Earlier this year, for Women’s History Month, we published a blog post about the triumphs and challenges of female homeownership. We celebrated single women’s impressive progress in the housing market but also pointed out the ongoing obstacles, especially for women of color. These women often deal with systemic barriers rooted in past and present racial discrimination, like limited access to quality education, job opportunities, and affordable housing. Additionally, income and wealth disparities—both generational and personal—can make it harder to become homeowners. While there has been progress, the journey isn’t over yet. In this blog post, we’ll look closer at who is buying homes, the sociodemographic factors that influence home buying, and the ages at which single female home buyers enter the market.

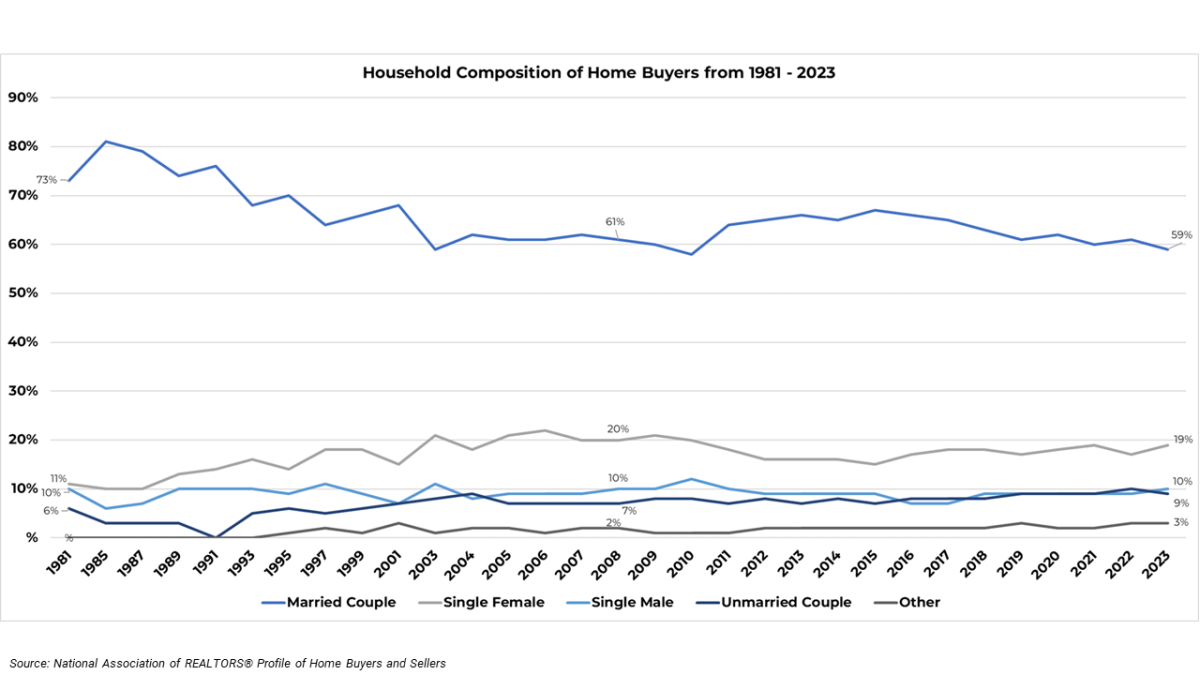

For a quick recap: Since 1981, the inaugural year of the National Association of REALTORS® Profile of Home Buyers and Sellers report, single women have outpaced nearly all other household composition groups, ranking just behind married couples.

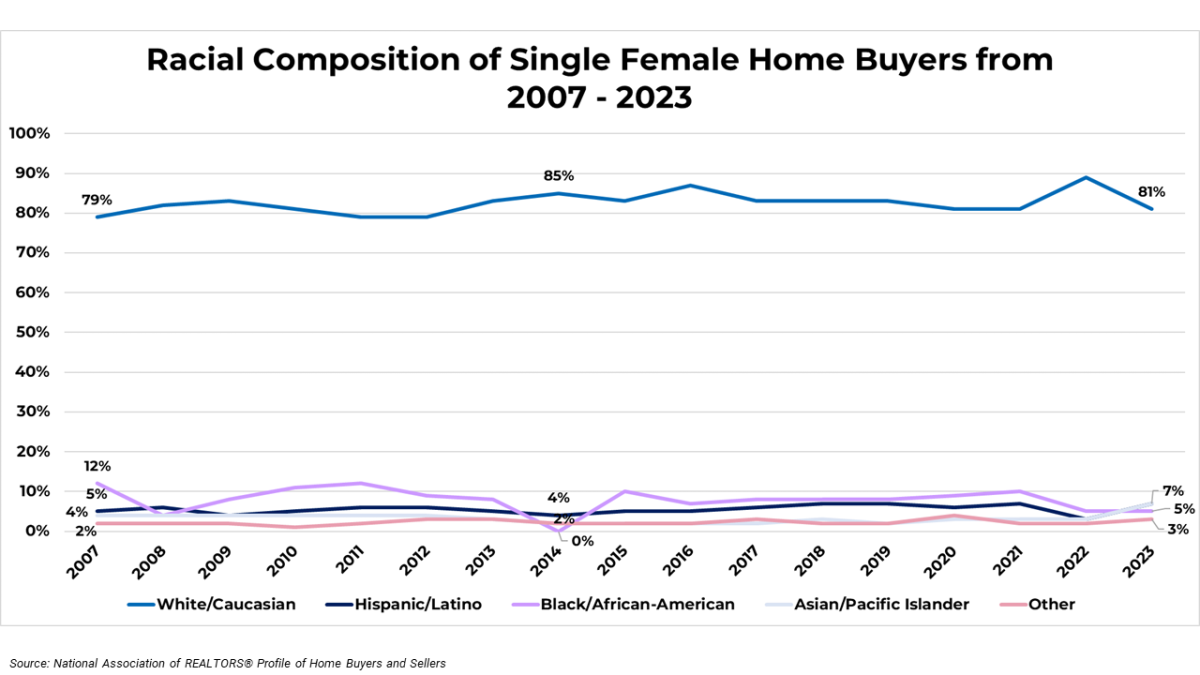

In 2007, we began reporting on the racial and ethnic composition of home buyers by household type in our Home Buyers and Sellers report. While single women are purchasing homes at the second highest rate compared to other household compositions, women of color remain significantly underserved in the housing market. When examining an average of the past 16 years, White women have dominated the category of single female home buyers, making up 82% of this group. By contrast, women of color are represented in much smaller percentages: Hispanic/Latina women at 6%, Black/African American women at 8%, and Asian/Pacific Islander women at just 3%. This disparity highlights the ongoing need to address the unique challenges women of color face in achieving homeownership.

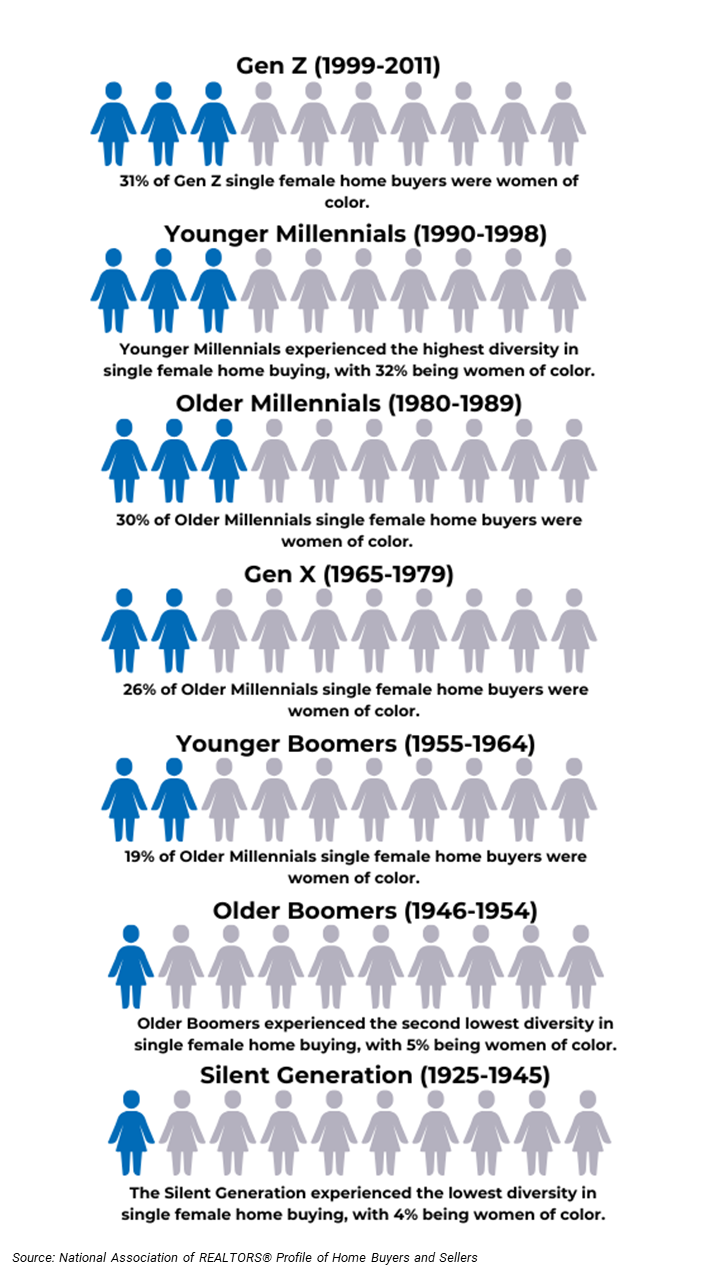

We saw similar patterns using data from our 2023 home Buyers and Sellers report. When broken down by generation, White single female home buyers dominated across all generations. In some cases, such as those with the Older Boomers and the Silent Generation, 9 out of 10 single female home buyers were White. Younger Millennials (those born from 1990 to 1998) saw the most diversity in single-female home buying, with 32% being women of color.

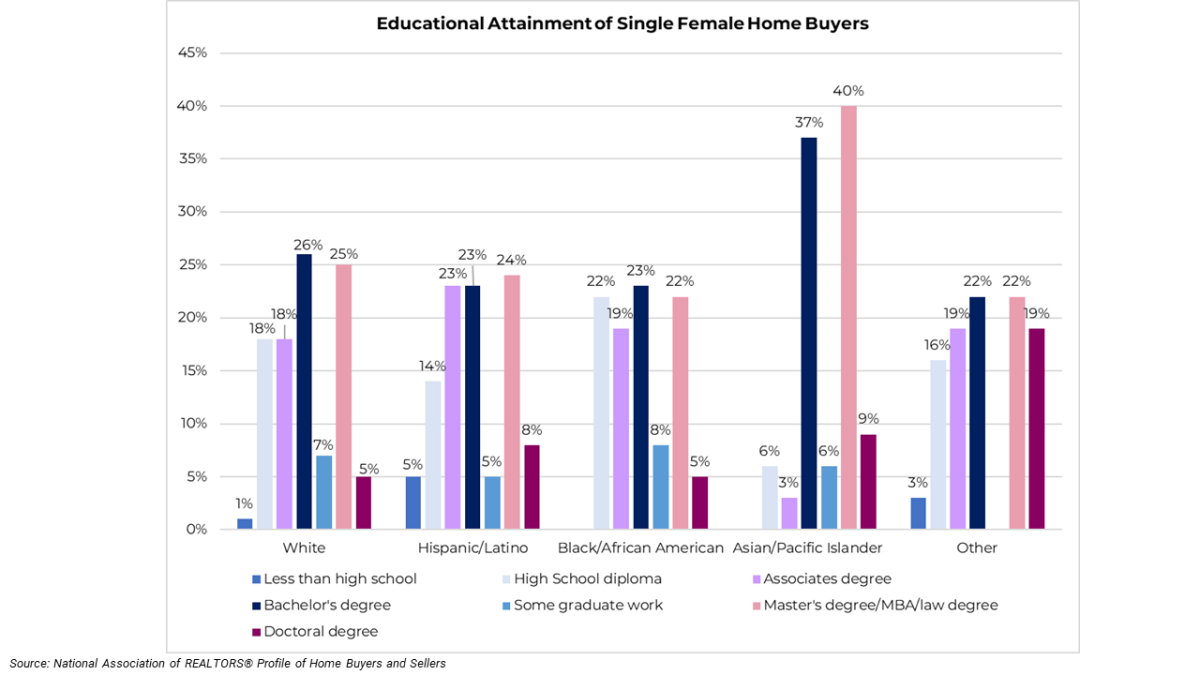

Over the past 60 years, homeownership rates among college graduates in the United States have risen by ten percentage points. Drawing from our Profile of Home Buyers and Sellers report, we can explore the educational levels of single female home buyers across various racial and ethnic groups. Notably, single female home buyers are more likely to be college-educated than not. A striking 95% of Asian/Pacific Islander single female home buyers hold college degrees, followed by Hispanic/Latina home buyers at 83%, White single female home buyers at 81%, and Black/African American female home buyers at 77%.

The data also highlights the diversity in educational backgrounds among these home buyers, indicating that while higher education is a common thread, women with varying educational attainments actively participate in the housing market. For instance, 22% of Black/African American single female home buyers have a high school diploma, the highest proportion among all racial/ethnic groups. Additionally, Asian/Pacific Islander and Hispanic/Latina single female home buyers are more likely to have completed some graduate school, at 49% and 32%, respectively. This diversity underscores the multifaceted nature of educational attainment among single female home buyers.

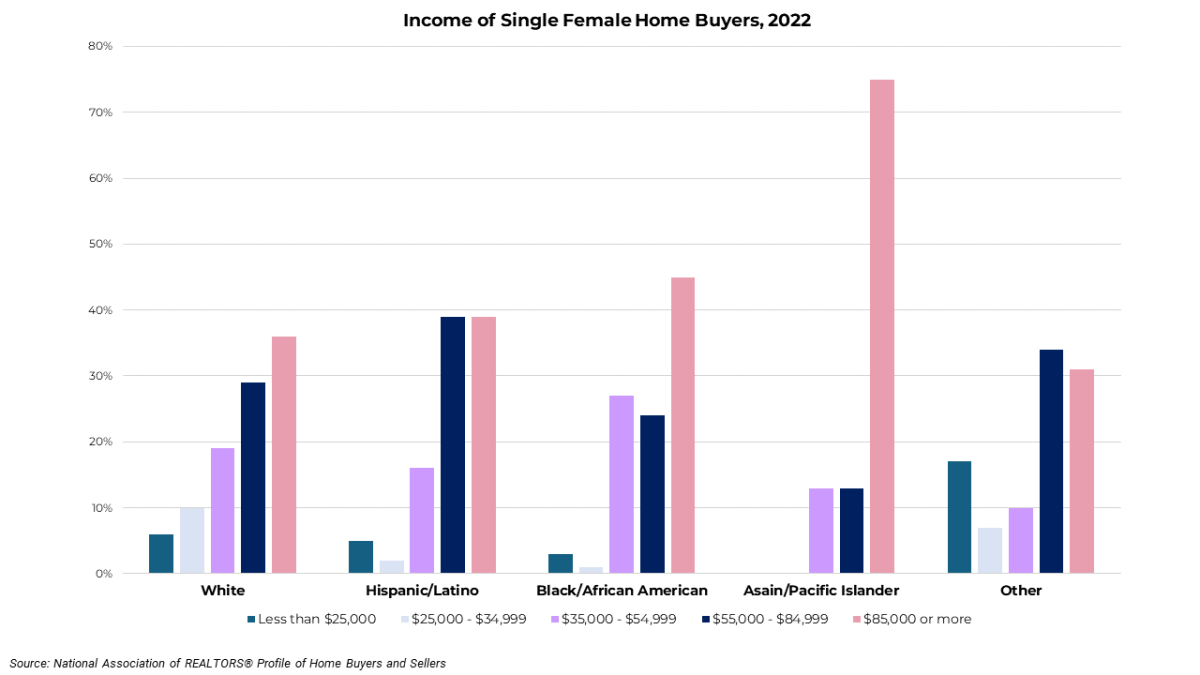

When analyzing single female home buyers across racial and ethnic groups, Asian/Pacific Islander, Black/African American, and White female home buyers are more likely to be in the highest income bracket ($85,000 and above). Asian/Pacific Islander female home buyers lead this category with a significant presence at 56%, followed by Black/African American women at 45%. Hispanic/Latina women and women of other racial/ethnic identities are less represented in this high-income bracket, at 36% and 31%, respectively.

Hispanic/Latina women and women of other racial/ethnic identities are more likely to fall into the moderate-income bracket ($55,000-$84,999), at 39% and 34%. When it comes to the lowest income bracket (less than $25,000), women of other racial/ethnic identities have the highest representation at 17%, significantly higher than any other group. This data reveals an apparent economic disparity among single female home buyers across different racial and ethnic groups. White women are more evenly distributed across all income levels, whereas Hispanic/Latina, Black/African American, and Asian/Pacific Islander women are more concentrated in the highest two income brackets.

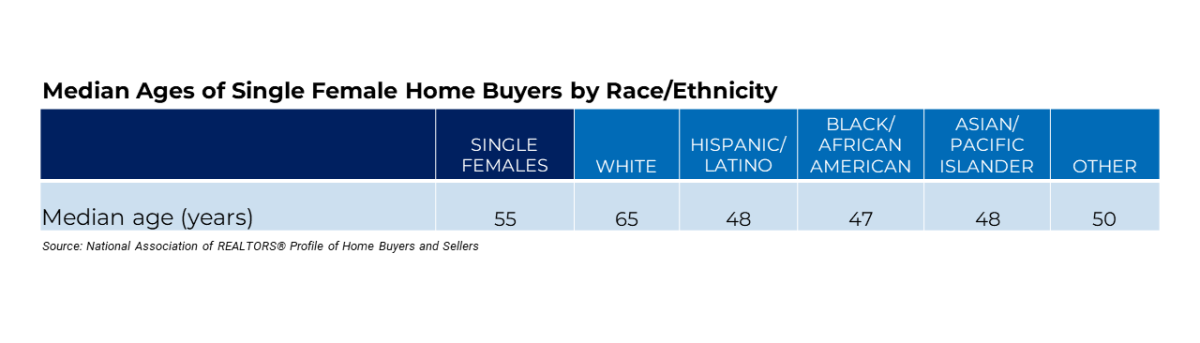

In 2023, the median age of a single female home buyer was 55. Single Black/African American women had the lowest median age at 47, while White women had the highest median age at 65, which is ten years above the overall median.

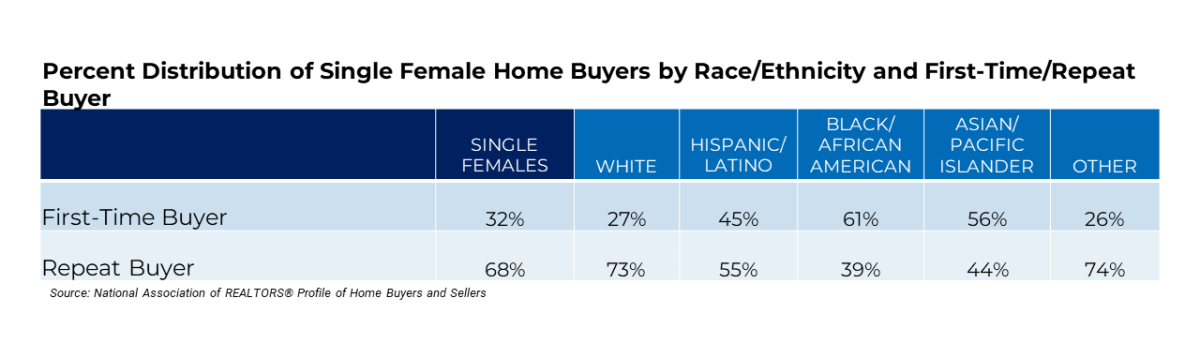

Seventy-three percent of White single female home buyers were repeat buyers in 2023. Black/African American and Asian/Pacific Islander single female home buyers were more likely to be first-time buyers at 61% and 56%, respectively.

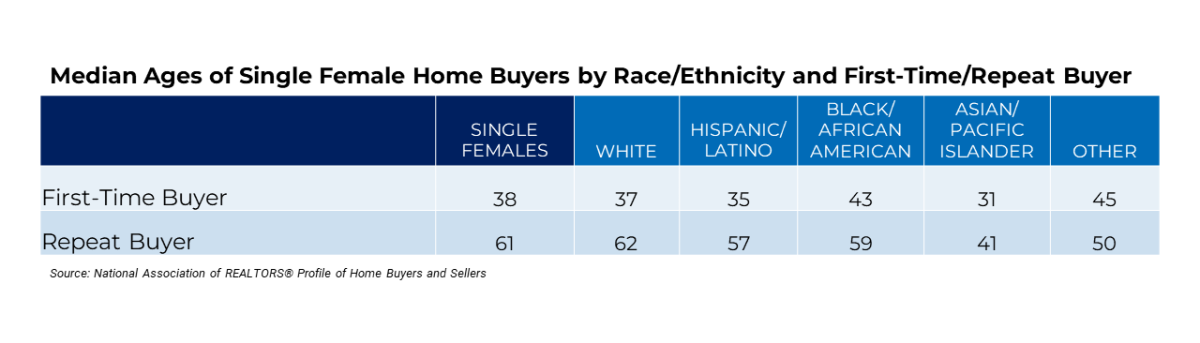

There are more illuminating insights into this landscape when we look at the median ages of single female home buyers segmented by race/ethnicity and whether they are first-time or repeat buyers. For first-time buyers, the median age varies across different groups. Asian/Pacific Islander women are the youngest first-time buyers at a median age of 31, while Black/African American women are the oldest at 43. White and Hispanic/Latina women fall in between, with median ages of 37 and 35, respectively.

When it comes to repeat buyers, the age differences remain notable. Asian/Pacific Islander women continue to be the youngest, with a median age of 41. Hispanic/Latina and Black/African American women are slightly older, with median ages of 57 and 59, respectively. Whites have a wider age range, with a median age of 62.

Asian/Pacific Islander women tend to enter the housing market earlier than their counterparts from other racial/ethnic groups, both as first-time and repeat buyers. On the other hand, Black/African American women tend to be older when they purchase their first home compared to other groups. This may suggest socioeconomic factors influencing the timing of home purchases among different racial/ethnic groups.