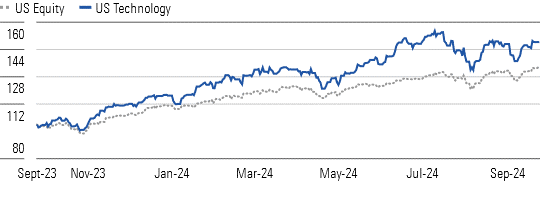

After a strong start to 2024, tech slumped in the third quarter. We continue to see software and services companies deliver solid quarterly results, even while shares were relatively flat. There is light at the end of the tunnel for semiconductor firms, but these stocks remain a drag on the sector’s overall performance. As a result, it’s been the second-best-performing sector over the last 12 months but the second-worst performer in the quarter. We remain confident in secular tailwinds in technology, such as cloud computing, artificial intelligence, and the long-term expansion of semiconductor demand. After a strong run for technology stocks since the beginning of 2023, we see pockets of opportunities.

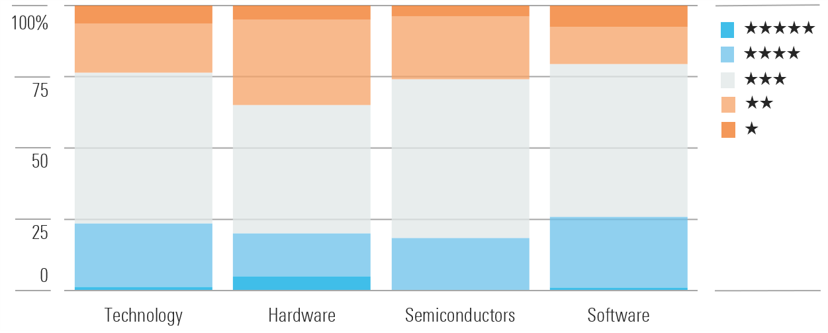

The Morningstar US Technology Index is up 32% on a trailing 12-month basis, compared with the US equity market being up 24%. The median US technology stock is fairly valued, with a modest margin of safety, although on a market-weighted basis, the sector trades at a modest premium. We see semis and hardware as the most overvalued, with software skewing the most attractive.

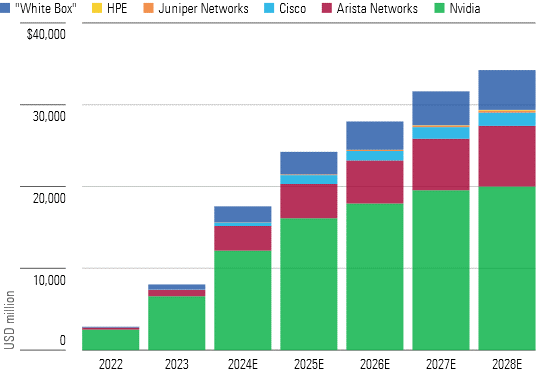

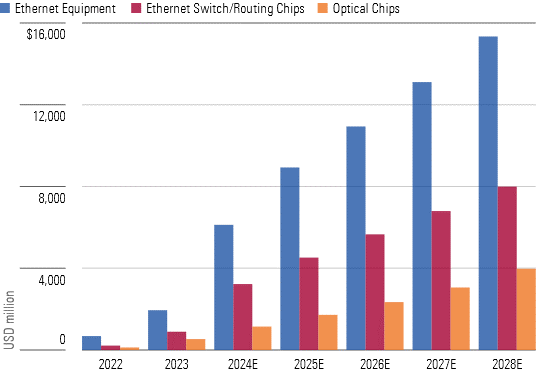

The most important force we see across technology is generative AI. Software companies are developing and incorporating next-generation AI capabilities within their solutions, cloud providers are introducing new services and ramping capacity, and semiconductor firms, notably Nvidia NVDA, are experiencing surging demand for AI and data center chip applications. That said, shares of Nvidia were surging earlier in the year and have pulled back lately despite strong results.

Investors are excited about generative AI and have searched for stocks within this theme. We think there are opportunities beyond Microsoft MSFT and Nvidia, and we expect networking investment in generative AI to grow in line with investment in GPUs, representing a derivative investment avenue. We view this as a durable, long-term opportunity, even if we see most of the best-positioned networking stocks as fairly valued or overvalued.

Top Technology Sector Picks

Microsoft

Microsoft dominates several of its served markets, such as Office in productivity software and Windows for PC operating systems, and it’s established itself as one of two clear leaders in public cloud. We think the proliferation of hybrid cloud environments will continue strengthening Microsoft’s position with Azure. Further, the company’s investment in OpenAI has catapulted it into a leadership position in generative AI, which has driven an acceleration of Azure growth in recent quarters. Our growth assumptions are centered around Azure, Microsoft 365 E5 migration, traction with the Power Platform for long-term value creation, and the proliferation of AI.

NXP Semiconductors

NXP Semiconductors NXP is one of our top picks in the analog and mixed-signal chip space. We’re especially fond of the company’s outsize exposure to the automotive end market, where it obtains nearly 50% of revenue. NXP is well diversified in automotive, with a nice product portfolio of processors, microcontrollers, and analog parts. We think the firm will gain its fair share in electrification and safety automotive products, such as radar and battery management systems. Overall, NXP’s auto business is strongly tied to the secular tailwinds around rising chip content per vehicle, and we think the market is too focused on a near-term slowdown in demand. We expect NXP will return to revenue growth in 2025.

STMicroelectronics

STMicroelectronics STM offers an attractive margin of safety for long-term, patient investors. We continue to like the long-term secular tailwinds in the automotive end market, as ST should profit from increased chip content per car, especially in electric vehicles. The company has also achieved nice gross margin expansion in recent years, and we foresee the company maintaining these margins in the long run.