief Fund will require proof of financial hardship before licensed cultivators and processors could access benefits.

Potency Tax Repeal Considered

March 20, 2024 – The Senate budget proposal also repeals the potency tax and replaces it with a wholesale flat tax that would start at 5% come June 1, 2024, but comes with a catch. The flat tax would increase to 7% in 2028 and then up to 9% in 2031. Governor Hochel proposed a 9% flat tax. The Senate version gives a few years of relief before each boost in the tax.

Also considered is a repeal of the medical cannabis excise tax. New York State currently has one of the highest tax rates on medical cannabis in the nation. Bordering states, including Connecticut, Massachusetts, New Jersey, Rhode Island, and Vermont have no excise tax on medical cannabis products whatsoever.

COD List? What’s That About?

In New York State, licensed retailers who purchase cannabis products from licensed suppliers are required to pay in full for the purchase no later than 30 days from the date of delivery. Suppliers are required to report to the Office of Cannabis Management any retail licensee who, after 30 days from delivery date, still has an outstanding balance due for a credit purchase.

Suppliers are also required to send a “Notice of Default” and upload a copy to OCM when reporting delinquent payments. When payment is received in full from the retailer, suppliers must send a notice to OCM of receipt of payment to remove the retailer from the COD (Cash On Delivery) list.

The list is not public, and OCM does not act as a collection agency for past due receivables. OCM simply determines the validity of the report before placing a retailer on the COD list. Retailers remain on the list until past due invoices are cleared.

If a retailer appears on the list, no supplier can sell cannabis products to it on credit. Suppliers are required to check the COD list before extending credit. Licensed retailers can request information about the C.O.D. list by emailing CODReporting@ocm.ny.gov. The Office will provide the retailer with information specific to your business only. If on the C.O.D. list, OCM will provide the name of the supplier(s) who reported you as delinquent and how much they claim you owe them.

Powerhouse Pacific Legal Foundation Joins The Fray Challenging New York’s SEE Licensing Preferences

March 11, 2024 – January’s lawsuit by Jamesville, New York’s Valencia, AG LLC was largely minimized (and sometimes laughed at) by New York’s Cannabis Bar – the commentaries of experts who predict the outcomes of every lawsuit, even though most have been resolved by settlement and not litigation.

Valencia’s lawsuit, filed in the United States District Court for the Northern District of New York challenged the advantages given to women and minority applicants in retail licensing by the Office of Cannabis Management. According to the lawsuit, the plaintiff was owned by “males of light pigmentation who might best be described as Caucasian or white men.” Valencia filed an application with OCM on October 12, 2023 seeking a microbusiness cannabis license. Not falling into any of the categories for SEE status, Valencia was unable to request any sort of priority status in its application.

In OCM’s randomized hierarchy for reviewing applications, Valencia ranked 2,042 out of what was supposed to be 2,200 “operationally-ready” applicants and knew he had no chance of having his application reviewed or receiving a coveted license.

The complaint alleged that the preference or priority given to women and minorities, over white men, violates the Equal Protection Clause of the United States Constitution. Plaintiff also charges that the higher application fees paid by white men over women and minorities also violates the US Constitution.

For relief, Plaintiff asks for: (1) a preliminary and permanent injunction against the preferences given women and minorities; (2) a prohibition against OCM from processing any applications for cannabis licenses where those applications claim SEE status based on women or minority ownership; (3) the revocation and cancellation of licenses granted to SEE status licensees when based on women or minority ownership; (4) a refund of the higher application fees paid by applicants unable to claim SEE status based on women or minority ownership; and (5) a prohibition against the differing fee schedules based SEE status.

Valencia’s request for a temporary restraining order was denied when the District Court found that the plaintiff had not demonstrated that it would suffer irreparable harm waiting for a full hearing on a preliminary injunction. That ruling was sound.

With the hearing originally set for Thursday, March 14th, OCM filed its affirmations, hundreds of pages of exhibits and memoranda of law in opposition to the request for a temporary injunction. It referred to the harm to applicants, farmers, processors, the market in general, and how an injunction would bolster the illicit market.

Then, a funny thing happened on the way to the courthouse.

On February 29, 2024, Valencia’s local counsel got some help. Two attorneys from the Pacific Legal Foundation (PLF) entered appearances as co-counsel on plaintiff’s behalf. On Friday, the team from PLF asked to have the Motion For A Temporary Injunction taken off the Court calendar.

For those unfamiliar with the Pacific Legal Foundation (PLF), it is generally known as a powerhouse litigation group supporting libertarian and conservative causes. As of 2022, PLF has litigated 19 cases before the United States Supreme Court, won 17, and lost 2.

Its practice has been focused lately on challenging race-based preferences. It filed a lawsuit last month challenged Alabama’s racial quota on the Real Estate Appraisers Board where the State off Alabama sets aside two seats on its Real Estate Appraisers Board for racial minorities. It has filed lawsuits around the country challenging diversity set-asides and quotas.

In New York City, PLF is fighting policies that adversely impact Asian high-school students in admission to preferred schools because of social equity set-asides.

It fights race-based quotas and challenges laws giving preferential treatment to minorities. In fact, the Foundation is known for challenging minority set-asides and quotas that adversely impact non-minorities or that set up systems for racial quotas.

While PLF has not disclosed its strategy going forward in the Valencia case, it is fairly certain that it will mount a vigorous legal challenge to New York’s SEE policies in granting cannabis licensing preferences.

This is now the case to watch.

Potency Tax Repeal?

March 11, 2024 – New York’s controversial “potency tax” on cannabis products is likely to be repealed in the state budget as Gov. Kathy Hochul and the state legislature figure out how to best replace it with a flat excise tax.

According to the Albany Times Union, sources in the Senate and Assembly said their “one-house” budgets, due next week, both have policy language to repeal the potency tax, which industry stakeholders have said is also damaging legal retail sales and has driven more consumers to buy cannabis from unlicensed vendors who are not collecting or paying taxes.

Governor Hochul’s proposal would replace the potency tax with a wholesale excise tax of 9 percent, which would be in addition to the state and local retail sales taxes of 9 and 4 percent, respectively.

A Senate proposal would repeal the potency tax and replace it with a flat-rate 7 percent tax, which is similar to how alcohol products that vary in potency are taxed.

Whatever the ultimate tax rate, it seems that the potency tax is on the way out.

Will (And When Will) Cannabis Events Take The Place Of Growers’ Showcases?

March 11, 2024 – We may have to wait some time for the release of regulations governing the reincarnation of Growers’ Showcases as Special Events, but word is that rules are being considered for publication, public comment, and adoption some time in the next few months. Regulators are not known for swift work on regulations.

Growers’ Showcases were instrumental in relieving the backlog of product in cultivators’ inventories late last year when there were only a handful of open licensed dispensaries and dozens of showcases operating.

Now, with 78 dispensaries open, and more set to open soon, there is less pressure to pass regulations allowing cannabis events. What these Special Events will look like is anyone’s guess right now, but any opportunity for increased sales will presumably be welcome especially in those areas of the state with minimal retail options.

Opportunity Knocks! Community Reinvestment Grant Funding

March 4, 2024 – Last week, we explained that after the costs of administering MRTA, and costs related to training, and implementing incubators and workforce development for social and economic equity applicants, 40% of the tax revenue is dedicated to Community Grants Reinvestment Fund (CGR Funds).

The funds go to qualified community-based non-profit organizations and local governments to support several different community revitalization efforts, including, employment, adult education, mental health treatment, housing, financial literacy, and a litany of other programs assisting adults and children.

Last week, the Cannabis Advisory Board (CAB) convened its first meeting of 2024 to discuss the Community Grants Reinvestment Fund (CGR Fund).

The CAB is a multidisciplinary group of experts, comprised of 13 voting members appointed by the Governor, New York State Senate, and Assembly, and supported by a range of context experts from various agencies from across New York State.

The CAB is also tasked with governing and administering the CGR Fund which reinvests tax revenue from cannabis sales to those communities disproportionately affected by past cannabis prohibition policies.

The money in the CGR Fund will be administered and disbursed by the Office of Cannabis Management to provide grants for qualified community-based nonprofit organizations and approved local government entities to reinvest in communities disproportionately affected by past federal and state drug policies.

With New York topping $180 million in total cannabis sales in 2023, the CAB will soon be able to begin issuing these grants from the CGR Fund to community-based nonprofits and local governments. The Community Grants Reinvestment Subcommittee meeting furthered the discussion of how the CAB will decide who to issue these grants to.

Building on this momentum, the CAB has proposed a tentative timeline to establish goals for the implementation and distribution of the first funds in the CGR Fund:

- Mid-April: Public announcement of the CGR Fund opportunity and anticipated release date for the Request for Applications (RFA). Those interested in learning more about this opportunity shall register with the New York State Contract Reporter (https://www.nyscr.ny.gov/) to receive updated notifications on available opportunities. Nonprofit organizations must also be prequalified to receive awards and may visit https://grantsmanagement.ny.gov/get-prequalified to learn more about registering early.

- Early June: Goal to release the RFA, allowing applicants to start the application process.

- October 1st: Projected deadline for applicants to submit their applications.

- November/December: Anticipated Announcement of the awardees, culminating the selection process for community-based nonprofits and local governments.

Critics of this schedule have asked the same questions you are probably asking: Several years into cannabis sales and no grants have yet been awarded? And, the second question: Why no awards until November/December? Should it really take the better part of a year to get this program going? It looks like tax revenue collected from 2023’s sales won’t reach community-based organizations until early 2025 — at best.

New York awards 110 more adult-use marijuana business licenses

February 18, 2024 – It’s the event that we’ve all been waiting for: the first round of issuance of new licenses from the application window opened last year. At its last meeting, the Cannabis Control Board, voted to issue twenty-four cultivator licenses, nine distributor licenses, twenty-six microbusiness licenses, twenty-five non-provisional adult use retail licenses, and 13 provisional retail licenses.

The approvals mark the first round of non-conditional licenses issued by the state.

On Friday, the governor celebrated the board’s issuance of non-conditional licenses.

“Adult-use cannabis is a growing industry in New York that will help local economies across the state,” she said. “The approval of over 100 licenses is a good start and provides individuals with the opportunity to apply for licensing to help drive up local economies around them.”

[Congratulations to all of the successful applicants and awardees, and a shout-out to Rockland County-based Highland Gallery, LLC, a soon-to-be-open retailer in the Village of Piermont.]

Keep in mind that it may still take some time for some of the licensees to open their doors as there are likely still local municipal rules and inspections that need to be completed, depending on their jurisdictions.

For a complete list of licensees, click here.

2100 applications were received in the last round for what has been announced to be 250 licenses.

Some good news: New York retailers have recorded at least $174 million in legal cannabis sales, according to OCM figures released Friday.

New York Regulators Approve Marijuana Home Grown Rules

February 18, 2024 – Rolled over from the canceled meeting last month was consideration of rules allowing the home cultivation of recreational marijuana. At last week’s meeting, proposed rules were approved, but the approved resolution also starts a 60-day public comment period before the rules are finalized.

The regulations would allow anyone 21 or older to grow up to six plants for personal use, only three of which could be mature at one time. A residence with multiple adults could have a maximum of 12 plants, and people could possess up to five pounds of marijuana derived from the plants.

The six allowed for individuals include three mature and three immature plants. An immature plant is one that does not have visible flowers or buds.

For those who transform the flower to a concentrate, the limit on how much of that substance they can possess will be the equivalent of what the product would represent in weight from cultivated cannabis.

The rules also include a provision allowing licensed retailers to sell starter plants. The proposal was designed to give licensed retailers another vehicle to generate revenue. Retailers intending to sell starter plants will be required to have an active nursery dealer registration certificate from the New York State Department of Agriculture and Markets. Plants must be labeled with information that includes the strain, expected date of harvest and a warning to keep it out of the reach of children.

Cannabis officials on Friday said that their research indicates the ability of New York residents to grow their own marijuana should have a minimal impact on the licensed retail industry.

Marijuana seeds have been legally sold in the U.S. since 2018 under the federal Agriculture Improvement Act. The state Office of Cannabis Management does not regulate the sale of seeds and anyone 21 or older can purchase them online or at cannabis retail shops.

Landlords May Face Civil Forfeiture Of Real Property For Allowing Illicit Retail Operators

February 18,2024 – Readers of this newsletter know that we’ve been advocating for an amendment to the MRTA that would allow “in rem” actions against real property that is knowingly used to house illicit cannabis retail sales. The idea is that if a property owner or landlord knew or should have known that its tenant was operating an illicit retail outlet, the real property could be subject to civil forfeiture.

Last week, an Assembly bill was sent to the Economic Development Committee for review. The bill is titled, “The SMOKEOUT Act, (Stop Marijuana Over-Proliferation And Keep Empty Operators of Unlicensed Transactions” (Okay, doesn’t really flow off the tongue).

The SMOKEOUT Act does just that – Section 455 allows for the taking and forfeiture of real property utilized in the illicit sale of cannabis and cannabis products. Unfortunately, the Act also allows a defense where the property owner establishes by a preponderance of the evidence (more likely than not) that the use of the real property was not intentional on the part of the owner.

Obvious questions will arise as to what duty of investigation a property owner has. Can it turn a blind eye to the use? Will it have an affirmative obligation to determine and monitor how its property is being used. Do tenant uses like “smoke shop” and “paraphernalia” sufficiently put a landlord on notice that the use may be suspect? Can the property owner insulate itself from forfeiture by using a property manager or leasing agent between it and the tenant?

All of these issues should be worked out, but as before, we suggest the duty to keep illicit operators out of retail should fall on the property owner, and an affirmative duty to investigate the use of the property and the risk of loss should fall squarely on the property owner.

The Senate version of the SMOKEOUT bill is currently in Investigations and Government Operations Committee.

New Lawsuit Challenges Licensing and Fee Schedule Advantages For Women and Minorities; Claims White Men Denied Equal Protection

January 25, 2024 – A lawsuit filed yesterday in the United States District Court for the Northern District of New York challenges the advantages given to women and minority applicants in retail licensing by the Office of Cannabis Management. The plaintiff, Valencia AG, LLC, based in Jamesville, NY is owned by “males of light pigmentation who might best be described as Caucasian or white men,” according to the complaint. Valencia filed an application with OCM on October 12, 2023 seeking a microbusiness cannabis license. Not falling into any of the categories for SEE status, Valencia was unable to request any sort of priority status in its application.

Believing that priority would be given to applicants that attested they either owned or rented space that was immediately ready to open, and relying on representations made by OCM, plaintiff leased a storefront for $2,000 per month, plus utilities and insurance.

In January, when OCM published it list of the hierarchy of applicants based on the “randomized,” but prioritized and weighted selection of applicants, plaintiff ranked 2,042 out of about 2,200 “operationally-ready” applicants. Based on statements made by OCM, plaintiff believes it is unlikely that it will have its application reviewed or receive a license.

The complaint alleges that the preference or priority given to women and minorities, over white men, violates the Equal Protection Clause of the United States Constitution. Plaintiff also charges that the higher application fees paid by white men over women and minorities also violates the US Constitution.

For relief, Plaintiff asks for: (1) a preliminary and permanent injunction against the preferences given women and minorities; (2) a prohibition against OCM from processing any applications for cannabis licenses where those applications claim SEE status based on women or minority ownership; (3) the revocation and cancellation of licenses granted to SEE status licensees when based on women or minority ownership; (4) a refund of the higher application fees paid by applicants unable to claim SEE status based on women or minority ownership; and (5) a prohibition against the differing fee schedules based SEE status.

The case was assigned to US District Court Judge Gary L. Sharpe, Case No.: 5:24-cv-00116-GLS-DJS. Plaintiff is represented by Robert Purcell, Esq., of Syracuse, New York.

New Jersey Opens Doors To Cannabis Lounges – Sets Rules

January 28, 2024 – New Jersey Cannabis Regulatory Commission (NJ-CRC) finalized regulations to allow marijuana consumption lounges statewide. The regs are set to be published next month.

Here’s how the “social use” licenses will work:

- Consumption lounges cannot sell food or alcohol, but adults 21 and older could their own bring food or have it delivered if the local government code allows it;

- A consumption area must be attached to a dispensary, customers must be at least 21 or older;

- Food trucks will be allowed, if provided for in the local municipal code;

- Medical cannabis patients would be able to bring their own marijuana products;

- A business would be limited to owning one social use license;

- Microbusinesses would pay a $1,000 fee for a “consumption area endorsement” and standard businesses would pay $5,000;

- The application process hasn’t opened yet, but according to NJ-CRC Chief Counsel Christopher Riggs, the application portal for prospective licensees will open soon; and

- There will also be an exclusivity period (length of time unknown) for social equity and diversity licensees before other social use licenses will be awarded.

Adding the consumption lounges are expected to generate additional fees and tax revenue for the state.

On top of that, the commission also approved 70 new adult-use cannabis licenses, including retailers, manufacturers, cultivators and delivery services, positioning the state to see more than $1 billion in cannabis sales in 2024.

OCM Establishes A Randomized Queue For Reviewing Adult-Use License Applications

January 15, 2024 – Random generally means “made, done, happening, or chosen without method or conscious decision.” Is it destiny or fate, or just the luck of the draw? Well, for the 2,000-plus applicants that applied between October 4th and November 17th for Non-Provisional Adult-Use Retail and Microbusiness, the random sequencing used by OCM establishes their place in line to have their applications reviewed.

According to OCM, “The random queuing process was audited by an independent third-party to ensure it was random and unbiased.

Keep in mind that the queue order doesn’t indicate that order in which licenses will be issued, if at all, just the order in which the applications will be reviewed.

For brevity, and space, here is a list of the first page of applicants. For the entire list, click here to see where applications in your area fall out.

Hochul Vetoed Law Allowing Growers To Sell Surplus To Tribal Retailers

January 15, 2024 – Gov. Kathy Hochul (D) vetoed legislation at the end of December that would have allowed New York cannabis cultivation licensees to temporarily sell surplus cannabis to tribal retailers, as the state continues to struggle with a long-delayed market and limited number of dispensaries.

Readers of this newsletter may recall that one proposal to aid growers with surplus inventory was to temporarily allow sales to tribal retailers who operate under a different set of laws as Adult-Use dispensaries. Those hopes were dashed by Governor Hochul.

With the continue, but slow rollout of licensed dispensaries, growers will have additional outlets to sell inventory. But with sunsetting of Growers’ Showcases and the inability to sell to tribal retailers, growers will continue to struggle with existing and new inventory until New York has enough retailers to absorb past and present crops.

Multistate Operators Slow To Take The $5 Million Plunge

January 15, 2024 – PharmaCann is the only medical operator to open a co-located store in the state.

Although six cannabis multistate operators were approved by New York regulators to open retail shops, only one has so far taken the plunge.

The New York Office of Cannabis Management confirmed that as of Jan. 5, only Chicago-based PharmaCann had paid the required $5 million retail license fee and opened a joint medical-recreational location in Albany, which does business as Verilife.

The other five MSO’s that are eligible to open dual medical-recreational shops are Columbia Care NY LLC, Curaleaf NY LLC, Etain LLC, NYCANNA LLC, and Valley Agriceuticals LLC.

To open, MSOs will have to pay $5 million to the state for new adult-use cannabis retail locations. Each retail licensee – including the multistate operators – will ultimately be allocated three locations.

Speculation is that until New York’s illicit market is tamed, the $5 million entry fee makes the New York retail market less appealing.

Here’s The Skinny On Cannabis in New York State

January 7, 2023 – OCM issued its 2023 Annual Report. Here are some highlights:

- Adult-Use sales are expected to top $150 Million in 2023, with $137 million recorded as of December 9th.

- The state has 46 operational adult-use dispensaries opened and operating.

- State regulators granted 6,200 licenses, permits, registrations and provisional approvals in 2023 and 2024, according to the OCM. This includes 279 adult-use conditional cultivator licenses, 40 adult-use conditional processor licenses, 463 conditional adult-use retail dispensary licenses, 5,404 cannabinoid hemp licenses and permits, and 10 approved medical cannabis organizations, which are called registered organizations (ROs) in New York.

- The OCM received 6,934 total applications: 538 from processors, 372 from cultivators, 351 from distributors, 1,349 from microbusinesses and 4,324 from retailers. Of the applications received, 3,826, or more than 55%, were from social equity applicants.

- OCM officials has released a map that identifies the communities deemed disproportionately impacted by past cannabis enforcement (Loads Slowly). Approximately 25% of New York’s population experienced 75% of the arrests over the last four decades.

- The OCM indicated that it has provided training and mentorship to up to 300 conditionally approved retail licensees, as well as 241 legacy growers and processors, traditional farmers, and food and beverage manufacturers.

- The OCM’s Social & Economic Equity Team trained and engaged more than 60 Technical Assistance Providers (TAPs) to offer support to more than 700 equity applicants who sought assistance.

- Regulators also announced that the OCM is offering up to $50,000 in grants for eligible TAPs to support their efforts to help applicants in the recent application window.

- The OCM has also hosted more than 17 Cannabis Equity Roundtables to present the Social & Economic Equity Plan to advocates, municipalities, elected officials and interagency working groups.

- Regarding New York’s medical cannabis program, the state has more than 121,900 registered patients.

- Officials said they have seized 11,600 pounds of unregulated products, worth approximately $56 million street value. Officials have performed 369 enforcement inspections of unlicensed cannabis operations.

- Dispensary sales rose month by month throughout 2023. Adult-use cannabis sales grew from $2.2 million in January to $18.8 million in November.

- Adult-use dispensaries carry roughly 550 locally grown strains.

End Of A Good Thing — Cannabis Growers Showcases Sunset December 31st

December 11, 2023 – New York’s Office of Cannabis Management made an unexpected announcement on Friday and dealt a fatal blow to the state’s small contingent of craft growers who received a lifeline through Cannabis Growers’ Showcases (CGS).

OCM announced the successful Cannabis Growers Showcase program would be scrapped by year-end – over the objections and contrary to the wishes of cultivators.

The showcases, which range from farmers market-like setups to pop-up tents to more conventional retail experiences, were designed to help marijuana cultivators sell off the glut of inventory left over from last year’s growing season. The showcases generated more than $4 million in sales this year, or just under 4% of the total retail cannabis sales generated so far in 2023.

The showcases broadened the availability of cannabis products throughout the state and enabled buyers to purchase cannabis products in areas where no retail outlets were open, and where none could open because of litigation that stalled the opening of new retail outlets.

“There’s not enough distribution for small farmers,” Wyatt Harms, the co-founder and CEO of Brooklyn-based pre-roll brand Flamer, told MJBizDaily. He added “that many invested their life savings into legal marijuana. I don’t know why you would stop a program that is providing at least some relief to the farmers.”

With only a few weeks left in the CGS program, a new application has been filed for two pop-up showcases in Rosendale (Ulster County) in the former Esso gas station and Stone Krafters building at 2223 Route 32.

If approved, the showcases would be held on December 22nd through the 24th and again on the 29th through the 31st. The promoters expect about 200 customers arriving each day with half-hour entry slots available.

Two New Retail Dispensaries Open In Capital Region

On Friday, the Office of Cannabis Management said 31 adult-use stores are now open statewide.

Two newly opened retail dispensaries in the Capital Region include:

420 Bliss opened December 7th at 740 Hoosick Street in Troy. According to New York State, 420 Bliss is owned by Al Attoh, Renee Lindo and Gregg Little, entrepreneurs with experience in the retail, real estate, construction and the music business.

Capital District Cannabis and Wellness, 997 Central Avenue in Albany, opened December 8. The dispensary is owned by Capital Region natives James Frese and Pasha Adams, who bring to their enterprise diverse backgrounds in the restaurant and real estate industries.

The new dispensaries are supported by the New York Cannabis Social Equity Investment Fund. The fund was created to provide opportunities for those impacted by the inequitable enforcement of cannabis laws.

Six New Registered Organizations (Multi-State Operators) Receive CCB Approval

The CCB, at its meeting Friday, approved the following six registered organizations for adult use retailing:

- Columbia Care NY, whose parent is New York-based MSO The Cannabist Co.

- Curaleaf NY, part of New York-headquartered MSO Curaleaf Holdings.

- Etain Health, owned by RIV Capital, a Toronto-based investment firm.

- NYCanna, part of New York-headquartered MSO Acreage Holdings.

- PharmaCann of New York, whose parent is Chicago-based MSO PharmaCann.

- Valley Agriceuticals, whose parent is Chicago-headquartered MSO Cresco Labs.

In June, New York’s Office of Cannabis Management proposed allowing ROs/MSOs to enter the recreational retail market by year-end, reversing itself on the promised three-year waiting period for the state’s 10 vertically integrated medical marijuana providers.

The original roll-out provided a first-to-market advantage for social equity applicants and smaller suppliers by requiring the larger ROs to wait three years before competing. CCB scrapped that plan as it recognized the need to expand licensed and taxed retail availability in the face of thousands of unlicensed marijuana outlets that flooded the market statewide.

Other states, like Maryland’s relatively recent launch of adult cannabis, allowed ROs/MSOs access on day one of opening the adult market without incident.

Besides, whatever first-to-market advantage that existed was stalled and effectively derailed as approvals for hundreds of Conditional Adult-Use Retail Dispensary (CAURD) applicants and licensees were delayed for months because of lawsuits over the licensing process and social equity provisions that gave priority to justice-affected applicants over disabled veterans, distressed farmers, and women and minority owned businesses.

The ROs should open their doors to adult-use retail sales on or around December 29th.

Stipulation And Order Of Settlement Submitted To Court – Clock Starts On Acceptance

The settlement stipulation hangs on the Court accepting its terms and dissolving the Preliminary Injunction within 10 business days of presentation to the Court, with an allowance for an agreement to extend the time should the court not feel bound by the time frame imposed by the Stipulation.

No consideration is given for a modification of the terms of the injunction – it seems like a take it or leave it offer, and the terms specifically say that the failure to dissolve the preliminary injunction renders all of the other provisions of the Stipulation and Settlement null and void.

The Stipulation settles all of the claims between the parties, with each side paying its own costs and attorney’s fees. In exchange for the dismissal, OCM will issue one adult-use dispensary license to each plaintiff and take whatever other steps are necessary to allow each plaintiff to become “fully operational.” Each plaintiff will also get “site protection” for the sites submitted.

Part of the bargain struck precludes OCM from issuing and “new or additional provisional” CAURD licenses until April 1, 2024, purportedly to allow OCM to focus and dedicate itself to process the pending applications and licenses.

Another provision of the agreement establishes a requirement that OCM work with the Division of Service-Disabled Veterans Business Development to ensure that participants in that program can avail themselves of opportunities in the cannabis market.

And, to prevent similarly situated potential plaintiffs from relying on this settlement to secure their own licenses, the language declares the settlement has no “precedential value” and not binding beyond this agreement.

Enforcement of the terms of the agreement are only available to the disabled veterans for 30 days from entry of an Order accepting the Stipulation (with a few extra days to cure). Within that window, an aggrieved party can move the court to compel enforcement of the terms of the stipulation. After that window closes, enforcement becomes an open issue.

So, just like in the Variscite case, OCM avoided the complicated legal and constitutional questions by awarding licenses to complainants instead of addressing the underlying problems with the implementation of the laws and regulations applicable to the agency. But what about the distressed farmers, minority and women-owned businesses and other disabled veterans who were not parties to the litigation?

Justice Bryant issued the temporary injunction because the implementation of the awarding of licenses ran afoul of the law – not just for the four plaintiffs, but for any applicant similarly situated. Yes, it’s true that there was no effort to establish a “class” for a class action suit, and giving away four licenses to set over 400 applicants back on track may seem like a small price to pay, but either the scheme awarding licenses was legal or it wasn’t. Justice Bryant said it wasn’t.

For the next few days, perhaps longer, we will see just how Justice Bryant views the stipulation and settlement. Perhaps he has a longer, more expansive view of the legal issues, or perhaps he will defer to the litigants. Either way, we will know very soon.

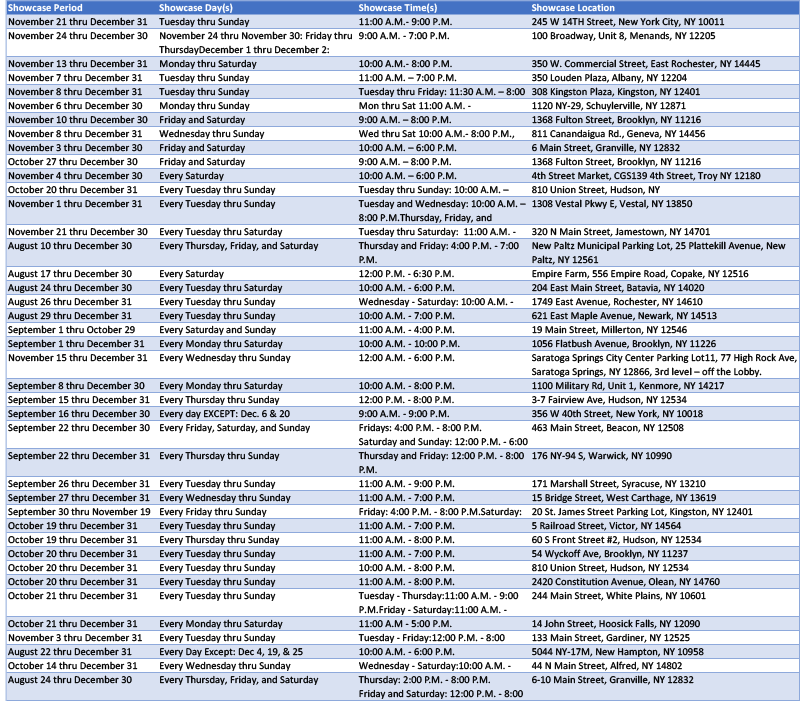

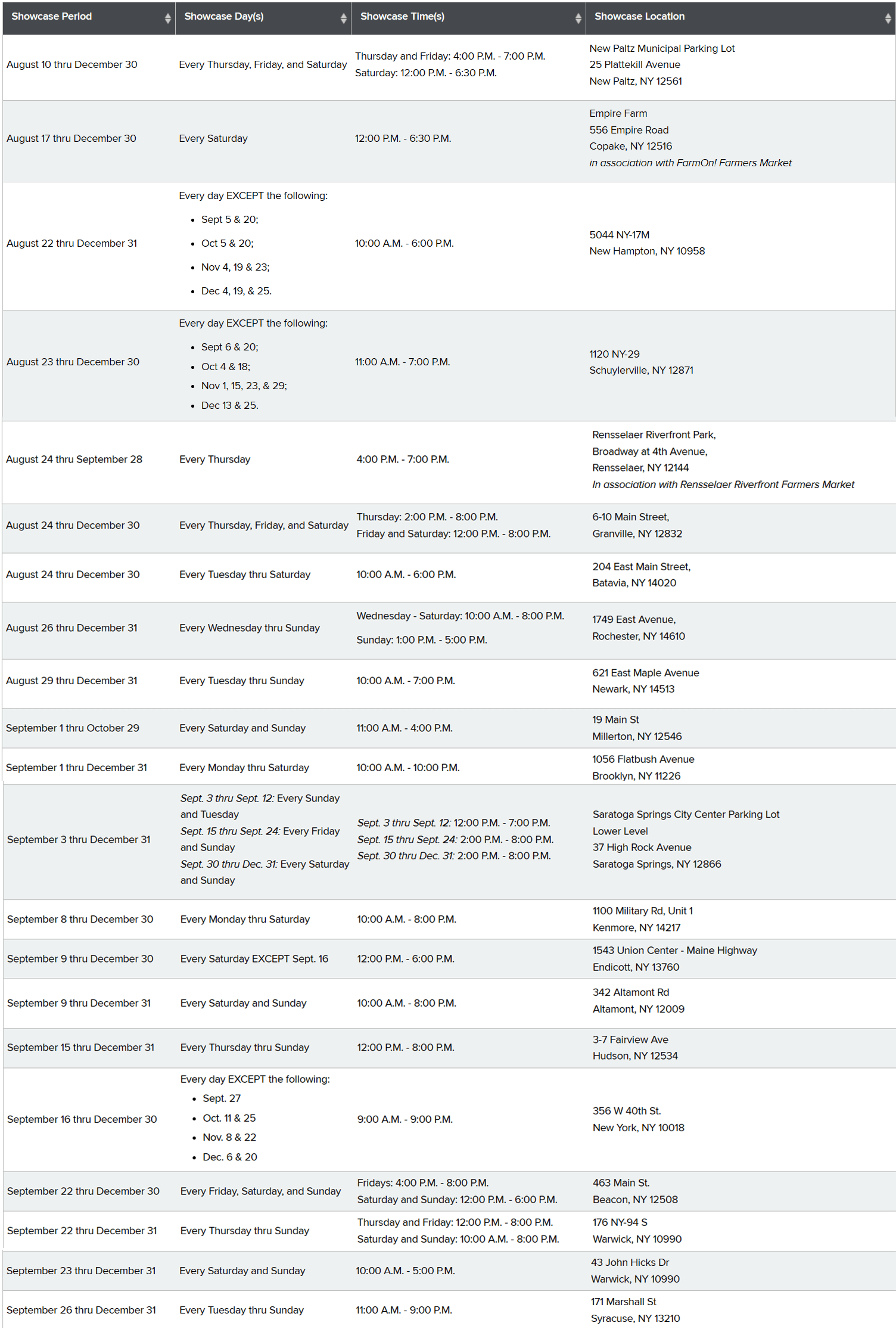

Find a Cannabis Growers’ Showcase Near You (As of December 2, 2023)

“Settlement In Principle” Reached In Disabled Veterans’ Litigation

November 20, 2023 – New York regulators and a collective of disabled military veterans who challenged the state’s adult-use marijuana licensing process in state court have reached “an agreement in principle to settle this matter,” according to correspondence from Plaintiffs’ Counsel filed with the Appellate Division, 3rd Department, New York State.

The agreement announced Monday between the New York Cannabis Control Board and plaintiffs is likely to lead to the end of a temporary injunction that’s been in place since August as well as render moot motions for summary judgment pending before the Supreme Court.

The injunction, put in place by the New York State Supreme Court Justice Kevin Bryant, stalled the issuance of more than 400 conditional adult-use retail dispensary (CAURD) licensees across the state, and prevented the opening of licensed dispensaries for months.

The lawsuit, Carmine Fiore v. New York State Cannabis Control Board, filed by a cohort of disabled veterans, charged that the OCM overstepped its authority under New York’s 2021 legalization law – the Marijuana Regulation and Taxation Act (MRTA) – when it opened the licensing application window first to those with cannabis-related offenses and their immediate family rather than allowing other similarly situated applicants – disabled veterans, distressed farmers and women and minority-owned businesses to apply at the same time.

The agreement still must be finalized by all parties, including the state Cannabis Control Board and Justice Bryant, according to court documents.

During the pendency of the litigation, the New York State Supreme Court allowed a few exceptions to the injunction. Applicants caught up in the legal morass were left in a sort-of legal limbo, waiting on the sidelines while incurring financial losses from rent payments, legal fees, and other obligations they were obligated to meet.

The “agreement in principle” is happening at a time when New York has opened its application process broadly, with thousands of new applications expected during the open-application period.

The court delays from various suits likely contributed to the proliferation of illegal retail outlets across the state – some estimates put the number of illicit operations in the thousands, despite New York’s efforts to crack down on unlicensed sellers of cannabis products.

Tax Relief For NYC-based Cannabis Businesses

November 20, 2023 – Governor Kathy Hochul has signed legislation that provides income tax relief to New York City marijuana businesses that are currently prohibited from declaring business expenses as federal deductions under an Internal Revenue Service (IRS) code known as 280E.

Hochul signed it into law on Friday.

While Hochul signed a separate bill last year that included provisions allowing state-level cannabis business tax deductions, New York City has its own tax laws that weren’t affected by the state-wide change. The new measure is meant to close that gap and provide relief for New York City-based businesses.

“This bill would allow a deduction for business expenses, incurred by taxpayers authorized by the Cannabis Law to engage in the sale, distribution, or production of adult-use cannabis products or medical cannabis, for purposes of the unincorporated business tax (UBT), the general corporation tax (GCT), and the corporate tax of 2015, commonly referred to as the business corporation tax (BCT),” a summary of the law says.

The city’s tax code would be amended to add sections allowing the deductions “in an amount equal to any federal deduction disallowed by section 280E of the internal revenue code.”

“This modification to income is appropriate because, while the expenses of cannabis-related business cannot be deducted for federal purposes, New York law permits and encourages these businesses akin to any other legitimate business occurring in the State,” a memo attached to the bill says. “The City’s business taxes should similarly encourage these business activities.”

Other states have pursued similar income tax workarounds. Marijuana tax reform legislation at the federal level is stalled, leaving state-licensed cannabis businesses with significantly higher federal effective tax rates than similarly situated businesses.

The governor of New Jersey signed legislation in May to allow licensed marijuana businesses to deduct certain expenses on their state tax returns as a partial IRS 280E fix.

Multistate Operators (Registered Organizations) Gain Entry To New York Cannabis Marketplace

November 6, 2023 – To the joy of many, and the chagrin of others, New York is expanding medical cannabis retail licenses to large multistate operators.

The application window for “registered organizations” opened October. 31 and will run until 5:00pm December 19, according to a notice from state’s Office of Cannabis Management (OCM).

Registered organizations will pay a premium to enter what many refer to as the nation’s most untapped retail marketplace. New York, nearly two years after launching adult use sales has just 27 fully-operational licensed adult-use retailers in the entire state, about one outlet for every million New Yorkers.

The entry price is steep. Applicants must submit: (1) a nonrefundable application fee of $10,000 before the application deadline; (2) a registration fee of $200,000 within 10 business days of approval; and (3) in lieu of a lease or secured property, a secured bond of $2 million.

OCM has not put a cap or limit on the number of RO licenses. Instead, the agency says it will “issue registrations based on the quality of applications received and market needs.” That statement is contained in a FAQ put out by OCM offering explanations and details of OCM policies with links to other relevant materials.

The early release of licenses to registered organization is a blow to the licensed and soon-to-be-licensed adult-use retailers as well as hundreds of Conditional Adult-Use Retail Dispensary (CAURD) licensees and applicants who have been trying to open stores for months while lawsuits drag on challenging the very framework of license issuance in the state.

In September, the OCM voted to allow the state’s 10 medical marijuana operators to apply for adult-use retail licenses, essentially reversing its policy to ban MSOs entering the recreational market for the first three years.

OCM plans to protect the RO’s trade secrets and confidential information from New York’s Freedom of Information Law requests made by the general public and likely competitors by asking the ROs to identify which areas of the application they wish to be redacted as exempt from disclosure.

And, the guidance says that ROs that submit applications earlier within the application window will not have an advantage over applications submitted later. All applications must be submitted by the December 19th deadline.

Senate Subcommittee Meeting Discusses Flaws in Cannabis Rollout

November 6, 2023 – Last Monday, members of a New York Senate committee heard from witnesses and discussed legislative solutions to the state’s ongoing cannabis legalization implementation rollout and related problems.

The Senate Cannabis Subcommittee is chaired by Sen. Jeremy Cooney (D), who said, “The goal of the hearing today is to provide an opportunity for stakeholders across the adult-use retail cannabis space to raise concerns and to offer constructive feedback regarding the current cannabis landscape in order to foster a more robust and equitable recreational adult-use cannabis marketplace in New York.”

Chris Alexander, Executive Director of the Office of Cannabis Management (OCM), along with other officials with OCM, testified at the hearing.

Alexander assured members that state regulators are working to address concerns with what some refer to as the state’s cannabis legalization rollout failure. He recognized that delays related to various lawsuits and pending litigation have had a “significant impact on the rest of New York’s adult use cannabis supply chain.”

“Small farmers who are already distressed were left with no outlets for their product and have experienced significant financial hardship and uncertainty as a result,” he said. “We still have a long way to go before we can claim that the supply chain is functioning as intended.”

Supply chain issues were also raised by Senate Agriculture Committee Chair Michelle Hinchey (D) who said she and other lawmakers have been “sounding the alarm since the middle of the legislative session earlier this year on the crisis that’s happening right now for our cannabis farmers to effectively very little to almost zero response.”

Hinchey referred to legislation that was passed by lawmakers and is awaiting the governor’s action, the Cannabis Crop Rescue Act. It would allow licensed marijuana producers to sell products to tribal retailers, which Hinchey said is an example of how the legislature is seeking to ameliorate the issue.

Lawmakers and regulators discussed the state’s THC potency tax, illicit market enforcement efforts, licensing distribution priorities, preventing youth from accessing cannabis, and laboratory testing practices.

Additional governmental witnesses included representatives of the Cannabis Advisory Board, Dormitory Authority of the State of New York (DASNY), New York State Department of Taxation & Finance, New York City Council and New York City Sheriff’s Office.

Watch the New York Senate committee marijuana hearing in the video below:

Powerhouse Lawyers Take On Federal Government’s Interference With Legal Cannabis

October 29, 2023 – Finally, a suit filed in the United States District Court for the Western Division of Massachusetts against Merrick Garland in his capacity at United States Attorney General by a group of cannabis growers, processors, transporters and retailers from Massachusetts sets the stage for the undoing of the part of the Controlled Substances Act that makes participation in state cannabis programs a federal crime.

Filed by powerhouse lawyers at Boies, Schiller and Flexner on October 25th, the lawsuit details the obstacles that legal cannabis businesses face based on what the suit describes as an archaic adherence to federal marijuana laws that are no longer applicable in a nationwide environment where 38 states, including the District of Columbia have legalized medical and/or recreational cannabis.

The suit describes a myriad of problems — denial of access to SBA loans and federal grants, denial of access to banking and credit card processing, denial of access to mortgages, loans and leasing opportunities, denial of access to payroll processing, denial to access to job fairs and training programs, unfair taxation and other difficulties — all caused by the federal government’s adherence to what the suit says is an unconstitutional exercise of federal authority.

Additional obstacles include denial of access to bankruptcy and trademark protections, complications with delivery to customers residing in federal housing or receiving federal housing support, and denial of federal farm benefits to farmers that lease even a portion of their fields for cannabis cultivation.

While the suit, filed in Massachusetts describes the difficulties of Massachusetts residents and businesses, the same obstacles are faced in New York and elsewhere and any relief afforded would likely be applied nationwide, or certainly to any state that adheres to the rigid controls in place in Massachusetts to keep cannabis out of interstate commerce.

The suit asks for relief in the form of declaratory judgments. First, that the CSA as applied to plaintiffs exceeds Congress’s authority under the commerce clause (regulation of interstate commerce) and the necessary and proper clauses. Second, declaratory relief that the CSA as applied to plaintiffs violates due process, that is by regulating cannabis in states where it is legalized, the federal government’s actions are unwarranted and unlawful.

The obstacles are real and this is the suit to watch going forward, though no temporary or permanent injunctive relief was requested. The SAFE Banking Act and rescheduling of cannabis may relieve some of the pressure on cannabis businesses, but would only have a limited impact on the problems created by the federal government’s adherence to the CSA.

The suit was filed in the Western Division of the United States District Court for the District of Massachusetts, Case No.: 3:23-cv-30113-KAR.

State Senate Subcommittee Meeting Studies Flaws in Cannabis Rollout

October 29, 2023 – All eyes are on the New York State Senate Subcommitee on Cannabis which is holding a public hearing, set for 11:00 October 30 at 11:00am, to discuss problems plaguing New York’s fledgling cannabis market.

The hearing, organized by Senator Jeremy Cooney, D-Rochester, who serves as the chair of the Subcommittee on Cannabis, will discuss the multiple lawsuits stymying the rollout of retail dispensaries as it relates to the State’s commitment to social justice goals, as well as the adverse impact on growers, processors and retailers.

Since passage back in 2021, the legal market for cannabis in New York has met a number of obstacles, both legal and logistical.

“As state lawmakers, we can’t just pass bills and hope they work out. Instead, through legislative oversight, we have the responsibility to work with our governor and state agencies to ensure our collective goals are met,” Cooney said. “Two years after legalizing adult-use recreational cannabis, New Yorkers are frustrated and disappointed in the state’s ability to launch a safe and legal marketplace. I am calling this hearing with my partners in the Senate because we believe New Yorkers deserve clarity on what has been done so far and how we can help the retail market going into the next legislative session.”

Licensing, has proven a challenge for the state. When New York first legalized recreational cannabis, it established the Conditional Adult-Use Retail Dispensary (CAURD) licensing program.

However, in recent litigation, New York Supreme Court Judge Kevin R. Bryant halted the approval of CAURD licensing for all of New York State, based on the priority given justice-affected applicants over other eligible licensees. The suit was brought by a group of disabled veterans who were supposed to have the same access to licensing as justice-affected applicants.

Bryant has since partially lifted the suspension, but only for about 30 licensees out of 463 given conditional approval. What’s clear to Cooney and his committee is that industry iprogress is pretty much at a halt, even with the opening of new applications and licensing options.

The October 30 hearing will also host the chairs of related Senate committees. The committee chairs of Agriculture, Finance and Investigations and Government Operations will all be attending. Additionally, testimony from cannabis growers, retailers and regulators will shine a spotlight on the flaws of the budding industry and hopefully discuss solutions.

This newsletter will update its readers on what happens at the committee meeting as soon as we are able.

New York’s Report Card on Dispensaries & Sales Show Comparative Weakness

October 23, 2023 – Let’s face it. New York’s rollout of legalized recreational marijuana dispensaries has not met the state’s expectations. Whether it was the federal lawsuit that challenged a system that preferred in-state applicants, or the state suit challenging the exclusion of disabled veterans as compared to justice-affected applicants, there have been a series, to be generous, of “speed bumps.”

But how bad has New York’s rollout been compared to other states and how have revenues met or fallen short of expectations. Remember that New York’s recreational market was expected to generate more than $1 billion per year in sales by 2025, and $4.41 billion by 2030, according to cannabis research firm New Frontier Data.

So let’s take a data dive at the numbers and see how New York is faring compared to other states that have legalized recreational marijuana. The analysis leaves off those states that had several years head start, and looks primarily at those states that legalized cannabis in 2019 or later.

New York passed MRTA in 2021. States like Maryland and Missouri passed their versions of legalized cannabis in 2022. Michigan with and Montana both had a head start over New York. But, New York has only 27 open dispensaries (as of this writing), while states like Maryland (which legalized cannabis in 2022) already have 101 dispensaries. Missouri, which legalized last year, has 214.

When New York State legalized recreational cannabis sales in 2021, the state predicted it at least 120 adult-use recreational dispensaries would be open by now.

Montana has 432 dispensaries. New Mexico has 633 – more than twenty times the number in New York.

But it’s not only the number of dispensaries that are behind expectations. Let’s take a dive at taxable sales, compiling the best numbers available.

In 2023, New York has pulled in about $66 million in taxable sales. Montana, with about 1/20th of the New York’s population has generated nearly $170 million during the same time period.

And, even though New York and New Jersey have about the same number of legally operating dispensaries, New Jersey has sold more than $305 million worth of recreational pot from its 29 dispensaries, four times New York’s sales. Connecticut’s sales eclipse New York’s by 50%.

Maryland stands apart. With legalized sales outlets first open in July, including allowing medical operators to sell recreational cannabis, it has generated $85 million in sales in the first month of opening dispensaries – more than New York has all year to date.

Critics say that New Yok has made a series of errors, including a flawed roll-out preferring justice-affected applicants, delay in allowing sales from medical cannabis operators, and a calamity in funding available to conditional licensees.

Others say despite these self-inflicted errors, New York sought to protect small operators from being overwhelmed by bigger, more experienced growers and sellers and that that was the right thing to do.

But these same stumbles have rendered New York’s legal cannabis cultivators unable to find buyers for a good part of last year’s crop, as well as this year’s.

New York is trying to make amends and get its cannabis industry back on track. Licensing is opened up broadly with thousands of applications flooding in. Medical marijuana firms will be able to to open adult-use stores this year and next.

Marginalized applicants will still receive some priority, with a lion’s share of the licenses in the general application pool going to them. New York is also fast-tracking applicants who can adequately prove they have control of a location (without contingencies) hoping to have more locations open soon.

All of these measures should help. Let’s take a look at these same metrics in mid-2024 and hopefully, New York’s nascent industry will be on a path to better meet its potential and expectations.

Adult Use Cannabis License Application Window Extended to December 18th

October 23, 2023 – The New York State Cannabis Control Board (CCB) voted to extend the adult-use cannabis license application window from December 4, 2023, to 5 PM EST Monday, December 18, 2023. This application window applies to all adult-use license types.

Additionally, the priority application period for non-provisional retail dispensary or microbusiness licenses where the applicant can demonstrate proof of control over a location, is also extended from November 3, 2023, to 5 PM EST on Friday, November 17, 2023.

Due to the uncertainty caused by the pending litigation challenging the validity of the CAURD program, provisional CAURD licensees have been notified of the opportunity to apply for an adult-use retail dispensary license during this application window.

Individuals with questions about the application process are encouraged to attend one of OCM’s “Roadmap to Adult-Use Application” events virtually or in-person to get real-time answers. These live sessions will provide insight and guidance on the application process.

Stay Pending Appeal Denied; Expedited Briefing Schedule and Calendar Preference Issued

October 16, 2023 – Many were surprised when the Supreme Court, Appellate Division, asked pointedly if the Cannabis Control Board’s Motion For A Stay of Justice Bryant’s Injunction was rendered moot by the opening of Adult-Use Licenses on October 4th. More surprising though was the response from the CCB and the Appellate Court’s Order denying the stay pending appeal. It seemed of little consequence to those awaiting relief that the Court agreed to a calendar preference (over other pending appeals) and an expedited briefing schedule. With briefing completed by November 3rd, perhaps a resolution of the matter is not far off.

Meanwhile, the CAURD licensees stuck behind the injunction continue to incur losses in time and money. Growers continue to lose access to retail markets. Processors the same. The opening of the licensing options on October 4th was good news for some, but to date only five licensees have secured relief from the temporary injunction.

Those fortunate few are Kush Culture Industry (Queens, NY), ConBud LLC (Manhattan), Air City Cannabis (Mohawk Valley), Gotham Buds, LLC (Manhattan), North Country Roots, Inc (North Country, Plattsburgh).

The license applications open as of October 4th include Adult Use Cultivators, Adult Use Processors, Adult Use Distributors, Adult Use Retail Dispensaries, and Adult Use Microbusinesses.

Applications for nursery, delivery, cooperative or collective, and on-site consumption licenses will be made available at a later date. Most municipalities in the state opted out of allowing consumption lounges in their jurisdictions.

The existing conditional adult-use dispensary or CAURD licenses are good for four years from the day issued. However, conditional cultivator licenses expire two years after issue and OCM is recommending those licensees start the transition (away from conditional) during the upcoming window.

The Office of Cannabis Management has sought to clarify the “Notice To Municipality” requirements for applicants applying for a retail dispensary or microbusiness license with retail authorization and made clear that OCM does not consider these types of applications filed until:

- the applicant provides proof of notification to the municipality;

- the applicant submits proof of control over the proposed retail dispensary location; and

- the proposed retail dispensary location receives a location determination from the Office as to whether the location meets the proximity requirements in the Cannabis Law and corresponding regulations.

In order to comply with Section 76 of the Cannabis Law, an applicant must have completed their notification to municipality 30 days before an application is filed with the Office.