Small business owners experience more volatility in their personal finances than non-owners.

Despite having higher levels of income, savings, and wealth, we find evidence that small business owners’ personal finances are much more volatile than those of non-owners. Figure 1, below, graphs the percentage point difference between small business owners and non-owners on several questions related to financial volatility. Because we might expect small business owners to have more financial stability based on their demographic characteristics, we display raw differences as well as differences after a simple adjustment for income and age. In Figure 1, we record a respondent as having “volatile” income if they indicate that their income varies “somewhat” or “a lot” from month to month. Small business owners are over 30 percentage points more likely to report having volatile income than non-owners. Small business owners are much more likely to report income varying “somewhat” (41 percent) compared to non-owners (21 percent) and are also much more likely to report income varying “a lot” (16 percent) compared to non-owners (6 percent).

In the 12 months prior to responding to the survey, small business owners were also over 20 percentage points more likely to have experienced a drop in income. The median reported drop in income for small business owners who experienced an income drop was $10,000. We also find that small business owners are more likely to have experienced an unexpected expense, to have incurred a credit card late fee, to have frequently (3 or more times) incurred an overdraft fee, or to have frequently (3 or more times) incurred an insufficient funds fee. The difference in frequently incurring overdraft fees is statistically significant.

FIGURE 1: Differences in income volatility and related measures between small business owners and non-owners

NOTE: The unadjusted and the income and age-adjusted percentage point difference between small business owners and non-owners in measures of financial volatility. Small business owners are more likely to report financial volatility than non-owners. Error bars represent 95% confidence intervals.

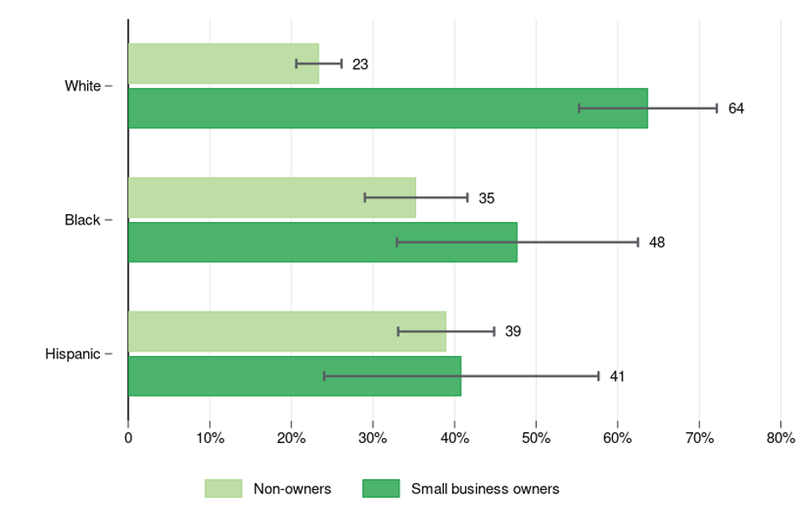

The differences in income volatility between small business owners and non-owners seem to differ by race/ethnicity. As Figure 2 shows, white business owners experience significantly more income volatility than white individuals who don’t own businesses. In contrast, Black and Hispanic business owners show similar levels of income volatility to Black and Hispanic non-owners. When comparing between business owners of different backgrounds, white business owners tend to have higher income volatility than Black and Hispanic business owners, though this difference is not statistically significant.

FIGURE 2: Income volatility by race and small business owner status

NOTE: White small business owners report higher and statistically significant income volatility than white non-owners. Black and Hispanic small business owners do not report much more income volatility than their non-owner counterparts. Black and Hispanic non-owners report more income volatility than white non-owners. Figure excludes groups with fewer than 50 respondents. Error bars represent 95% confidence intervals.

Small business owners appear to experience different types of credit constraints than non-owners.

Lastly, small business owners appear to experience some differences in credit constraints compared to non-owners. On the Making Ends Meet survey, respondents were asked 1) if they considered applying for credit but did not because they expected to be turned down, 2) if they applied for credit in the previous 12 months, and 3) conditional on applying, if they were turned down for credit or did not receive as much as they had asked for. Respondents could be considering business credit, personal credit, or both when answering these questions because the survey does not specify a type of credit. Figure 3, below, plots the percentage point differences in responses between small business owners and non-owners in a similar manner to Figure 1, with an unadjusted difference and a difference adjusted for income and age. Small business owners had slightly higher rates of having considered but not applied for credit than non-owners. While small business owners and non-owners appeared to apply for credit at similar rates, small business owners were more likely to be turned down or not receive as much credit as they requested compared to non-owners. This difference is even more stark when adjusting for age and income-differences.

FIGURE 3: Differences in credit application and access between small business owners and non-owners.

![Figure 3: A dot and whisker plot showing the unadjusted and income-age adjusted differences between small business owners and non-owners for three metrics of credit access. The y-axis is the three metrics; applied for credit, turned down or received less than requested, and considered, but decided not to apply. The x-axis is the difference between small business owners and non-owners in percentage points. The line color is unadjusted or adjusted. The dot is the coefficient estimate and the whiskers are the confidence interval. The unadjusted difference in applying for credit between small business owners and non-owners is 2.5 percentage points with a confidence interval of [-5, 10]. The adjusted difference is 0 with a confidence interval of [ -7.5, 7.5]. For turned down or received less than requested, the unadjusted difference is 8.47 percentage points with a confidence interval of [-3.3, 20], the adjusted difference is 13.6 percentage points with a confidence interval of [ 2.4, 20.5]. For considered, but decided not to apply, the unadjusted difference is 2.98 percentage points with a confidence interval of [ -3.9, 9.9], the adjusted difference is 5.69 percentage points with a confidence interval of [ -1.3, 12.7]. Source: Making Ends Meet Survey. Includes responses from the 2023 sample and responses from 2022 respondents who received a follow-up survey in 2023.](https://files.consumerfinance.gov/f/images/cfpb_the-financial-security-of-small-business-.width-800_qDHL4qq.png)

NOTE: Figure 3 plots the unadjusted and income and age-adjusted percentage point differences in applying for credit and access to credit between small business owners and non-owners. Non-owners and small business owners applied for credit at similar rates. For both the adjusted and unadjusted measures, small business owners were more likely to be turned down or receive less credit than requested than non-owners. Small business owners had slightly higher rates of considering, but not applying for credit than non-owners. Error bars represent 95% confidence intervals.

Conclusion

These results provide evidence that, even with higher income, savings, and wealth, being a small business owner often entails higher income volatility. This higher volatility suggests that small business owners could turn to financial products that allow them to weather income shocks at low costs. Our results additionally suggest that, at least when the survey was conducted, small business owners might have faced difficulty in obtaining the credit they needed for these purposes.

![Figure 1: A dot and whisker plot showing the unadjusted and income-age adjusted difference between small business owners and non-owners for seven metrics of income volatility. The y-axis is the seven metrics of income volatility: volatile income, any drop in income, difficulty paying bills, any unexpected expense, credit card late fees, more than 3 overdraft fees, and more than 3 NSF fees. The x-axis is the difference between small business owners and non-owners in percentage points. The line color is unadjusted or adjusted difference. The dot is the coefficient estimate and the whiskers are the confidence interval. The unadjusted difference in volatile income between small business owners and non-owners is 30.1 percentage points with a confidence interval of [22.9, 37.4], the adjusted difference is 32 with a confidence interval of [24.9, 39.1]. For any drop in income, the unadjusted difference is 20.6 with a confidence interval of [13.2, 28.1], and the adjusted difference is 23.1 with a confidence interval of [15.8, 30.5]. For difficulty paying bills, the unadjusted difference is -.5 with a confidence interval of [-7.9, 6.8], and the adjusted difference is 4.6 with a confidence interval of [-2.4, 11.6]. For any unexpected expense the unadjusted difference is 6.5 with a confidence interval of [0, 13.1], and the adjusted difference is 6.2 with a confidence interval of [-0.2, 12.7]. For credit card late fees, the unadjusted difference is 3.7 with a confidence interval of [-3.8, 11.3], and the adjusted difference is 3.5 with a confidence interval of [-3.4, 10.6]. For more than 3 overdraft fees, the unadjusted difference is 6.4 with a confidence interval of [0.1. 12.7], and the adjusted difference is 9 with a confidence interval of [2.3, 15.6]. For more than 3 NSF fees, the unadjusted difference is 4.8 with a confidence interval of [-0.4, 10.1], and the adjusted difference is 5.6 with a confidence interval of [0, 11.2].](https://hispanicbusinesstv.com/wp-content/uploads/2025/01/cfpb_the-financial-security-of-small-business-.width-800.png)