A shortage of labor is giving small businesses headaches, but not restricting their growth, according to a study from Minneapolis-based U.S. Bank.

Almost three quarters (73%) of American small business owners say their business has grown in the last year, with even higher percentages for Black (84%) and Hispanic (80%) owners, according to the “U.S. Bank 2024 Small Business Perspective,” released Monday.

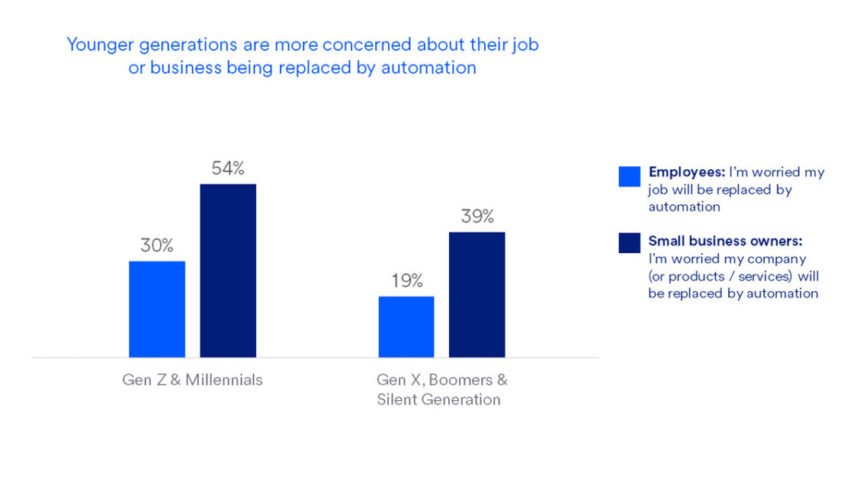

One way small business owners are making that trick happen is by embracing digital tools and AI/automated solutions to help their businesses run more efficiently, the study found. However, some workers are wary of those new tools, and Gen Z and Millennial employees are 1.5 times are more likely to feel worried about their job being replaced by automation than older generations such as Gen X and Boomers.

The data comes from an April and May survey of 1,000 U.S. small business owners, 1,000 U.S. small business employees, plus additional over-samples of 300 Hispanic small business owners, 300 Black small business owners, and 200 small business owners from four regions: Los Angeles County, Phoenix, Charlotte, and Minneapolis/St. Paul (Twin Cities).

The results revealed a challenging business climate, as small business owners reported their top five macroeconomic stressors this year as:

- Competition (73%)

- Economic environment (71%)

- Inflation and the increased costs of materials/supplies (65%)

- Supply chain disruptions (47%)

- Obtaining enough funding to support their business (42%)

And in an election year, almost a third (31%) of small business owners also ranked the political environment as a top stressor.

Still, many U.S. small business owners have been growing while also facing labor challenges, which include being understaffed (52%), navigating a more competitive labor market (77%), and struggling to increase their employees’ salaries to keep pace with inflation (65%).

To cope, owners are taking proactive steps to help their company attract and retain employees – such as the 83% who say they plan to offer flexible hours to support a healthier work/life balance. Owners are also embracing digital tools, with three quarters (75%) planning to focus on digital tools in the next 12 months to help reach their business goals. Small business owners are open to AI and automated solutions, with nearly 7 in 10 (68%) seeing their benefit, and 6 in 10 (60%) having already implemented a solution with AI or automation.

“Small business owners continue to show resilience and optimism despite feeling impact from ongoing stressors such as the economy, changing labor market dynamics, higher prices and wages, and other macroeconomic factors,” Shruti Patel, chief product officer for business banking at U.S. Bank, said in a release. “The survey also reinforces the importance they place on digital tools in increasing efficiency and productivity. As small businesses owners rely more and more on software to manage their operations, U.S. Bank is focused on bringing our clients a seamless integrated experience across banking and payments to help streamline their cashflow and workflow.”