The San Antonio metro area saw some of the weakest house-flipping profit margins last year, according to a recent report from real estate data company ATTOM.

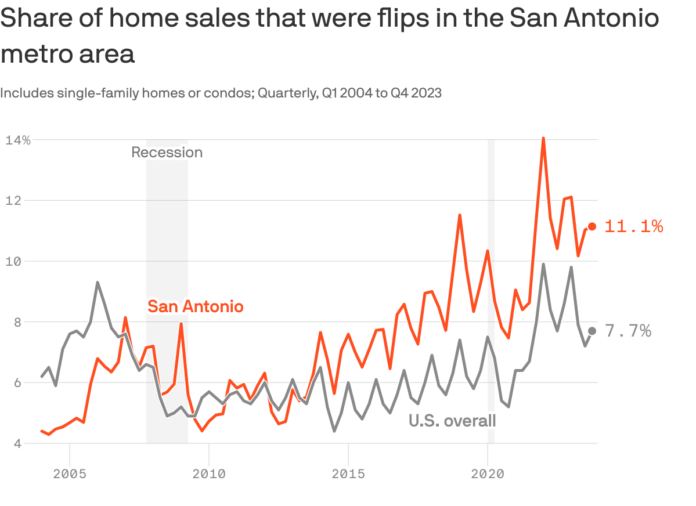

Why it matters: Flipped houses made up about 11% of the home sales last year in the San Antonio-New Braunfels metro as investors look to profit.

- The renovated homes can help stabilize neighborhoods but can also help fuel resident displacement.

By the numbers: Four Texas metros — San Antonio ($12,289 profit), Dallas ($14,817 profit), Houston ($16,932 profit) and Austin ($18,640 loss) — were among the weakest home-flip returns in the country among metros with a population of 1 million or more, according to ATTOM.

- San Antonio home-flip profit margins were down from an 11.7% profit in 2022 to a 5% profit in 2023.

Between the lines: Flipping rates are still up 93% from a decade ago, and 27.8% from five years ago, ATTOM data show.

The big picture: In 2023, house-flipping activity nationwide dropped 29.3%, the biggest annual decline since 2008, ATTOM found.

- Return on investment, at 27.5%, hasn’t been this bad since 2007. The ROI was down from 28.1% in 2022 and 35.7% in 2021.

The bottom line: Our cooling housing market makes it difficult for flippers to make a profit.