For the past 18 years, Suzie Hall has coordinated the logistics for Advantage Solutions at the National Association of Convenience Stores (NACS) Show.

She’s seen firsthand the show grow over the years to become the massive tradeshow that it is today for more than 23,500 industry stakeholders, including brands, retailers, wholesalers and more. And she’s also had a front-row seat to Advantage’s evolution, which culminated this year with a new brand identity as a unified solutions provider.

All of that is to say, Hall has pretty much seen it all.

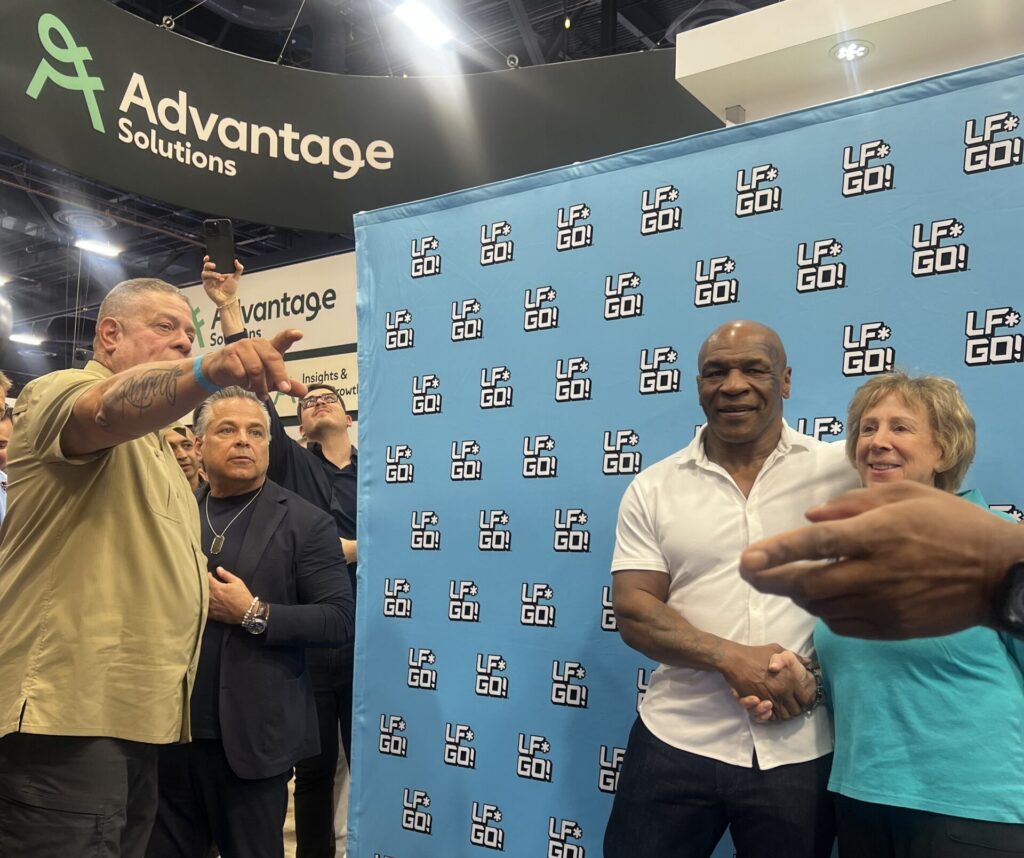

But she was as surprised as anyone when global celebrity mixed martial artist Conor McGregor strutted past her at the Advantage booth, after he shared an impromptu moment for the cameras with boxing legend Mike Tyson, who made a guest appearance promoting his new LF*GO! energy pouches.

“That’s a first,” Hall said, wide-eyed and smiling, as a crowd swarmed the Advantage booth to catch a glimpse of the two celebrity pugilists.

Beyond the phantasmagoria of celebrity sightings and brand mascots, this year’s NACS Show featured a robust showcase of innovations and brand launches in the convenience store channel. The annual tradeshow, which concluded this week, was also a modern-day bazaar of relationship building and deal brokering, bringing thousands of business friends and foes together under one roof in Las Vegas.

For the Advantage team, NACS was an opportunity to showcase the company’s unification and tout its ability to generate demand for brands and help retailers succeed in the hypercompetitive c-store channel.

“It’s exciting to be able share our new corporate and visual identity,” said Brian McRoskey, chief growth officer for Advantage. “I think it’s important because of the breadth of services and solutions we have to offer.”

What Advantage’s support looks exactly like depends on the distinct needs of brands and retailers. Take, for example, Tyson’s LF*GO! energy pouches, which launched online sales in June.

Advantage is working with the LF*GO! team to bring the product to market in convenience stores, McRoskey said, which can be very difficult for emerging brands. The pouches are a new entry in the growing energy category, he said, and could bring net new sales for retailers.

To get there, Advantage will provide an array of support to the new brand, including entry strategy, marketing support, and deep relationships with wholesalers and retailers.

“It’s unique because we’re in at the absolute ground floor,” McRoskey said. “It’s an opportunity to bring the whole power of Advantage to launch them into retail.”

Established brands need help, too

In the U.S., there are more than 152,000 convenience stores, a number that ticked up 1.5% in 2024 after a four-year decline, according to the NACS U.S. Convenience Store Count.

While many of them are owned by large chains, more than 63% of convenience stores are owned by single-store operators, according to NACS. Such a large and fragmented retail channel is alluring and challenging for both new and established brands.

“Convenience stores are a tough business to grow a brand,” said Rich Adams, Advantage’s senior vice president of client service for Mars Wrigley North America business. “Everyone wants to get in, but it’s one of the hardest channels because of the complexity.”

Advantage’s business engagement with Mars Wrigley spans more 37 years, Adams said. In recent years, the renowned candy company has grown its snacking and pet care divisions, too, creating new opportunities for growth, he said.

While at the NACS Show, Adams planned to meet with certain large c-store retailers to discuss joint growth plans for the Mars Wrigley brands — in-depth strategic meetings held behind closed doors, he said. Other meetings with potential clients were more like “speed dating.”

Such is the nature of the NACS Show. Established brands need help, too, given the sheer size of the channel.

“I view Advantage as an extension of our company,” said Bobby Elkes, national account manager for convenience for Energizer, another longtime Advantage client. “We rely on their expertise.”

For batteries in convenience stores, space and placement are key, Elkes said. And Advantage’s ability to produce in-depth category analysis and data insights, combined with its deep relationships with retailers, have helped move the needle for Energizer.

“We’ve had great successes together in the battery channel,” Elkes said.

Be open to innovation

For retailers, the ever-present challenge is finding just the right mix of products to outperform the competitor right across the street.

Just take it from Sukhi Sandhu, chairman of the National Coalition of Associations of 7-Eleven Franchises, an umbrella organization that represents more than 7,400 7-Eleven franchised convenience stores.

“We need suppliers, we need vendor partnerships, and Advantage is the perfect conduit,” said Sandhu, who also owns 11 7-Eleven stores in northern California. “Advantage knows that there has to be the right products in such a limited space.”

Gradually over time, the right product mix influences traffic, said Michael Atkins, head of sales for branded services for Advantage. C-store retailers need to ensure they’re always in stock on staples — the items their shoppers expect. But they also need to invest in innovation, the new and emerging products that keep them relevant and ahead of the curve with their competition.

Time will tell whether LF*GO! will break through and forge a new category — and a new revenue stream for C-stores, but there was no denying the buzz at the NACS Show.

Though Advantage has been in talks with the new brand for months, Atkins said, the decision to showcase it at the Advantage booth was made mere days prior the show.

One must move quickly to thrive in the c-store world.

“We’re a $4 billion company,” Atkins said, “but we can pivot on a dime.”