Nicknamed the “Mile High City” for its elevation, Denver’s housing market has reached new heights as well. Once known for affordability, Denver now boasts a competitive market with rising prices. This surge is fueled by a booming job market and a limited housing inventory.

However, there are signs of a potential shift with price moderation on the horizon. This article covers everything you should know about this housing market, including home values, trends you should be aware of, and more.

Trends in the Denver Real Estate Market

Median Home Sold Price

The median close price experienced an upward trajectory, ascending by 3.48 percent to reach $595,000 (DMAR). Denver Metro witnessed this ascent in prices, a seasonal trend peaking typically in June and tapering off towards December. It’s worth mentioning that these price hikes, both month-over-month and year-over-year, represented a more stabilized increase compared to the steep spikes observed during the peak of the pandemic.

Furthermore, the median days on the Multiple Listing Service (MLS) plummeted by 52.17 percent from 23 days in February to just 11 days, indicating a swift turnaround for properties being placed under contract. This surge in both prices and the pace of transactions underscores the palpable eagerness among buyers.

Housing Supply is on the Rise

In March, new listings sprouted with a notable 16.27 percent increase compared to the previous month, totaling 4,932 properties. Although this marked a modest 3.28 percent decrease from the previous year, the overall inventory is gradually expanding. Active listings by the end of the month showed a 6.13 percent rise, reflecting a substantial 29.52 percent surge year-over-year.

Home Sales Are Increasing

Pending sales surged impressively by 31.94 percent, totaling 4,317 properties, showcasing a 7.47 percent year-over-year increase. However, closed sales witnessed a more modest growth, rising by 13.40 percent to 3,512 properties, which represented a 13.37 percent decline from the same period last year. This lag in closed transactions indicates that most of the sales inked in March were likely initiated in February.

Commenting on this trend, Libby Levinson-Katz, Chair of the DMAR Market Trends Committee, highlighted the increasing willingness among sellers to capitalize on the current market conditions. Many have chosen to downsize, leveraging the equity in their homes to either upgrade or secure a more manageable mortgage.

Demand for Luxury Homes in Up

Delving into the luxury segment, properties valued at $1 million or more witnessed a springtime surge, mirroring seasonal expectations. Inventory in this bracket rose by 6.8 percent from February to March, accompanied by a substantial 42.12 percent increase in closed properties.

Notably, demand continued to outstrip supply, leading to a decrease in the months of inventory to 2.77 months. In the $1.5+ million range, the market dynamics varied, with attached properties hovering in a balanced market territory while detached properties edged slightly towards a seller’s market.

Examining the trends in previous months, the months of inventory for properties valued above $1.5 million tilted towards a seller’s market for attached properties and leaned towards a neutral market for detached properties. However, in the latest data snapshot, a nuanced shift is observed in the $1.5 to $2 million price bracket.

For properties sold between $1.5 and $2 million, the months of inventory for attached properties stood at 3.09, signaling a balanced market equilibrium. Meanwhile, detached properties in the same price range boasted a slightly more favorable position, with a months of inventory figure of 2.45, indicating a slight seller’s market.

It’s noteworthy that properties priced above $2 million tend to exhibit higher months of inventory, a trend attributed to the slower pace at which these higher-priced properties traditionally change hands.

Denver Market Forecast for the Summer

Looking ahead, the trajectory indicates a warming trend in the real estate arena, akin to the rising temperatures of summer. Andrew Abrams, a member of the DMAR Market Trends Committee, emphasized the potential for intensified competition as we progress further into the season.

As interest rates continue to influence the market pace, the interplay between increased inventory, robust buyer demand, and seasonal dynamics promises an eventful journey for Denver’s real estate landscape.

As the petals of spring give way to the blossoms of summer, Denver’s housing market remains a fascinating arena to watch, characterized by its resilience and adaptability to the shifting tides of the seasons.

Andrew Abrams, a respected member of the DMAR Market Trends Committee and a seasoned Metro Denver Realtor®, predicts an escalation in activity as we transition toward summer. Drawing a parallel between the competitive realms of sports and real estate, Abrams foresees a surge in momentum.

What’s Affecting the Denver Housing Market in 2024?

The Denver housing market in 2024 is experiencing a period of cautious optimism. While some of the challenges that plagued the market in 2023 remain, there are also hints of a potential shift towards a more balanced market.

Lingering obstacles:

- Mortgage rates: Interest rates remain higher than in recent years, impacting affordability and dampening buyer enthusiasm somewhat.

- Inventory shortage: Denver continues to grapple with a lack of available homes, which puts upward pressure on prices and creates a competitive environment for buyers.

- Affordability concerns: With both home prices and interest rates still elevated, Denver is becoming cost-prohibitive for some potential buyers, particularly first-timers.

Reasons for potential hope:

- Inventory on the rise: There are indications that the number of homes on the market is gradually increasing. This could lead to a more balanced market where buyers have more options and some leverage in negotiations.

- Interest rate dip: Experts predict that mortgage rates will continue to decrease, making homes slightly more affordable and potentially stimulating buyer activity.

- Seller adjustments: As market conditions change, sellers may need to adjust their pricing expectations and strategies to attract buyers in a more competitive landscape.

Predictions for the Denver Real Estate Market

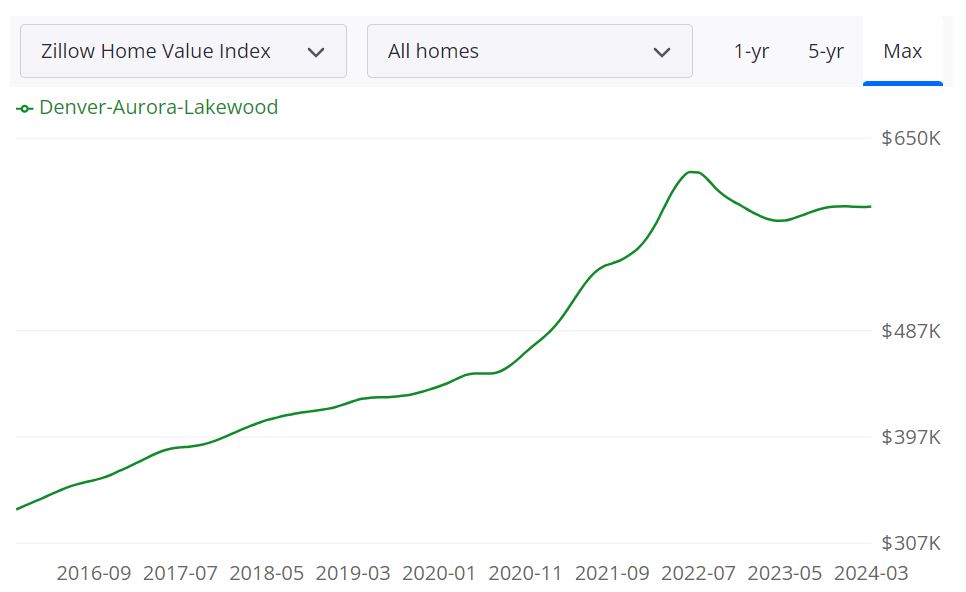

The average Denver-Aurora-Lakewood home value is $592,912, up 1.8% over the past year and going to pending in around 12 days (Zillow). The 1-year market forecast for Denver’s housing market shows a marginal growth of just 0.1% for the next twelve months ending with March 31, 2025.

In February 2024, the median sale price for homes was $542,933. However, by March 2024, the median list price had risen to $593,050. This indicates a significant increase in the listed prices within a month.

As of February 29, 2024, 25.7% of home sales were conducted over the list price, while 49.8% of sales were completed under the list price. These figures provide insights into the dynamics of pricing negotiations in the Denver real estate market during that period.

Let’s delve into the predictions for the Denver real estate market, exploring both lingering challenges and potential opportunities.

- Modest Price Adjustments: Buckle up for a potential cooling-off period. This doesn’t signal a crash, but rather a correction towards a more balanced market.

- Inventory Inching Upward: Good news for buyers! The tide may be turning on the historically low inventory. With an increase in available homes, buyers can expect more options and potentially less intense bidding wars.

- Mortgage Rates: A Balancing Act: While interest rates remain higher than the rock-bottom levels of recent years, experts predict a slight decrease in the latter half of 2024. This could make homeownership a touch more attainable for some buyers.

The Denver market in 2024 promises to be an intriguing chapter. While there may be some price softening, affordability will likely remain a key concern. However, with a potential rise in inventory and a more balanced market dynamic, opportunities could emerge for both buyers and sellers.

This graph by Zillow illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

How is the Denver Area for Real Estate Investors?

The Denver Metro Area has been a hotbed for real estate investment, and for good reason. Denver’s real estate market offers a compelling combination of economic strength, limited land, and a growing population – factors likely to persist for years to come. This can be particularly enticing for long-term investors seeking stable rental income and the potential for capital appreciation.

Here’s a breakdown of the market from an investor’s perspective:

Pros for Investors:

- Thriving Economy: Denver boasts a strong job market, particularly in tech and aerospace, attracting a wave of young professionals who fuel rental demand. According to MMG Real Estate Advisors, Denver’s economic outlook for 2024 is tempered growth with a 0.4% job growth rate. The Colorado General Assembly also predicts that 2024 will have an annual growth of 2.4%. This translates to a consistent stream of tenants, crucial for generating positive cash flow and ensuring property occupancy.

- Highly Desirable Quality of Life: Beyond economics, Denver offers a highly desirable lifestyle. With 300 days of sunshine, a thriving cultural scene, craft breweries, and stunning natural beauty with the Rocky Mountains at its doorstep, Denver attracts residents from all walks of life. This creates a diverse tenant pool and a vibrant city, further fueling demand for housing.

- Diverse Tenant Pool: Beyond young professionals, Denver’s cultural scene, craft breweries, and stunning natural beauty attract a wide range of residents, from artists and retirees to students and entrepreneurs. This diversification mitigates risk for investors compared to a market overly reliant on a single industry. If a particular industry faces a downturn, it’s less likely to cause a ripple effect throughout the entire rental market.

- Limited Land Availability: Nestled by the majestic Rocky Mountains, Denver has limited space for sprawl. This scarcity of developable land keeps housing inventory tight, pushing rents and property values upwards. This dynamic benefits investors seeking properties with the potential for steady rental income appreciation and long-term capital gains.

- Population Growth: Denver’s population has been on a steady upward climb for years, fueled by its economic opportunities and attractive lifestyle. It has experienced population growth, with the Denver-Aurora-Centennial metro area growing 1.2% between July 2020 and July 2023, adding more than 35,000 people to the region. This is compared to a 1% population increase nationwide. In 2024, the metro area’s population is 2,963,000, which is a 1.09% increase from 2023. This consistent population growth translates to a sustained demand for housing, which can benefit real estate investors in a few ways. First, it helps ensure a steady pool of renters. Second, it contributes to an overall rise in property values, allowing investors to potentially build wealth through appreciation over time.

Cons for Investors:

- Competitive Market: Denver’s allure isn’t a secret, leading to fierce competition among investors. Be prepared to move fast and potentially offer above asking price to secure a deal. The competition can be particularly intense for single-family homes and desirable neighborhoods, so investors need to have their financing pre-approved and be ready to act decisively.

- High Entry Point: Denver’s median home price sits above the national average. The median listing home price in Denver, CO was $614.9K in April 2024 while the price per square foot was $399. You’ll need a solid financial foundation to enter this market. A larger down payment will not only strengthen your offer but also reduce your monthly mortgage payment, allowing for better cash flow management.

The Verdict: Denver’s real estate market presents a promising landscape for investment, but it’s not a walk in the park. Before diving in, delve into market research. Identify your investment goals, whether it’s building long-term wealth through appreciation or generating steady rental income. Connect with a local real estate agent who can give you a current pulse of the market and navigate you towards the right property based on your criteria.

FAQs

Is Denver a Buyer’s Market or a Seller’s Market?

Denver currently leans towards a seller’s market. This means there’s generally more demand for houses than there are available properties. This can lead to competition among buyers, with homes potentially selling above asking price and inventory moving quickly.

Are Home Prices Dropping in Denver, CO?

No. While the Denver market has seen some moderation in price growth compared to the peak frenzy of 2021, home prices haven’t dropped significantly. They’ve continued to show a modest year-over-year increase.

Is This a Good Time to Buy a House in Denver?

Whether it’s a good time to buy depends on your individual circumstances and goals. Denver offers a strong rental market and potential for appreciation, but there’s also competition and a higher entry point compared to the national average.

What is the Future of the Housing Market in Denver?

The long-term outlook for Denver’s real estate market appears positive. Economic strength, limited land, and a growing population suggest continued demand for housing. However, short-term fluctuations can always occur.

Is This a Good Time to Sell a House in Denver?

With a seller’s market, Denver could be a good time to sell if you’re looking to capitalize on current market conditions. However, factors like your specific property and long-term plans should also be considered.

ALSO READ: Colorado housing market forecast & trends